For all the “big tech”, momentum, hype; for all the “all-time highs”; this has not been a great year for tech...

Based on closing prices, the only day since January 19th, that you could have bought the Nasdaq 100 index and be profitable, is January 31st (and unless I type quickly, that might not even be true).

Had you came into the year long the Nasdaq 100, you would be up just over 2%.

Think about how many people got “FOMO’d” into buying markets at levels they weren’t comfortable with?

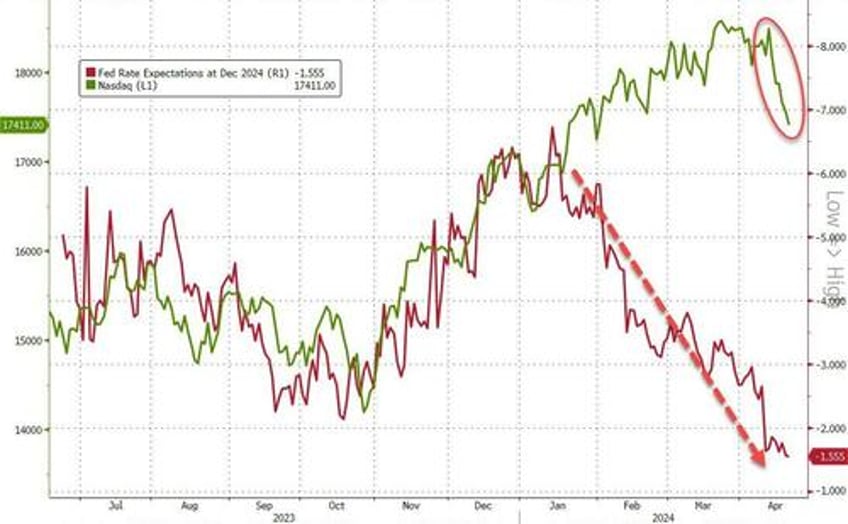

Now with yields rising, the Fed potentially on hold until after the election, valuation concerns mounting, and the “reaction function” to earnings, seems to be looking for negatives rather than positives, will people stay in this market?

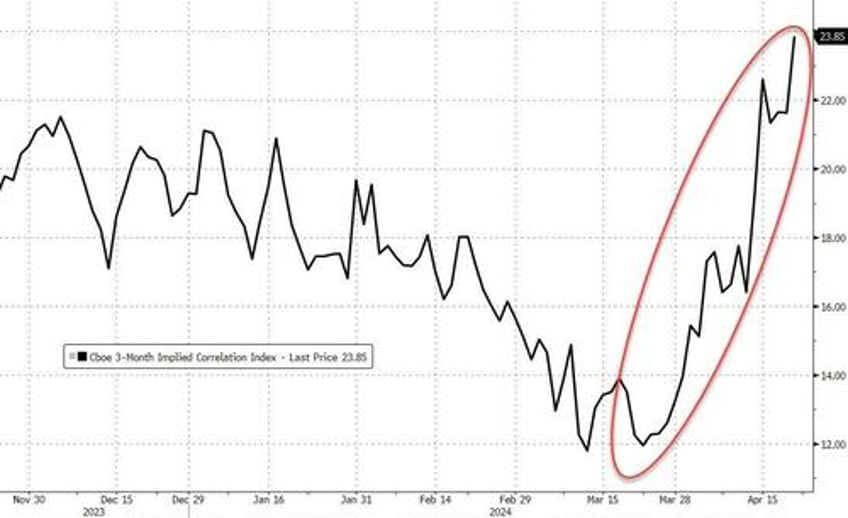

Not great for 60/40 accounts and not sure when risk parity has to reduce exposures (they’ve been helped by commodities), but should be soon, if not already (changing correlations is as important for their models as individual asset class volatility – none going the “right” direction at the moment).

Finally, and for those who have been reading T-Reports for a long time, know that I like to say “flash crashes” and “massive overnight moves” are like criminals, they tend to return to the scene of the crime, which does not bode well for equity risk (and therefore credit risk – credit is moving due to that far more than anything wrong in credit fundamentals).