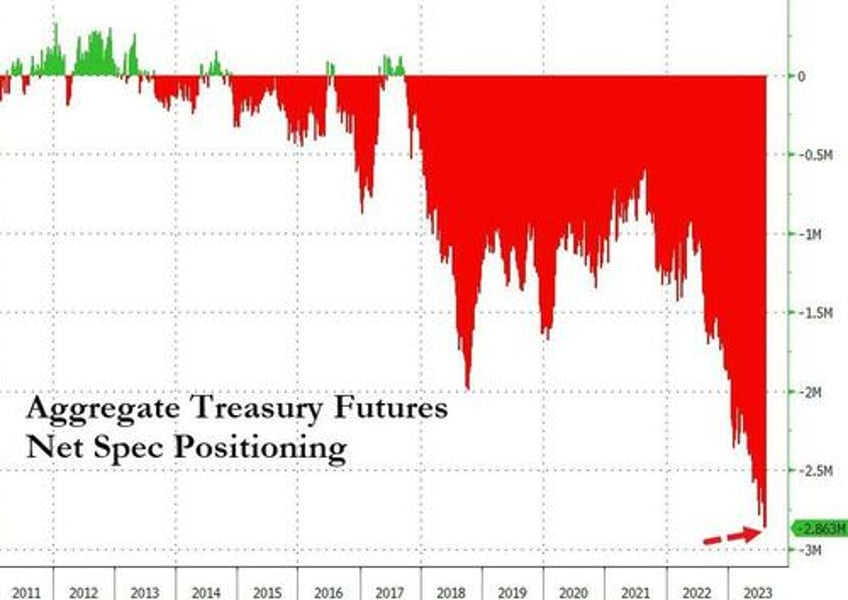

Hedge funds ramped up their bearish Treasuries bets to another new record last week (before yields plunged on Friday after the 'goldilocks' jobs data).

The aggregate Treasury Bond futures position pushed to a new record short across the whole curve...

Source: Bloomberg

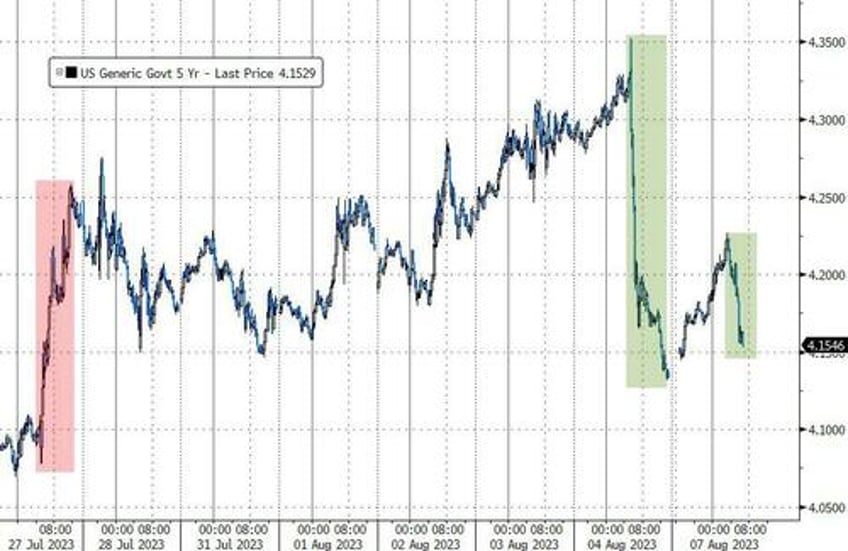

Right before yields puked Friday...

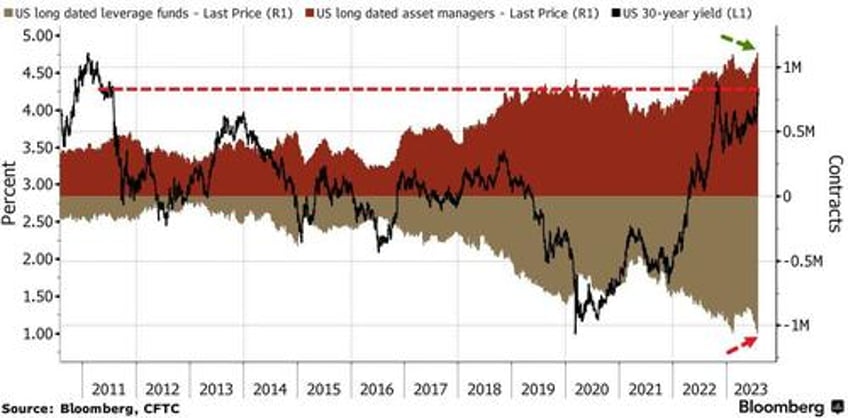

But, as Bloomberg notes, there is a big divergence between hedgies and traditional investors.

Leveraged fund increased net-short positions of longer-maturity Treasuries derivatives to the most since figures going back to 2010, according to an aggregate of Commodity Futures Trading Commission data for the week to Aug. 1.

Asset managers took opposite bets, taking their own net-bullish positions to an all-time high.

Additionally, Call Open Interest in TLT (the long-dated Treasury Bond ETF) is at a record high relative to Put Open Interest, adding to the bullish bond bias among more traditional investors...

We previously explained why the hedge fund Treasury short position could well be more related to the 'basis' trade which has seen a renaissance of late.

The strategy, which imploded spectacularly in 2020, has become popular once more as speculators seek to profit from small differences in the price between cash Treasuries and corresponding futures.

“Short positions in these few years seem to be largely due to the futures basis trade,” said Naokazu Koshimizu, senior rates strategist at Nomura Securities Co. in Tokyo.

The selling may continue “unless there is a huge disruption in the Treasury market which deteriorates the basis trade.”

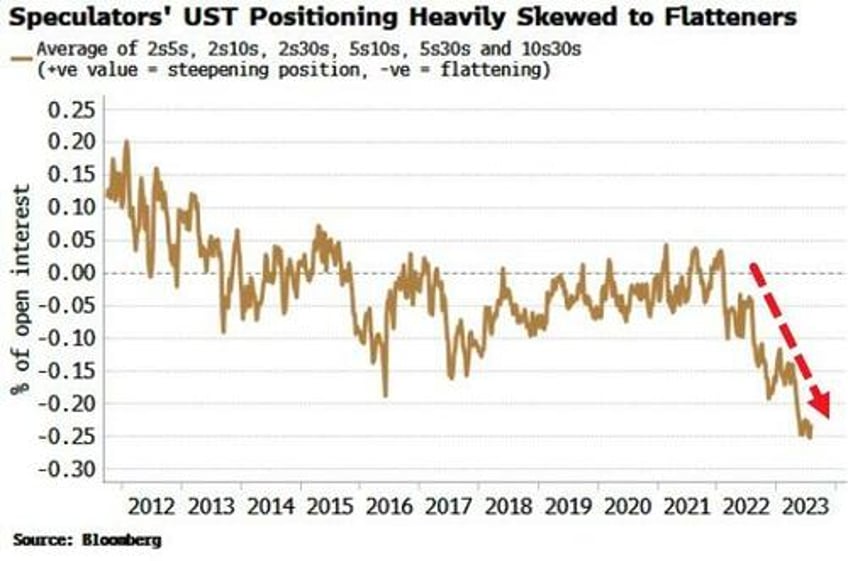

Additionally, as we highlighted earlier, stronger-than-expected data probably means higher yields in a market more acutely alert to inflation (and therefore supply) risks. As with last week, term premium would likely drive the move, meaning a curve steepening. After relentlessly flattening for the last two years, the pain trade is for a steeper curve. Implicit positioning of speculators from the COT report shows there is a heavy skew to a flatter curve.

The negative carry for most flatteners remains punitive (for 2s10s USTs it’s ~83bps over a year), but the large upside potential from supply/inflation worries and the covering of positions begins to make that look less insurmountable.

Speculative investors weren’t confined to just shorting longer-dated paper, also boosting five-year short futures positions to an all-time high, the CFTC data showed.

Which is interesting because JPMorgan's FICC traders have just recommended a tactical long in the the 5-Year TSY...

Outright yields are back at levels observed briefly last fall, and sustainably in 2011, and intermediates appear fairly valued after controlling for the market’s near-term Fed policy expectations, as well as medium-term inflation and growth expectations: we recommend tactical longs in 5-year Treasuries

There’s been a wide-ranging discussion in recent days on the drivers of this vicious sell-off in recent days, and we think it’s worth digging in further.

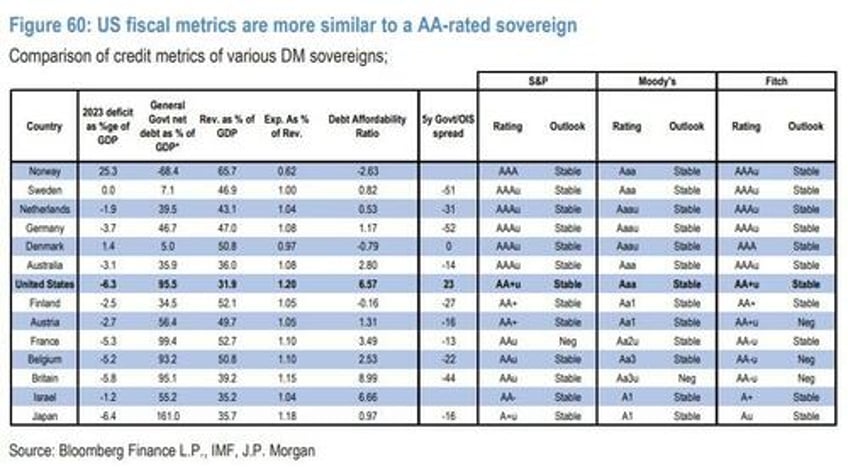

First, we think the downgrade has played a limited role as we see limited impact for ratings on yield levels.

Notably, various fiscal metrics of the US are closer to that of other AA-rated sovereigns than AAA-rated sovereigns, though the dynamics of the economy and its reserve currency status afford the US more leniency than other issuers. Arguably, this backdrop made the downgrade less surprising than S&Ps' shocking actions in August of 2011, producing a smaller reaction. Moreover, we’ve shown that each 1-notch downgrade by a single ratings Agency should narrow 5-year swap spreads by about 2.8bp. Certainly, swap spreads did narrow by a magnitude consistent with the downgrade the day after the downgrade, but completely reversed course over the remainder of the week.

Second, there is some question on whether Treasury’s larger-than-expected financing estimates and quarterly refunding announcement could have been a catalyst.

To an extent, an ongoing series of increases to coupon auction sizes could pressure yields higher, particularly when the Treasury market is transitioning from the support of price insensitive buyers to more price sensitive sources of demand. However, Wednesday’s announcement was just $1bn/month larger than our own estimates, which had already forecast a 30% increase in duration supply in 2024. We do think supply is a catalyst for this sell-off, but cannot fully explain the moves of the last few days.

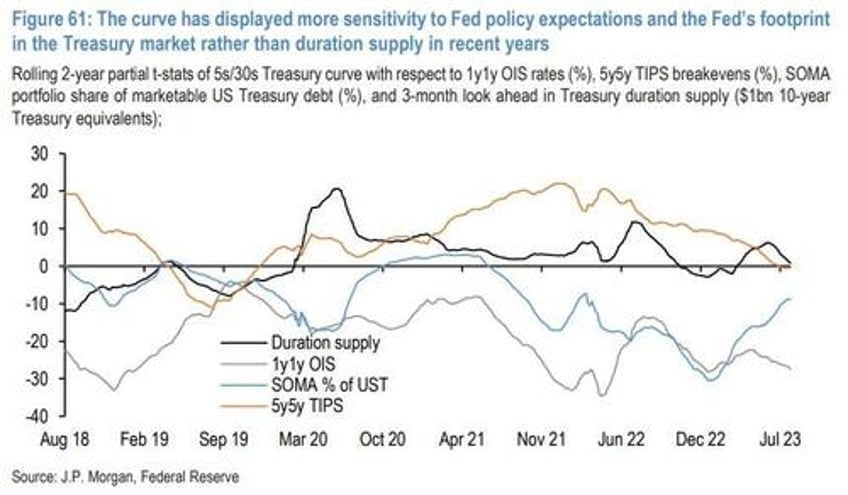

Indeed, the yield curve has shown reduced sensitivity to changes in duration supply in recent years: Figure 61 shows the partial T-stat for the 5s/30s curve with respect to 1y1y OIS rates (as a proxy for Fed policy expectations), 5y5y TIPS breakevens (as a proxy for inflation expectations), the Fed’s share of the Treasury market, and the 3-month look ahead in Treasury duration supply (we bring realized duration supply data three months forward, as Treasury is well known for being regular and predictable, communicating changes in auction sizes well in advance of actual delivery).

Looking at these factors, market-based Fed expectations and the Fed’s share of the Treasury market have the largest t-stats, indicating these factors have been the most statistically significant drivers of the curve slope. They are both highly negative, indicating that the curve tends to steepen as OIS forward rates fall, and as the Fed’s share of the Treasury market declines. Meanwhile, the signs of both the inflation expectations and duration supply factors are positive, indicating the curve tends to steepen as TIPS breakevens widen and as duration supply increases on a forward basis. However, these t-states are very close to zero, indicating limited significance over the last two years. Thus, we are not sure increased Treasury duration expectations were an ongoing driver of the steepening this week.

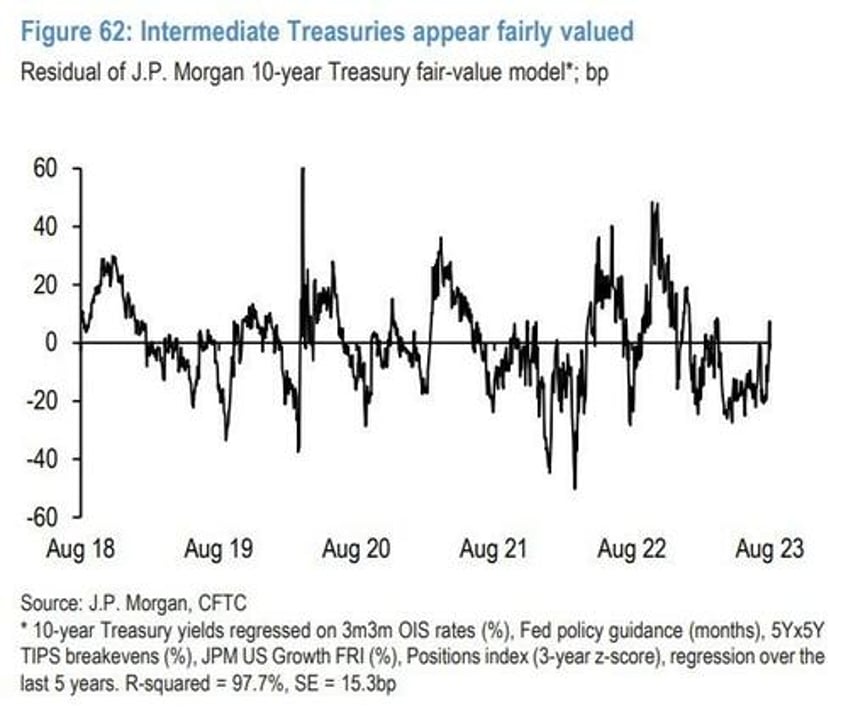

Third, we think valuations have played a significant role as well.

As we’ve highlighted for the better part of the last three months, intermediate Treasuries have displayed some sort of market’s near-term Fed policy expectations, as well as medium-term growth and inflation expectations. With these latest moves, Treasuries have fully mean reverted, and are now trading in line with their fundamental drivers, after trading rich for the last number of months (Figure 62).

Fourth, we think this mean reversion has been particularly powerful because investor positioning has played a role as well.

Our latest Treasury Client Survey (taken Monday) stood near its longest levels of the past decade as investors add duration into the end of the Fed tightening cycle.

This matters because we have found that when investor positions deviate sharply from average levels, they portend a reversal in yields.

It’s likely with the moves we’ve had this week that positioning is more neutral, but with the Fed likely on pause for an extended period, we are not sure the exposure to lower yields has been fully unwound.

And so, as JPMorgan concludes, net of these factors, with nominal yields near their highest levels of the current cycle, and valuations modestly cheap, it is becoming more compelling to add duration.

We think the data flow next week also support lower yields, as we forecast core CPI rose 0.17% in July, and 4.7% oya, the lowest run rate since October 2021, driven by further moderation in shelter pricing, airfares, and used vehicle prices.

Given the combination of these factors, we recommend tactical longs in 5-year Treasuries.