Friday’s jobs data sparked a relief rally in bonds and a flatter yield curve, but the pain trade is still for higher yields and a steeper curve – the lesser-spotted bear steepener – with this week’s CPI a potential catalyst.

Last week was a turbulent one for bonds, but the continued softening in payrolls data served to remind the market that supply and fiscal-profligacy fears have to be counter-balanced with an economy that’s in its late-cycle stages.

After the data, 10-year yields took the elevator back down to sub-4.05% after briefly going above 4.20%. They have since clambered back to 4.12%, but their next cue is likely to come from Thursday’s CPI report. Headline is expected to nudge back up to 3.3% (from 3% last month), mainly due to base effects, and core is expected to hold steady at 4.8%.

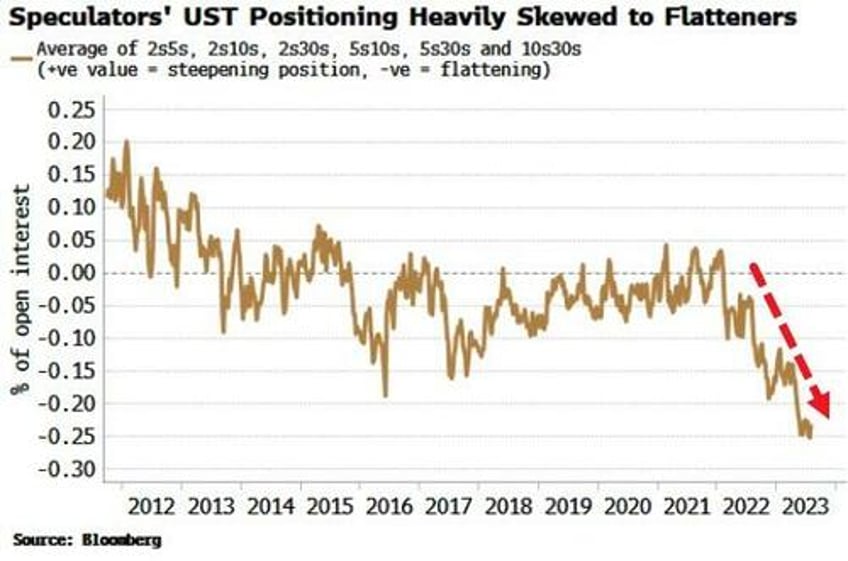

Still, stronger-than-expected data probably means higher yields in a market more acutely alert to inflation (and therefore supply) risks. As with last week, term premium would likely drive the move, meaning a curve steepening. After relentlessly flattening for the last two years, the pain trade is for a steeper curve. Implicit positioning of speculators from the COT report shows there is a heavy skew to a flatter curve.

The negative carry for most flatteners remains punitive (for 2s10s USTs it’s ~83bps over a year), but the large upside potential from supply/inflation worries and the covering of positions begins to make that look less insurmountable.

Finally, the Bundesbank’s decision to stop paying interest on domestic government deposits - which initially pushed short-term German bonds higher this morning - highlights the broader issue of central banks paying interest on reserves when they are superabundant.

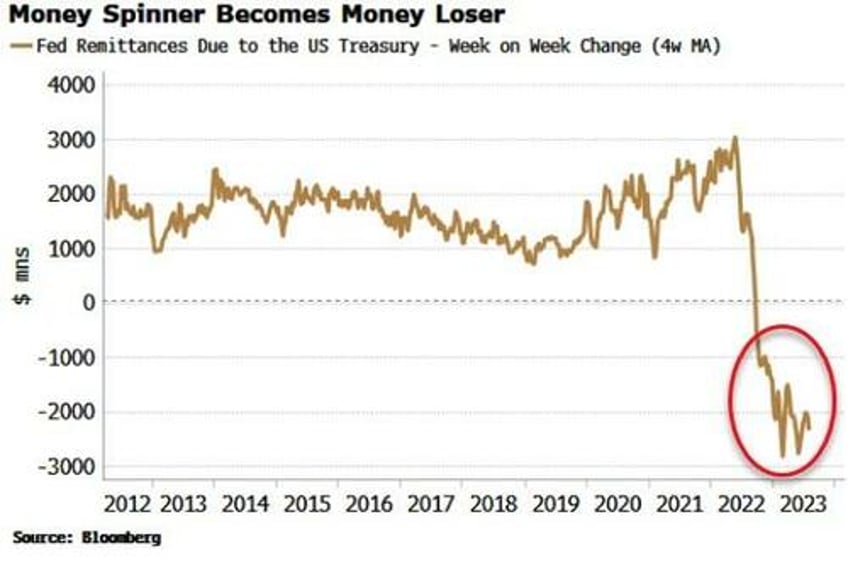

In the days of QE and 0% interest rates, the ECB and Fed at al. remitted money to their treasuries from the income on their bond portfolios.

But now that is reversed as bond income is dwarfed by the cost of paying interest on trillions of bank reserves. Take the Fed, whose debt to the Treasury is now accruing at over $2 billion each week.

This is something that will become more politically contentious, especially as economies continue to slow and cost-of-living pressures bite further.