We got a hint of what will happen once the AI bubble bursts last Thursday when we saw not only a frenzied selloff in tech, but also the biggest divergence between the tumbling Nasdaq and the soaring Russell since Lehman. And while Friday did not see an extension of the tech liquidation, and instead there was some widespread short covering, hedge funds - which as we profiled before have been rapidly fleeing the tech sector - are getting out of Dodge, and according to Goldman's prime brokerage rarely has the tech revulstion been greater among the 2 and 20 community.

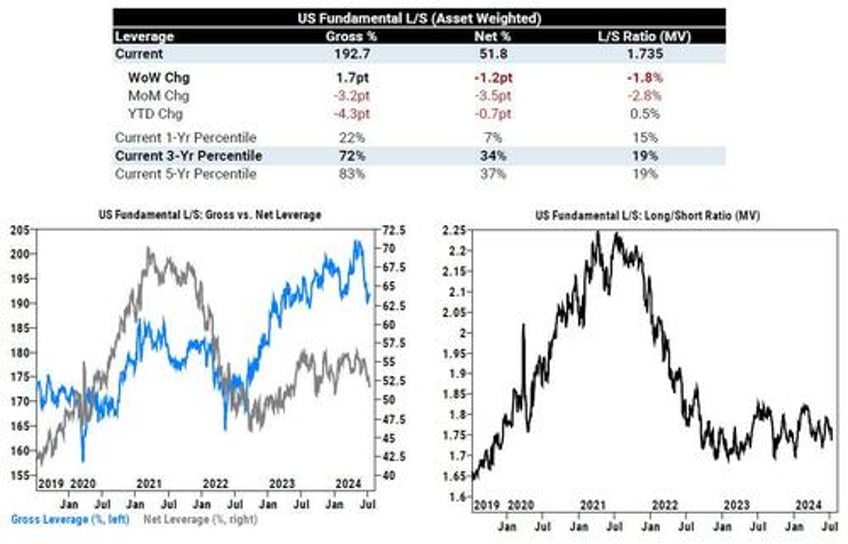

As Goldman writes in its latest must read Weekly Rundown note (link here), US Long/Short Gross leverage rose for the first time in 8 weeks though Net leverage remained on a downward path, which points to an increasingly cautious stance by HFs. As shown in the chart below, US Fundamental L/S Gross leverage rose +1.7 pts to 192.7% (72nd percentile three-year, and as noted above the first increase in 8 weeks), while US Fundamental L/S Net leverage declined for a 5th straight week by -1.2 pts to 51.8% (34th percentile three-year). US Fundamental long/short ratio fell -1.8% to 1.735 (19th percentile three-year).