In a week where the stunning Nvidia meltup momentum finally broke after the company briefly topped $3 trillion in market cap and surpassed Apple as the 2nd most valuable company in the world, US stocks closed slightly lower on Friday after a red hot - if completely ridiculous - jobs report, though the S&P 500 touched fresh ATHs and rose +1.3% on the week, as newly released macro data (e.g., weaker ISM Manufacturing index vs. mixed payroll report) increased the uncertainly on the timing and path of potential rate cuts by the Fed. This happened even after (or perhaps because) hedge funds shorted tech as the fastest pace in 11 weeks according to Goldman's Prime Brokerage. More notable is that megacap tech soared to a new all time high, even as hedge funds net sold US Tech stocks for a 3rd straight week, driven by long-and-short sales (1.6 to 1), according to Goldman Prime. Within the group, Semis & Semi Equip was the most notionally net sold Tech subsector on the week, while Software was the most net bought; suggesting a potential change of stance on an industry level vs. the YTD trends (more details in the full note available to pro subscribers).

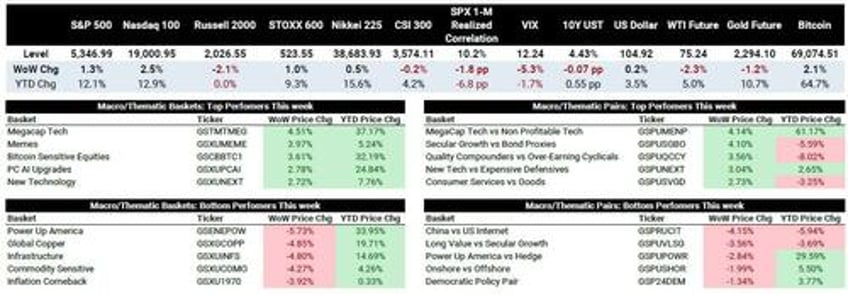

Looking at the bigger picture, Megacap Tech, Memes, and PC AI Upgrades names outperformed on the week, while Power Consumption, Infrastructure, and Commodity Sensitive stocks were among the biggest losers.