Submitted by QTR's Fringe Finance

As always, I’m stoked to be able to bring you content from one of my favorite investors, Chris DeMuth Jr. Chris took the time to share his up-to-the-minute thoughts on the market for Fringe Finance subscribers this week.

Chris writes the Vale Tudo Substack, which can be found here and the Sifting the World Special Purpose Research Substack, which can be found here.

All information contained herein is opinion only of Chris DeMuth & does not constitute investment recommendations. Nothing is a solicitation to buy or sell securities.

Kill Your Good Ideas

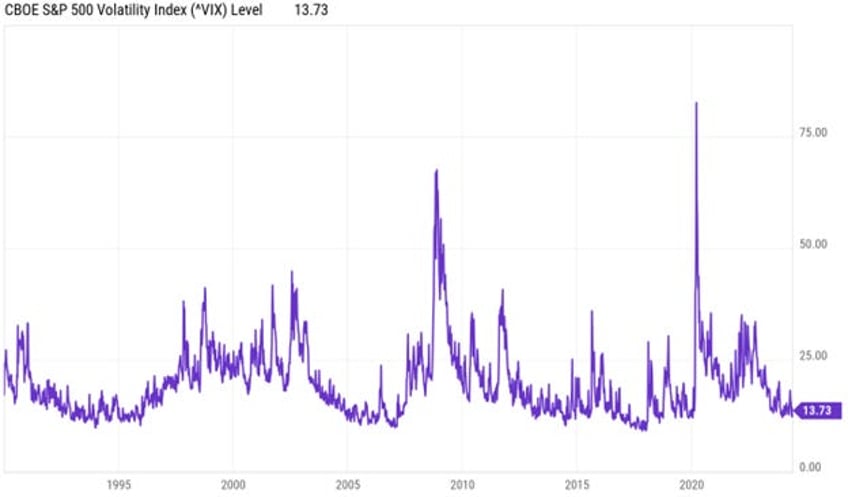

Implied volatility is quite low.

This doesn’t seem to comport with the number of discreet issues that have a material (at least 1%) chance of happening and far greater (at least 5%) chance of spooking the market if concerns grow.

Internationally, growing Russia coordination with China risks bolder moves from both. This could cause the Ukraine conflict to spill beyond Ukraine’s borders into the Baltic states or Poland. It could also increase the tempo and likelihood of a Taiwan invasion. Domestically, profligate peacetime (relative to a hot world war) spending could lead to a failed government bond auction. With a bipartisan consensus on unlimited deficit spending, the bond market has become the loyal opposition. It is complacent so far, but when it turns it can do so abruptly and without warning. For a pandemic to devastate the economy far beyond what Covid caused, it needs to have both contagion and lethality; Covid was contagious but not particularly lethal. Covid caused more hysteria than death. But bird flu has the possibility of being far more lethal and as contagious as the seasonal flu. Politically, we are in an unstable political year with the most unpopular president in the history of polling getting challenged by the second least popular president in the history of polling. It is entirely plausible that the presumptive challenger gets convicted with multiple felonies, loses a close election, then has the charges thrown out on appeal. His followers might not respond with equanimity.

In short, lots could go wrong. I wouldn’t want to be short volatility here. What to do? Instead of buy writing marginal positions, just sell them. The best hedge is to own positions that don’t need a hedge. If yours do, consider selling half and hope you’re (and, er um I’m) wrong. March 2020 was a great time to have poise, capital, liquidity, and simplicity so that you could focus on offense. Any one of the above potential events could lead to an opportunity at least as pronounced as the Covid lows. Whatever you do – don’t freak out at the precise moment everyone else does. Once it is in the press, it is in the price. So prepare ahead of time so you can be a counterparty for those freaking out. How much liquidity will it take? More than your counterparty. If you get margin calls on the low, then your preparation failed.

🔥 40% OFF FOR LIFE: Using this coupon entitles you to 40% off an annual subscription to Fringe Finance for as long as you wish to remain a subscriber.

In addition to sizing discipline on my best ideas, I’m skipping my marginal ones. If you load up on your good ideas now, then it will be harder to take big swings at your best ones if volatility spikes. For one example, Marpai, Inc. (MRAI) is a good long idea at $0.60, crushed by over 30% for Nasdaq delisting with zero impact on its fundamental value. Bragg (BRAG) is a good long idea; it is a takeout candidate worth a substantial premium to today’s market price to any number of strategic buyers. But now’s not a great time to start any good long ideas with leverage and certainly not leverage anywhere close to your margin limit.

Remember – your broker can change margin requirements whenever they want and they will use that right at the worst possible time for you. Interactive Brokers (IBKR) is perhaps the most ruthless, but Goldman Sach (GS) and others will also force you to sell when you least want to. The relevant Goldman partners are multimillionaires and IB’s founder is a multibillionaire precisely because they hate risk to themselves and will do absolutely anything whatsoever to avoid it. As a leveraged client, you are not their partner or friend; you are their counterparty and on the other side of their ruthlessness when it comes to such risks.

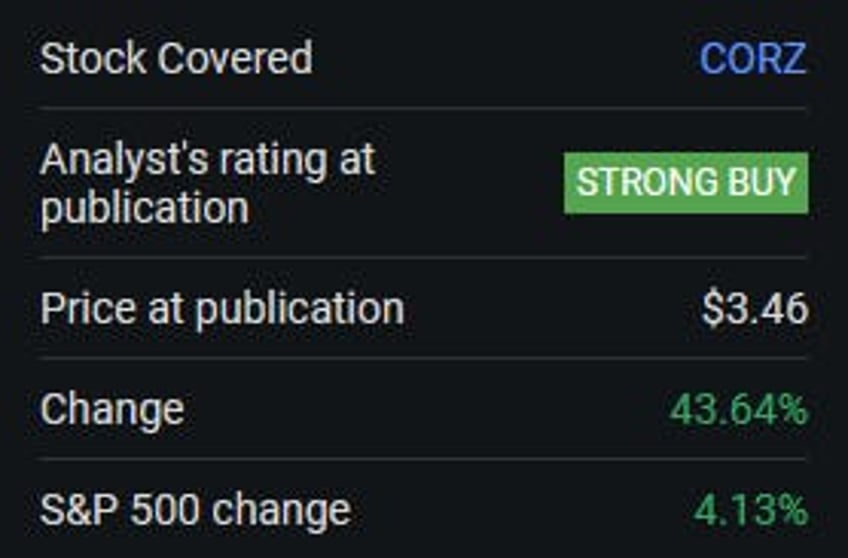

Instead of paying for leverage from your broker at the firm level, use the corporate balance sheets and capital structures to get any desired leverage at the position level. Brokers are surprisingly dumb about this. Underleveraged balance sheets (e.g. at recent demutualizations) are given far too little margin and massively leveraged balance sheets (e.g. equities in bankruptcy) are often given the same or more. Take advantage of this inefficiency. For example, I like owning bitcoin but love owning the most leveraged miner. For even greater leverage, they have a warrant (CORZZ) that is leveraged to the company which is in turn leveraged to bitcoin.

Skip the crisis. I often think about what I’d do the day after a horrific event. I would drive safely after a car crash. I would invest prudently after a market crash. But I’m perfectly capable of imagining such events, skipping them, and acting on them before they occur. Do you have any positions with stop losses (pre-planning to sell something lower because it declined)? Sell them now and skip the loss. If you prepare, then you need not predict or at least not with any particular precision. As Cat Stevens sang and as I mentioned here,

Oh baby baby it's a wild world, it's hard to get by just upon a smile. Oh baby baby it's a wild world.

- Cat Stevens on the log normal nature of capital markets

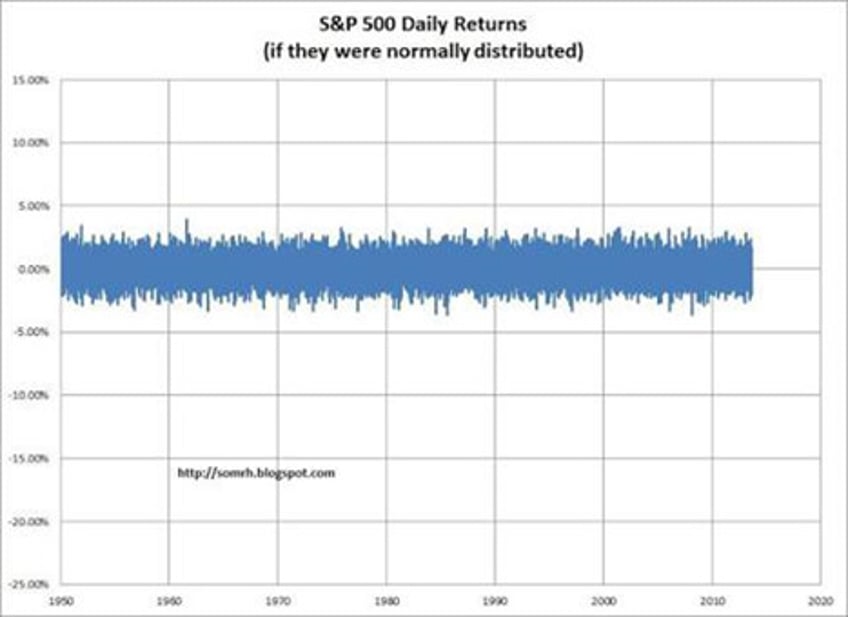

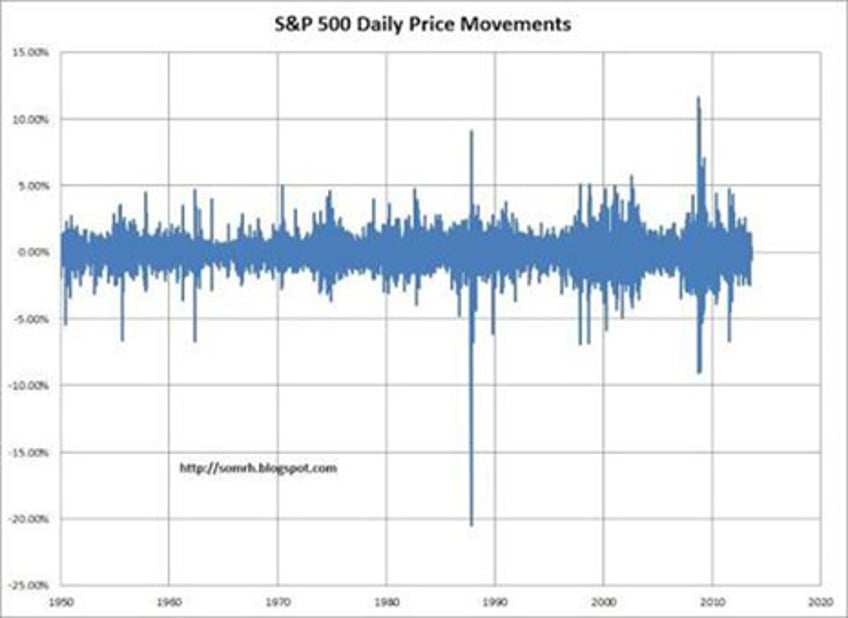

Something isn't normal in the market today. In fact, it wasn't normal yesterday. Come to think of it, it never has been. So perhaps, normal is not a particularly useful concept for markets or for nature. It is good for modeling, but reality conforms to normal distribution curves rarely. If it did, here is what the world would look like:

Here is what the world looks like:

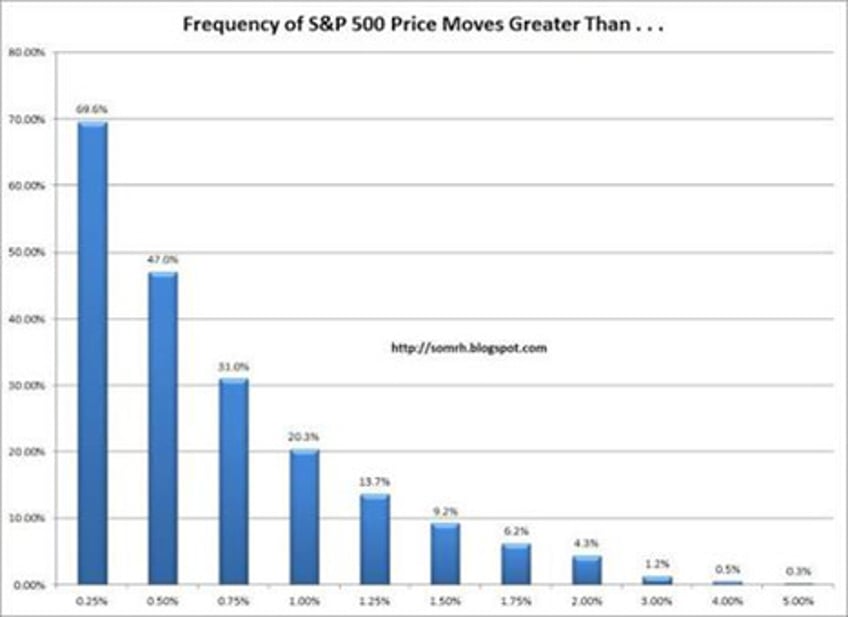

We live in a statistically wild world, baby. Like "unseasonably hot" weather in the middle of summer, unexpected things happen all of the time (that is, unexpected if you set your expectations to a normal distribution curve):

If you size risks based on downside, this is all fine. If you size risk based on volatility and the model for volatility is based on an expectation of normalcy, then sooner or later… you're doomed.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.