Commercial real estate is the third-largest asset class, trailing only behind fixed income and equities. Despite the "Magnificent Seven" driving broad equity indexes to new highs, CRE markets are experiencing a worsening downturn, particularly in the office sector. A series of notable CRE loan defaults and regional bank failures underscores this mess.

Goldman's senior equity research analyst Susan Maklari penned a note for clients on Monday titled "Non-Residential Construction: January Data Indicates Soft Start to the Year" (avail. to pro subs in the usual place).

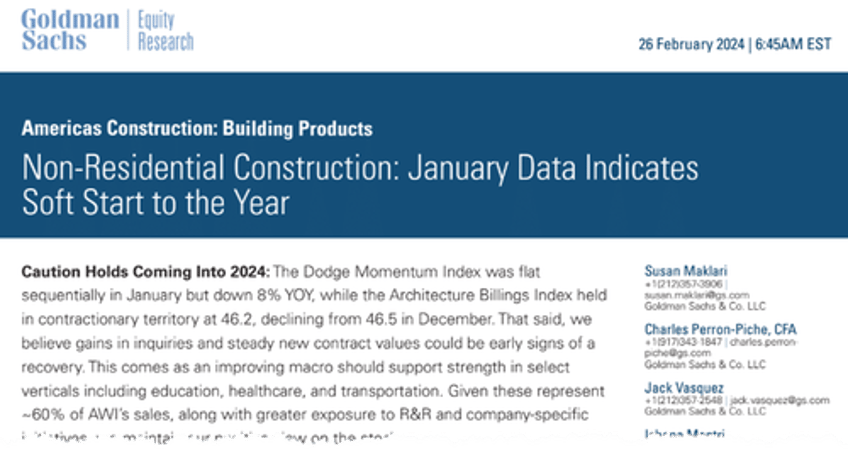

Maklari cited data from the Dodge Momentum Index, a 12-month leading indicator of construction spending for nonresidential buildings. She found that the index rose 0.1% in January to 184.1 from 183.9 in December but was down 8% from 199.3 a year ago.

"We will continue to monitor readings in the coming months given heightened risks surrounding commercial sub-sectors," she said.

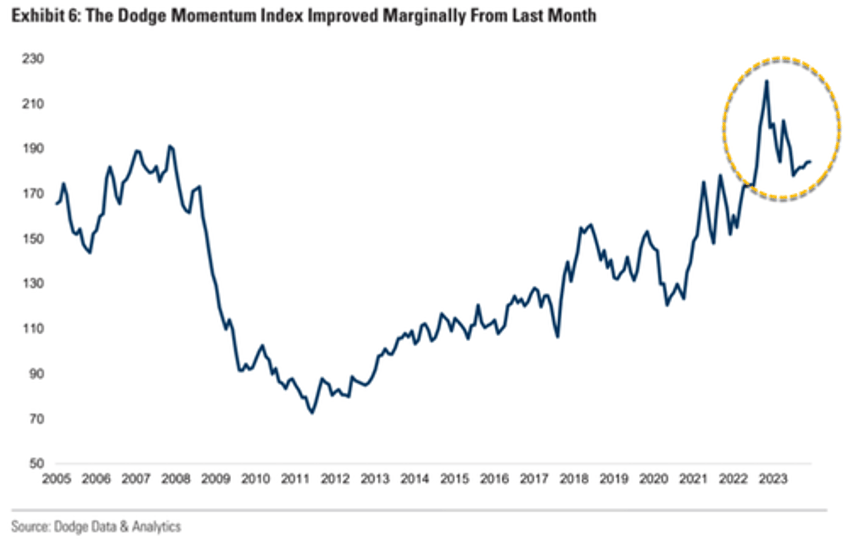

Meanwhile, the Architecture Billings Index is in contraction territory. Here's more from the analyst

The Architecture Billings Index (ABI) decreased to 46.2 from 46.5 in December. The commercial/industrial component fell to 47.0, from 47.2 in December, while the pace of institutional decline improved to 48.5 from 47.9 last month. Despite weaker backlogs, we believe the macro backdrop will support activity in certain verticals this year. We note the ABI is a leading indicator of spending for non-residential construction activity, with an average lead time of 9-12 months.

Our guess is that a continued gloomy outlook for CRE construction spending and waning demand for construction products and services will persist this year because of tight financial conditions.

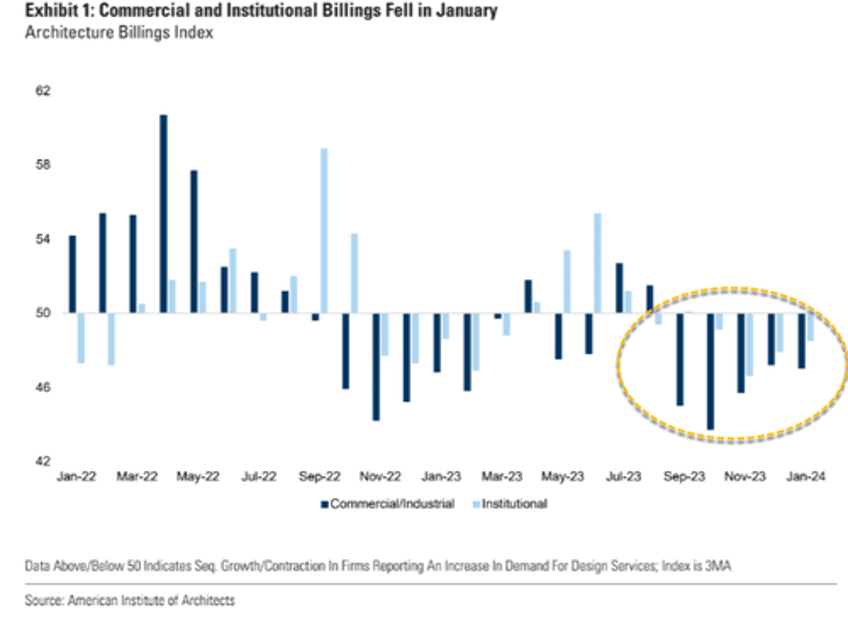

And let's not forget Morgan Stanley's latest note explaining that the "greatest headwind" facing the office segment of the CRE market is "years of supply."

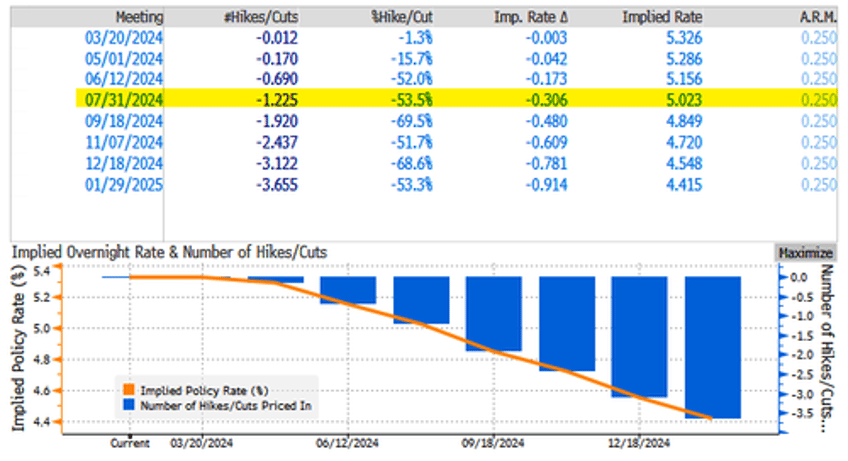

It remains to be seen if upside momentum in the Dodge Momentum Index returns this year as fears of inflation re-accelerating has repriced rates market from 7 to 3 cuts this year. The first expected rate cut has been pushed from March to July.

It's safe to say the CRE downturn will continue throughout the year.