"I'm not supposed to be here, I'm supposed to be dead," former President Trump told the New York Post on Sunday while traveling to Milwaukee for the Republican National Convention, adding, "The doctor at the hospital said he never saw anything like this, he called it a miracle."

The miracle, or as Navy Seal and Blackwater founder Erik Prince explained, "Donald J Trump is alive today solely due to a bad wind estimate by an evil would be assasin [sic]."

This chilling graphic illustrates how close we came. 100% divine intervention. pic.twitter.com/wkxQ3jp2ks

— End Wokeness (@EndWokeness) July 14, 2024

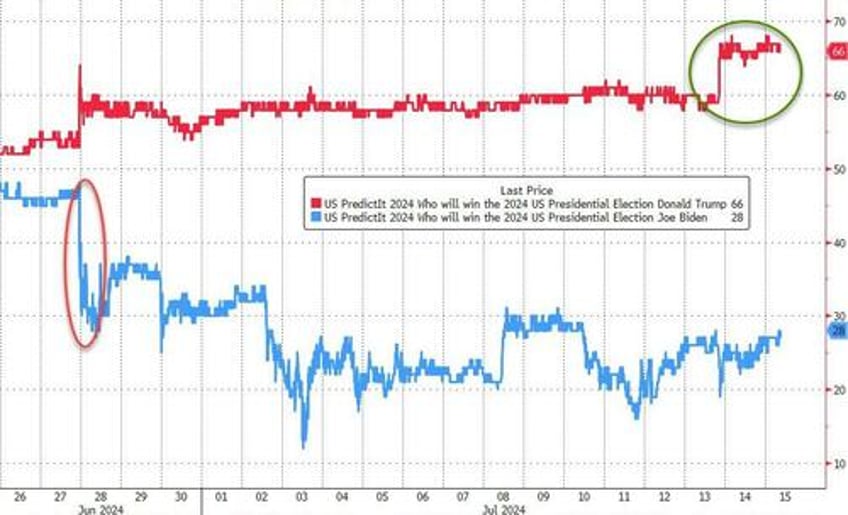

The assassination attempt on Trump has boosted his odds of winning the US election, according to PredictIt data.

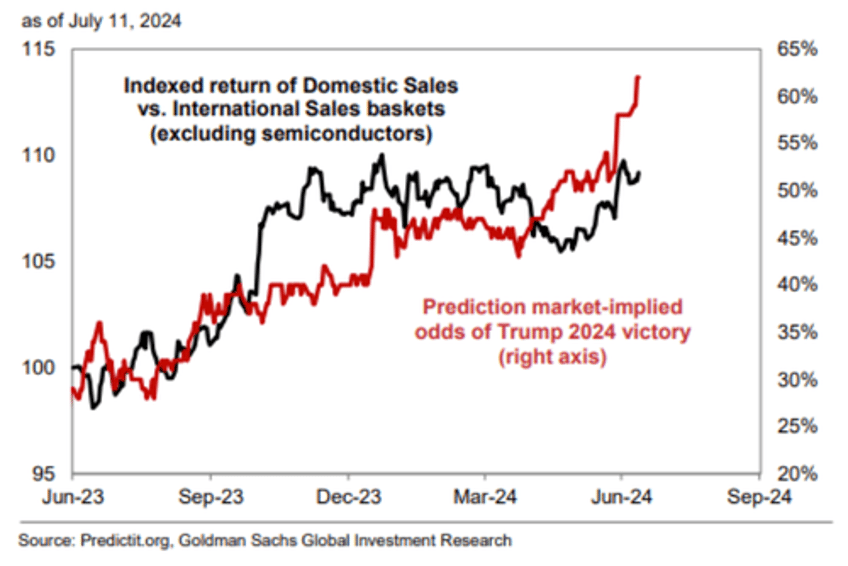

This has pushed traders to pile into stocks and industries that stand to benefit from a red wave.

"Donald Trump shifted his campaign focus to unity after being wounded in an assassination attempt, asking his onetime primary rival Nikki Haley to attend the RNC in Milwaukee," Goldman's John Flood told clients this morning.

Flood said, "Trump odds making new highs as are Republican sweep odds in the wake of Trump's assassination attempt."

The analyst continued with several themes that work under a Trump presidency:

"Simple breakdown is good for US equities (tax cuts/deregulation), bad for intl export exposed equities (tariffs), good for dollar (tariffs/bad for mxn) and bad for rates (bear steepener). Domestic-facing US stocks have outperformed those with foreign sales..."

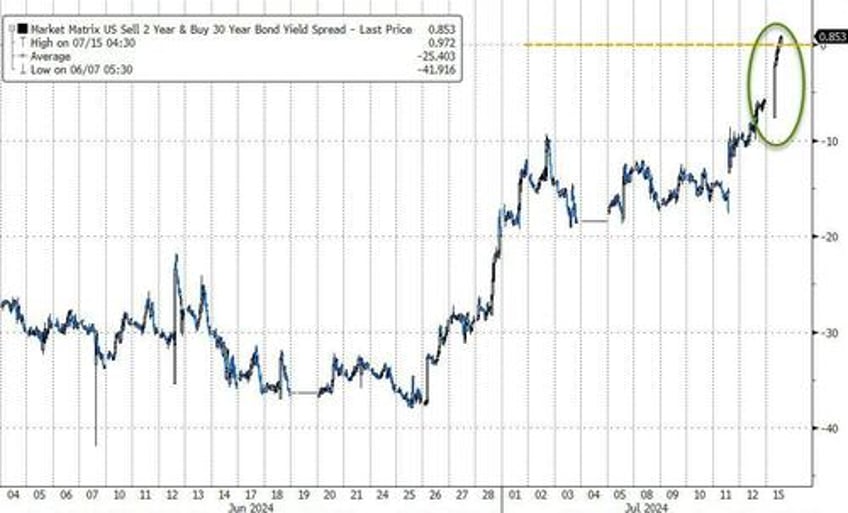

Treasury yields are higher and the 2s30s curve has uninverted this morning...

David Mazza, CEO at Roundhill Financial, said,

"The unprecedented nature of the attack will boost volatility and in the immediate could see investors seek out safety in the 2024 defensives — mega-caps, but also adds support for stocks that do well in a steepening yield curve, especially financials."

In premarket trading in New York, shares of gun companies to private prison operators are soaring:

Private prison stocks GEO Group Inc. and CoreCivic Inc are up 9.1% and 6.7% respectively

Gun stocks Smith & Wesson Brands and Sturm Ruger & Co. are also up; SWBI +4.6%, RGR +2.5%

In the health-care sector, managed care companies are rising with UnitedHealth up 2.1%, Humana +3.1%, and CVS Health Corp, which owns insurer Aetna, gains 2.1%

Crypto names are also higher: Coinbase Global +5.8%, Marathon Digital Holdings +5.2%, Riot Platforms +5.9%

In the technology sector, Trump Media & Technology Group Corp surges as much as 76% in early trading

Phunware, a software firm that worked on Trump's 2020 reelection campaign, jumps 41%

Rumble, a conservative video network, gains 11%

Separately, renewable energy and green energy focused stocks are underperforming in premarket trading

Shares of Trump Media & Technology Group Corp jumped as much as 50%.

Bloomberg provided a further breakdown of the industries that should benefit under a Trump presidency:

Private Prison Operators

Private prison stocks GEO Group Inc. and CoreCivic Inc. will benefit in a Republican sweep, as Trump has a tough stance on immigration

Trump is expected try to provide as many resources as possible to both the public and private sector when it comes to border security, with a focus on physical detention, Wedbush said

Crypto

Trump's ardent courting of Bitcoin miners and his enthusiastic stance on cryptocurrency has made this group a bet on his presidency

Stocks to watch include Coinbase Global Inc., Marathon Digital Holdings Inc., Riot Platforms Inc., Cleanspark Inc., MicroStrategy Inc. and Cipher Mining Inc., as well as the Bitwise Crypto Industry Innovators ETF

Gun Stocks

Conversations about access to firearms are likely to dominate conversations after the attack, and Republicans are seen as better for this sector

Watch Smith & Wesson Brands, Sturm Ruger & Co. as well as retailers who sell guns, such as Walmart Inc.

Financials

Regulation-heavy sectors, such as financials, can rise on Monday as a Republican presidency is expected to be more lenient than a Democratic one

Watch big bank stocks, funds such as the Vanguard Financials ETF, as well as credit card companies like Discover Financial Services, Capital One Financial Corp., Synchrony Financial

Healthcare

Healthcare is yet another regulation-heavy group, that may face easier rules under Republicans, and may outperform Monday

Watch managed care companies UnitedHealth Group Inc., Humana Inc. and CVS Health Corp, which owns insurer Aetna

Fossil Fuels

Traditional energy names can do well given Trump's general pro-oil stance

Watch Exxon Mobil Corp., Halliburton Co., Devon Energy Corp., EQT Corp., Chevron Corp., as well as the S&P 500 Energy Index

Trump Media

Shares of the Truth Social parent may be volatile as the former President owns a majority stake in the firm

The stock swung wildly in the trading day following the June debate between Biden and Trump, seeing gains and losses of as much as 8.8% and 14% respectively

Technology

A Bernstein basket looking at tech names that can do well under a Trump presidency includes Live Nation Entertainment Inc., Uber Technologies Inc., Lyft Inc., Charter Communications Inc., Etsy Inc., New York Times Co., Warner Bros Discovery Inc., Paramount Global, DoorDash Inc., Instacart parent Maplebear Inc., Comcast Corp. and Wayfair Inc.

Meanwhile companies Meta Platforms Inc., Google-parent Alphabet Inc. and Snap Inc. are expected to fare worse under Republicans and may underperform Monday

Also, the industries that should underperform...

China Exposed Stocks

Stocks across sectors with high exposure to China will likely be volatile

A JPMorgan index of companies with heavy exposure to the country includes Air Products and Chemicals Inc., Celanese Corp., BorgWarner Inc., Otis Worldwide Corp., Agilent Technologies Inc., IPG Photonics Corp. and Jabil Inc.

Renewable and Green Energy

Renewable energy and green energy focused stocks may underperform, as Democrats are widely seen as more friendly toward this industry

Watch First Solar Inc., Maxeon Solar Technologies Ltd., Sunnova Energy International Inc., Sunrun Inc., SunPower Corp., Enphase Energy Inc., Plug Power Inc., as well as the Invesco Solar ETF

Electric Vehicle Industry

The Biden administration's strong push toward electrification of transportation and Trump's claim that he will entirely reverse Biden's EV policy has put the industry in the midst of election rhetorics

While experts say that entirely throwing out the provisions of the Inflation Reduction Act is not very likely, there is a risk that EV makers, battery developers and other infrsatructure companies such as charging station operators may see benefits from the act narrow or slow down

Stocks that may move include Tesla Inc., Rivian Automotive Inc. and Lucid Group Inc., charging network operators such as ChargePoint Holdings Inc., Beam Global, Blink Charging Co.