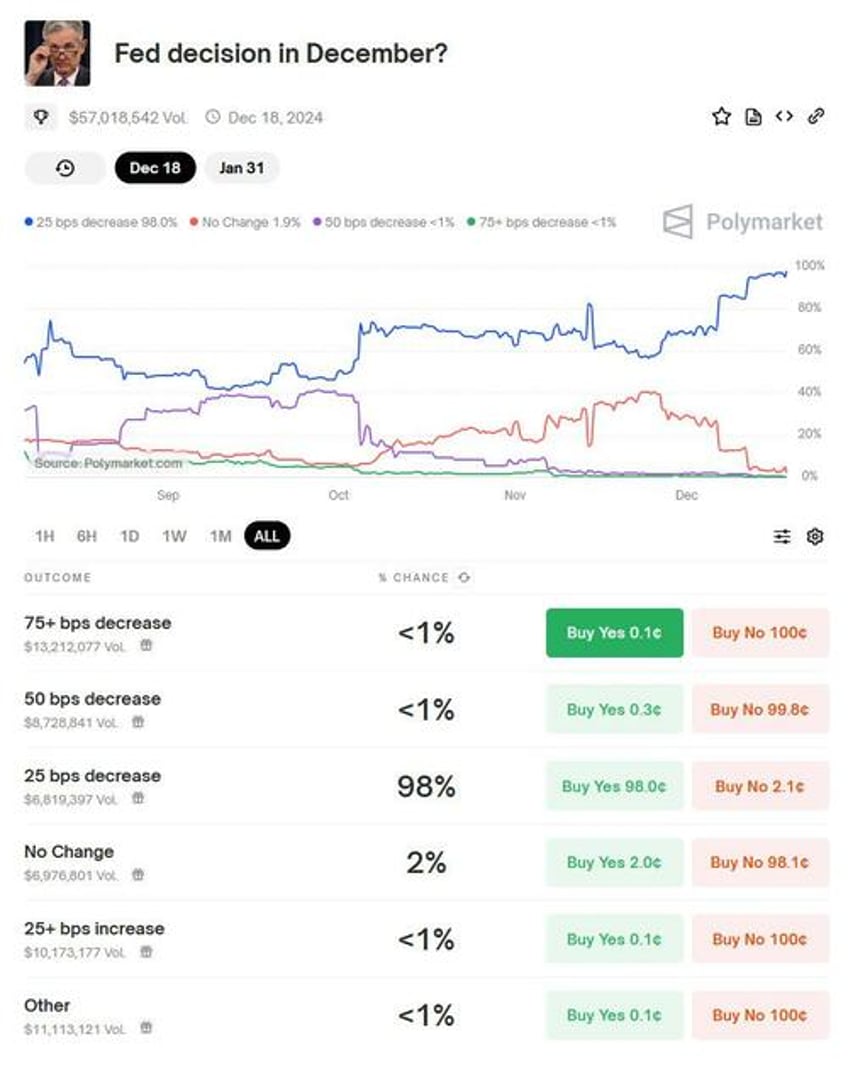

Earlier, we shared our comprehensive preview of what to expect from today's FOMC decision: in a nutshell, the Fed will cut rates by 25bps as Nikileaks, OIS and Polymarket all agree...

... in a "hawkish cut" which will see the Fed punt on a January rate cut by revising the dots higher, and since at that point Trump's fiscal policy will kick in, there is a material chance today's rate cut may also be the last one of this easing cycle. But certainly look to Powell's presser for more detail on what to expect in 2025. Also look to Powell to discuss any chances to the RRP rate (FOMC discussed dropping the RRP rate from 5 basis point above the target range to flat with the target range at the last meeting); also the FOMC will eventually taper Balance Sheet Runoff further, as otherwise it will once again have a reserve shortage crisis a la Sept 2019. The most likely scenario - when it happens - is a tapering Treasury runoff and a continuation of agency MBS runoff. Look for more details on that as well.