- APAC stocks kicked off the week mixed following the state-side gains on Wall Street after Fed Chair Powell's dovish pivot, whilst the weekend was packed with geopolitics.

- Lebanon's Hezbollah launched hundreds of rockets and drones at Israel early on Sunday. Israel's military said it struck Lebanon with around 100 jets to thwart a larger attack; Gaza talks in Cairo ended without agreement but negotiations continue.

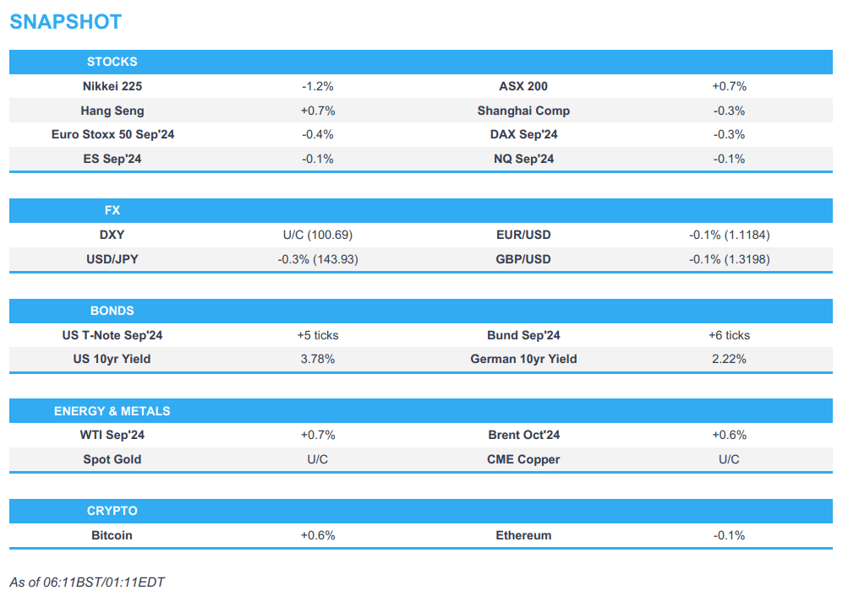

- DXY is steady on a 100 handle, EUR/USD briefly traded on a 1.12 level, Cable has slipped back below 1.32, JPY leads the majors.

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.3% after cash closed +0.5% on Friday.

- Looking ahead, highlights include German Ifo, US Durable Goods, UK Bank Holiday (market holiday), Supply from the EU, and Earnings from PDD.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks and Treasuries were firmer on Friday while the Dollar saw weakness after Fed Chair Powell completed his dovish pivot at the Jackson Hole Symposium.

- All sectors closed in the green with Real Estate and Consumer Discretionary sitting at the top of the pile whilst Consumer Staples and Utilities lagged - albeit still with modest gains.

- Key risk events this week include NVIDIA earnings (Wednesday) and US PCE (Friday).

- SPX +1.15% at 5,635, NDX +1.17% at 19,721, DJIA +1.14% at 41,175, RUT +3.19% at 2,219

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Goolsbee (2025, Voter) supports the Fed's new focus on the job market and inflation is on a path to 2%, according to CNBC. He said policy is now at its tightest point of the entire hike cycle. He added the Fed forecasts show widespread support for rate cuts, and the current Fed funds rate is set for different economic conditions. He wants to be careful about the employment side of the mandate and noted that by almost all measures the job market is cooling. Goolsbee does not like to offer firm guidance about Fed rate decisions and he does not think inflation will get stuck above 2%. He tries to resist committing himself on monetary policy, and historically rate cutting has been a process. He wants to hit the golden path of 2% inflation without a recession. Goolsbee reiterated Powell's rate comments were clear and definitive, according to Fox Business, and said there is every reason to think Fed forecasts of rate cuts will happen, while he has gotten warning signs of the job market. Goolsbee also reiterated the comments on Bloomberg TV.

- WSJ's Timiraos posted on X, "While Powell was forceful in laying out the Fed’s goals, he offered no specifics about the precise way officials will deliver them to retain maximum discretion". “He entirely avoided certain coded words like ‘gradual’ and ‘methodical’ that some colleagues in recent days had used to describe their expectation for a series of traditional quarter-point rate cuts. In doing so, Powell’s silence kept the door open to larger rate cuts if the labour market shows signs of greater weakness in the weeks ahead.”

- Canada Industrial Relations Board (CIRB) imposed binding arbitration on Teamsters Union, CN, and CPKC railways, according to Teamsters cited by Reuters. Canada Industrial Relations Board halts work stoppages at CN and CP railways.

- Canada Labour Minister Mackinnon said the CIRB has issued a decision to impose final and binding arbitration in negotiations between CN Rail, CPKC, and Teamsters Canada Rail Conference, and he expects that railway companies and employees will resume at the earliest opportunity, according to a post on X.

- Canadian National Railway said it had received an order from CIRB imposing binding arbitration between the company and Teamsters Canada Rail Conference. This means that the strike notice recently issued to CN by the Teamsters is now voided. CN Rail added that CIRB has also ordered that no further labour stoppage, including lockout or strike, can occur during the arbitration process, and will comply with the order, which also extends the current collective agreement until a new agreement is signed between the parties.

- Independent White House candidate Robert F Kennedy Jr has joined the Republican nominee Trump after dropping out of the race and endorsing the former US president, according to the BBC.

APAC TRADE

EQUITIES

- APAC stocks kicked off the week mixed following the gains on Wall Street after Fed Chair Powell's dovish pivot, whilst the weekend was packed with geopolitics in which the heavy fires between Israel and Hezbollah resulted in no civilian casualties, but both sides expressed no appetite for further escalation.

- ASX 200 traded firm with the index underpinned by Real Estate, Tech, and Energy, although further upside was limited by the losses in Healthcare - the underperforming sector.

- Nikkei 225 was pressured by the recent JPY strength following the Fed Chair's dovish comments after the BoJ Governor's hawkish remarks on Friday, in which Powell's speech ultimately resulted in a weaker Dollar and lower US bond yields. Auto stocks fell with Yamaha Motors sliding after reports Yamaha Corp was to sell a 1.7% stake in Yamaha Motors.

- Hang Seng and Shanghai Comp. were mixed with Hong Kong bolstered by its Real Estate sector, whilst the mainland was subdued in a tight range after the PBoC conducted its delayed MLF with a maintained rate at 2.30%.

- US equity futures were mostly subdued at the resumption of trade with contracts taking a breather after Friday's Powell-induced gains. Ultimately, price action was flat and horizontal overnight. (ES -0.1%)

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.4% after cash closed +0.5% on Friday.

FX

- DXY was caged within a narrow APAC range thus far after falling from a 101.55 high on Friday (vs 100.60 low) on the back of Fed Chair Powell's dovish pivot. DXY traded in a 100.53-72 APAC range with the next low to the downside at 100.01 (20th Jul 2023 low).

- EUR/USD was moving in tandem with the Dollar and contained within 1.1183-1.1201 parameters after printing a 1.1104-1.1200 range on Friday. The next level to the upside at 1.1228 (20th Jul 2023 high).

- GBP/USD was uneventful with UK participants away on Monday amid the Bank Holiday. GBP/USD was in a 1.3200-22 range (vs Friday's 1.3082-1.3230 parameter).

- JPY was narrowly outperforming in the G10 space as players reacted to the fallout from Fed Chair Powell. Traders are also cognizant of the difference in tone between BoJ Governor Ueda on Friday (hawkish) and Fed Chair Powell (dovish). USD/JPY dipped under 144.00 to trade in a 143.46-144.34 range.

- Antipodeans traded modestly softer overnight but consolidating following Friday's rise fuelled by the Fed Chair.

- PBoC set USD/CNY mid-point at 7.1139 vs exp. 7.1132 (prev. 7.1358)

- Brazil's Central Bank Chief Neto said recent volatility may show the market is pricing less room for fiscal and monetary intervention in the future, according to Reuters.

FIXED INCOME

- 10-year UST futures inched higher in early APAC hours as the region reacted to Friday's dovish pivot by Fed Chair Powell. Sep'24 futures traded in a 113'22+ to 113'30 APAC range, with the next upside level at 114'01 (21st Aug high).

- 10-year Bund futures faded earlier modest gains after gapping higher at the open (at 134.62 vs Friday's 134.46 close) as the contract caught up to the late gains in USTs on Friday. Traders look ahead to German Ifo.

- 10-year JGB futures were firmer in tandem with their US counterparts with the contract within a 144.54-87 band (vs Friday's 144.55-92 range).

COMMODITIES

- Crude futures were modestly firmer following a weekend of geopolitics which saw a heavy exchange of fire between Israel and Lebanon's Hezbollah, although no civilian casualties were reported and both sides signalled no appetite for escalation. The event was framed as one of the biggest clashes between the two sides in more than 10 months. Brent Oct'24 gapped up to USD 79.35/bbl (vs Friday's 78.98/bbl close), and prices traded on either side of USD 79.50/bbl for most of the APAC session.

- Spot gold saw mild initial upside following the modest escalation in geopolitics over the weekend coupled with a Dollar that remains subdued post-Powell. Spot gold saw an APAC range between 2,510.77-2,516.91/oz.

- Base metals were mostly and modestly firmer as Asia-Pac reacted to Fed Chair Powell's speech on Friday, whilst over the weekend PBoC Governor Pan said financial risks in key areas are being resolved in an orderly manner, according to Bloomberg. As a reminder, LME is closed today due to the UK Bank Holiday.

CRYPTO

- Bitcoin traded on either side of USD 64k following a weekend of rangebound trade, although Bitcoin found support near its 100 DMA (63,785) on some charts.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan said financial risks in key areas are being resolved in an orderly manner and added the government will encourage financial institutions to increase support for weak links or in key areas, according to Bloomberg.

- PBoC injected CNY 300bln via 1-year MLF at a maintained rate of 2.30% (delayed MLF).

- PBoC injected CNY 471bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- Japanese former Defence Minister Shigeru Ishiba says he will run in the ruling LDP leadership race on September 27th, according to Reuters.

- IMF Chief Economist said there is scope for the BoJ to further normalize monetary policy, raising interest rates gradually for some time, according to Reuters.

DATA RECAP

GEOPOLITICAL

MIDDLE EAST

- Lebanon's Hezbollah launched hundreds of rockets and drones at Israel early on Sunday. Meanwhile, Israel's military said it struck Lebanon with around 100 jets to thwart a larger attack. The event was framed as one of the biggest clashes in more than 10 months. Three deaths were confirmed in Lebanon and one death in Israel, both sides indicated appetite to avoid further escalation, but warned that there could be more strikes to come, according to Reuters.

- Hezbollah said it completed the 'first phase' of its response to Israel's killing of a top commander last month and hit 11 Israeli military sites on Sunday, firing more than 320 Katyusha rockets, according to Reuters. Hezbollah said it began the attack on Israel with a large number of drones in response to the top commander's killing in a Beirut suburb last month, and it will take “some time” to complete its response to the top commander's killing.

- Israeli PM Netanyahu said the military intercepted all the drones that Hezbollah launched at a strategic target in central Israel, and the attacks are 'not the end of the story.' Netanyahu added that the country has taken the first step towards returning its residents in the north safely to their homes, according to Reuters.

- Hezbollah leader Nasrallah said the group will assess the impact of Sunday’s operation; if results are not seen to be enough, "we will respond another time". The Group said its military operation was completed as planned, with precision, and decided not to respond to the killing of a top commander by targeting civilian areas. Response was delayed for several reasons, including mass Israeli and US military mobilization. Hezbollah said it wanted to target military sites close to Tel Aviv, and targeted a military intelligence base 110 km into Israeli territory, 1.5 km away from Tel Aviv. The group said for the first time, it sent drones to Israel from the Bekaa region, while the group said it had no intention to use precision missiles today, but may use them in the near future.

- Israel's Foreign Minister said Israel does not seek a full-scale war but will act according to developments on the ground, according to Reuters.

- Gaza talks in Cairo ended without agreement, according to Reuters citing Egyptian sources. "Axios quotes US official: Gaza talks will continue in the coming days through working groups to address issues and remaining details", reported by Sky News Arabia.

- White House National Security Adviser Sullivan says they are still working in Cairo towards a ceasefire deal, according to Reuters.

- Hamas' armed wing said it fired a rocket at Tel Aviv, according to Reuters.

- Jordan warned the escalation in Lebanon and its 'dangerous repercussions' could lead to regional war, according to Reuters.

- US President Biden asked Israeli PM Netanyahu to pull Israeli troops from part of the Egypt-Gaza border, according to Axios.

- On Sunday, Hamas said that it rejects the new Israeli conditions put forward in the Gaza ceasefire talk, according to Reuters.

- Iranian Foreign Minister said Iran is "not afraid of escalation, but we do not seek it, unlike Israel", according to Al Jazeera, adding that their retaliation "will be decisive and well calculated".

- Yemen's Defence Minister said Yemen is ready to inflict painful blows on Israel, according to IRNA.

RUSSIA-UKRAINE

- Ukrainian President Zelenskiy said negotiations are ongoing with Saudi Arabia, Qatar, Turkey, and Switzerland about a second summit on peace, according to Reuters. He added Ukraine’s operation in Russia’s Kursk region is difficult but he views its progress positively.

- Russia and Ukraine exchange 115 prisoners each, according to RIA. Russia said Ukraine has returned servicemen captured in the Kursk region.

- Ukraine's military says Ukraine air defence systems in Kyiv region engaged in repelling Russian air attack, according to Reuters.

- Ukraine said Belarus massing troops at the border under a pretext of drills, and warned of “unfriendly moves”, according to Walla's Elster.

SOUTH CHINA SEA

- Philippines' South China Sea Task Force said Chinese Coast Guard vessels 'made close perilous manoeuvres that resulted in ramming' and deployed water cannons against Manila's fisheries vessel, leading to engine failure, and added that fisheries vessel was 'targeted by People's Liberation Army Navy ship and multiple China Coast Guard ships' to block the mission.

- China says it 'took control measures' towards the Philippine vessel near the Sabina Shoal, and added that Philippine's vessel 'illegally' entered waters near Sabina Shoal in the South China Sea. China said the Philippine vessel has been continuously approaching Chinese Coast Guard ships in a dangerous manner, according to Reuters.

- Philippines South China Sea Task Force said a Chinese fighter jet 'engaged in irresponsible and dangerous manoeuvres, deploying flares multiple times at a dangerously close distance', according to Reuters.

US-CHINA

- Chinese Commerce Ministry said it strongly opposes the US adding Chinese entities to the export control list over Russia-related issues, and the action disrupts international trade order and hinders normal economic exchanges. Commerce Ministry said it will take necessary measures to resolutely safeguard the legitimate rights of Chinese companies.

OTHER

- Chinese President Xi is to visit Russia in October, according to RIA citing the Chinese envoy.

- North Korea said it will continue to strengthen strategic power to control security challenges posed by the reorientation of US nuclear strategy, according to KCNA.

- China's military said it conducted armed patrols and air-ground joint police patrols near China-Myanmar borders, according to a statement.

- Taiwan Defence Ministry says in the past 24 hours, 12 Chinese military aircraft were detected operating around Taiwan (vs 12 in the prior 24 hours), according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB's Chief Economist Lane said the return to the 2% inflation target is not yet secure. "The monetary stance will have to remain in restrictive territory for as long as needed to shepherd the disinflation process towards a timely return to the target", Lane said. Lane also warned that keeping rates high for too low could deliver below-target inflation.

- ECB's Rehn said disinflation and weak economy support a September cut; downtrend in inflation is on track, via Bloomberg TV. He said they have to be open to what rate decision they do, and do not want to commit themselves to what they do at this stage when asked about a 50bps cut. Rehn highlighted data-dependency and said the Euro has an indirect effect and doesn't target the FX rate.