The Fed could not have picked a worse time to start easing (although with the election in just over a month, the "apolitical" Fed really had no choice).

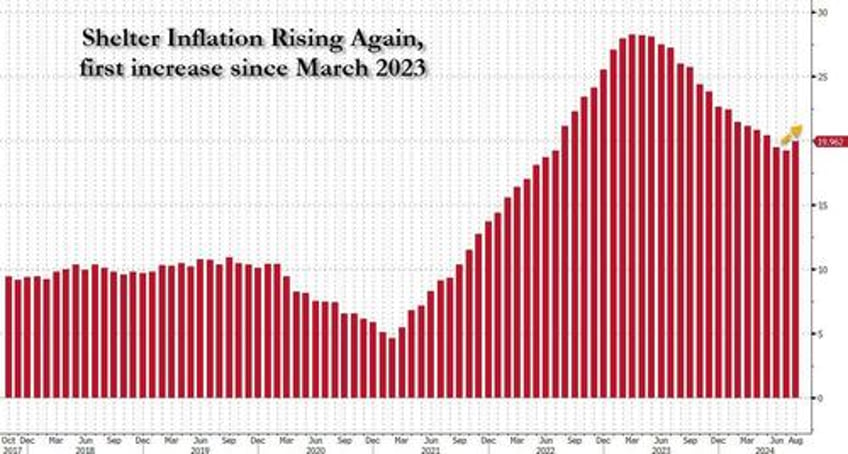

As we predicted all the way back in December, the Fed would cut rates just in time for shtler/home prices and rent to start rising again...

The next paradox for the Fed: since Shelter/OER inflation lags by 18 months, housing inflation will decline well into 2025 even as actual rents are again starting to tick up.

— zerohedge (@zerohedge) December 12, 2023

By the time lagged CPI catches up with "today", real rents will be rising double digits. pic.twitter.com/sHOWxN2OVQ

... and sure enough, just days before the Fed's jumbo 50bps rate hike, the BLS reported the first annual increase in shelter costs since March 2023.

But that's just the beginning: for what happens next, and the next price surge from already record high prices... hold on to your hats.

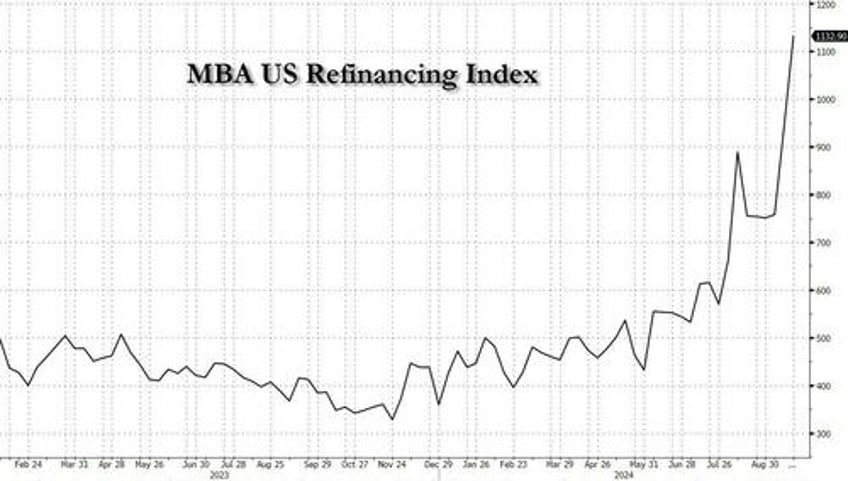

Thanks to the Fed's 50bps rate cut which has already translated into the cheapest mortgage borrowing costs in two years, applications to refinance mortgages surged for a second week: the Mortgage Bankers Association’s refinancing index (whose data covers more than 75% of all retail residential mortgage applications in the US) soared 20.3% in the week ended Sept. 20 to the highest level since April 2022 following a 24.2% surge in the previous week, as the rate on a 30-year fixed mortgage eased 2 basis points to 6.13%, the eighth straight weekly drop and the longest stretch of declines since 2018-2019.

That also helped boost the group’s home-purchase applications index higher by 1.4% last week to the highest level since early February. The fifth straight weekly advance in the measure points to burgeoning demand in a housing market that’s gradually finding some footing.

While traditionally an easing cycle does not immediately translate into a surge in refi applications, largely because borrowers would rather wait a little longer and lock in even lower rates, in this case there may be a glitch in the matrix since yields on the 10-year Treasury note already edged higher in the last week as traders debated the magnitude of Federal Reserve’s expected interest-rate cut in November as well as the path for reductions, and also started pricing in the next bout of inflation (which will be triggered in part by the coming burst in home prices).

Sure enough, as the average contract rate on a 15-year mortgage and the five-year adjustable-rate mortgage ticked up last week after sharp declines in the prior two weeks, those seeking to refinance may rush to do so now before rates rise even more and the curve steepens further.

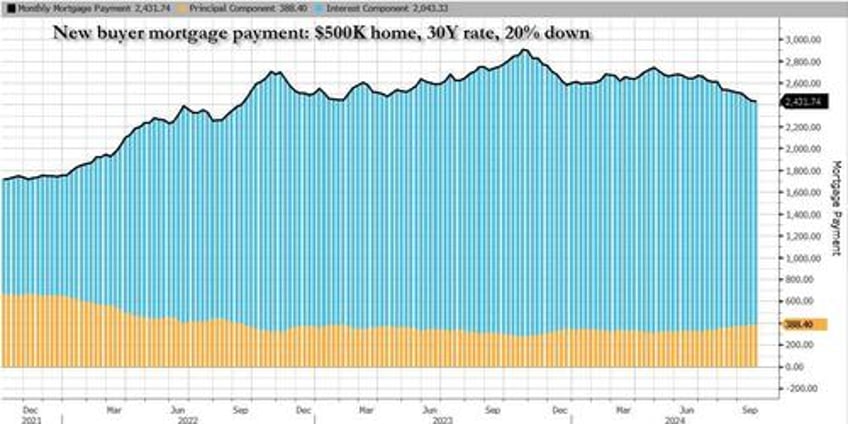

But why do lower refi rates mean higher prices? Simple: lower prices means higher affordability, and as mortgage rates slide to the lowest in two years, borrowers are set to shave thousands of dollars off of their annual payments. That’s freeing up cash that could be used to continue consumer spending, outlays for home improvements, debt repayment and more. But mostly for home purchases and even higher home prices at a time when the home supply pipeline is woefully plugged up.

In fact, one can make the argument that the surge in refinancings could spark a dramatic, double-digit increase in median home prices.

But the recent surge indicates it may not take much for other mortgage holders to realize significant savings. The last time refinancing activity was this high, mortgage rates were just under 5%, according to MBA.

“While the level of refinance activity is still modest compared to prior refi waves, they now account for the majority of applications,” said Joel Kan, MBA’s vice president and deputy chief economist.

Consider the following example: the average loan refinanced last week was around $386,000. If it were taken out a year ago and assuming that $4,000 in principal has been paid off in that time, the original loan amount was about $390,000. At a 7.41% rate when that loan was originated, the homeowner would pay $2,700 a month. But refinancing the remaining $386,000 into a new 30-year mortgage at the current 6.13% rate would translate to a payment just under $2,350. That’s a saving of $350 a month or more than $4,000 a year!

Naturally, the drop in mortgage rates helps larger loans exponentially. For a $1 million mortgage — once extremely rare but now much more common — the payment with a 6.13% mortgage interest rate would be around $6,079 a month. But a year ago, with rates at 7.41%, the payment would have been over $6,900, so that homeowner could save more than $800 a month.

The chart below shows the recent drop in the average mortgage payment for a $500K house, 30Y mortgage and 20% down.

Of course, falling mortgage rates are just one piece of the affordability puzzle. On the resale market, where inventory remains near the lowest on record as owners remain locked into their low mortgage rates, the median price is $416,700, near the highest on record. Which is why any cash unlocked thanks to lower refi rates, will almost certainly go toward the price of a new home, just as Kamala's $25,000 first home buyer subsidy will also lead to even recorder home prices. Which is why in the coming months, keep a close eye on the Owner-equivalent rent component of the CPI basket (which just happens to be the largest one) which is about to blast off just as fast as all those new mortgage refis.