By Russell Clark of the Capital Flows and Asset Markets substack

I started as an emerging market analyst in 2002, and one of the biggest best stocks at the time was Petrochina. It was listed in Hong Kong in 2000, and had done nothing for years, before stating to move in 2003, and rising 1,000% by 2007, before entering a prolonged bear market.

In 2003, Warren Buffett bought 7% of Petrochina, and then slowly began exiting in 2007. The final spike happened after Berkshire Hathaway had sold out fully, and the market believed the overhang was gone. Markets were getting very bullish on emerging markets as the Federal Reserve was beginning to cut interest rates as this was seen as the catalyst for emerging markets in 2002.

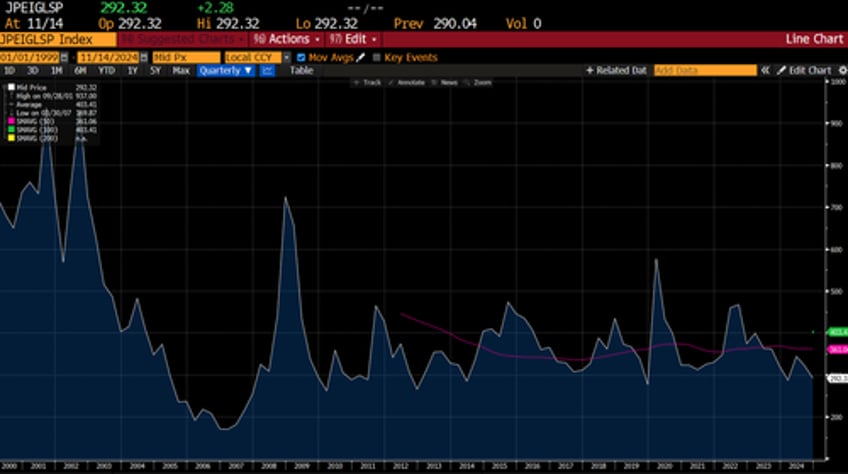

The problem with this view was that in 2002, Emerging market bond spreads were very wide, and commodity prices low. By 2007, emerging market spreads were tight, and commodity prices high. Even though the Fed cut rates, emerging markets and Petrochina were not the place to be anymore. However, by early 2009, Emerging market bond spread were attractive again, but as of today, look unappealing.

I was reminded of this by seeing Warren Buffett continuing to reduce his stake in Apple. Buffett has done very well out of Apple. He started building a stake in 2016, and kept increasing. Average cost in USD 37, versus a price today of 225.

Is there any similarity between Apple and Petrochina?

In 2016, US corporate credit spreads were relatively wide as fears of a China devaluation and recession took hold of the market. Today we are plumbing new all time lows in US corporate spreads.

To make this more germane to the analysis, we can look at Apple’s earning yield compared to 5 year treasuries. You can see that 5 year treasury is more attractively priced for the first time since 2007. With tariff threats on all imports, it would also possible to see Apple earnings fall.

But I can see other ways things go wrong from here. US equities tend to do best when commodity markets are weak to falling. Using the CRB Raw Industrial Index, a spike in commodities bodes ill for US equities.

As you should be aware, gold has done well this year, although with a small selloff recently. So why has gold done well, and other commodities poorly?

The key here is that China has so far restrained from stimulus. Using the 12mth Shanghai Interbank Rate which has high correlation to activity, China remains in a funk.

However there is talk of stimulus. The bellwether stock for the Chinese economy are property stocks. Recently The Shanghai Property Sector Index has popped. What I find most interesting about the above and below graph is that in my mind China stimulated when Trump was in power, while they took austerity measures while Biden was in power. It seems to me the China takes the view that you need to negotiate with Trump from a position of strength- which makes sense to me. Did they use the period of Biden in power to husband resources?

Do we have a complete bearish story? Well valuations for US equities are very rich. We have Warren Buffett selling down, and raising cash. China economy is at lows, but with potential to stimulate, and investors remembering the last Trump stint in power and are all in. Its close to a complete story - the mystery, as always, is China.

Can and will they stimulate? I would be watching Chinese equities more than US equities these days.