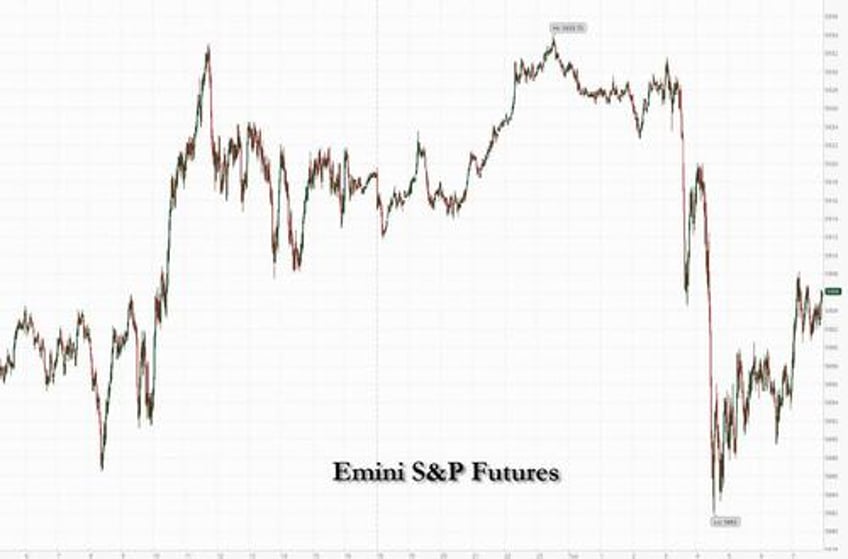

Stocks fell, with European equities shedding almost 1%, and global bonds and the dollar climbing on worries over the latest escalation in the Ukraine. Sentiment was spooked after Vladimir Putin signed a decree lowering Russia's threshold for a nuclear strike in the event of a massive conventional attack on its soil. The warning came just minutes before Ukrainian forces carried out their first strike within Russian territory with a Western-supplied ATACMS missile, although the tepid Russian response indicated that Putin is in no rush to retaliate to this provocation by the deep state. As of 8:00am S&P 500 futures dipped 0.3%, but were well off their session lows; Nasdaq futures dropped 0.2% with TSLA down 1.5% and NVDA up +0.8% pre-market. The yield on 10-year Treasuries fell three basis points to 4.38% after earlier dropping to 4.33%. The moves were steeper in Europe, with German bond yields dropping to the lowest since October. The euro retreated 0.3%. Poland’s main stock index sank more than 3%. However, bunds then pared gains and their outperformance over Treasuries as traders unwind haven buying after Russia reports limited damage following Ukraine’s missile attack using US weapons, a move seen as Putin's unwillingness to push the world into WW3. Commodities are mixed: oil is flat, base metals are mixed with copper and iron ore higher, and Precious Metals are higher. Today, the key focus will be LOW and WMT earnings pre-market. On macro data, we will receive Housing Starts and Building Permits.

In premarket trading, Walmart rose 4% after the company boosted its outlook for the year on strong demand from US consumers searching for value. Alphabet dropped 0.5% on reports that top Justice Department antitrust officials decided to ask a judge to force Google to sell off its Chrome browser to break its monopoly search. Bakkt jumped another 18% after the Financial Times reported that Trump Media and Technology Group is in advanced talks to buy the crypto trading firm, citing people familiar with the matter. Here are some other notable premarket movers:

- Incyte drops 11% after the company announced it will pause enrollment in a Phase 2 study of MRGPRX2, which is aimed at a chronic skin condition.

- Super Micro Computer jumps 23% after the company hired a new auditor and filed a plan to come into compliance with Nasdaq listing requirements.

- Symbotic soars 30% after the robotics warehouse automation company provided a 1Q revenue outlook that beat estimates.

- XPeng ADRs gains 5% after the electric-vehicle maker’s fourth-quarter forecast beat estimates, with the company forecasting sales of 87,000 to 91,000 units — higher than the average estimate of 73,960.

Markets were rattled by reports that Ukrainian forces reportedly carried out their first strike on a border region in Russia using Western-supplied missiles. Earlier, President Vladimir Putin had approved an updated nuclear doctrine that expanded the conditions for Russia to use atomic weapons, including in response to a massive conventional attack on its soil. Putin had pledged in September to revise the doctrine.

“The market reaction is logical, one could feel already yesterday that the tension was rising,” said Andrea Tueni, head of sales trading at Saxo Banque France. “For the moment the market reaction is contained, some are still in a wait-and see-mode.”

Traditional haven assets including the Japanese yen, Swiss franc and gold gained. Ukraine’s sovereign dollar bonds - which had risen sharply in recent days on hopes for a Trump-led ceasefire, fell the most among emerging-market peers, with a note due February 2029 losing 1.6 cent on the dollar.

Also on Tuesday, traders were discussing how Trump’s nomination of Treasury secretary could shape policy. The transition team is considering pairing Kevin Warsh, a former Fed official, in the Treasury secretary role, with hedge fund manager Scott Bessent as director of the White House’s National Economic Council, according to people familiar with the matter. “Kevin Warsh was in the FOMC, so the likelihood of political interference into the Fed policy making is certainly diminishing if he were to become the Treasury secretary,” said Gero Jung, chief economist of Mirabaud Asset Management in Geneva.

Europe's Stoxx 600 fell as much as 1% on concerns Russia’s war in Ukraine is escalating. The turbulence boosted the region’s defense stocks, several of which are among the top gainers alongside Aeroports de Paris and Imperial Brands. At the other end of the index, Siemens and Husqvarna fall on respective broker downgrades. Here are the biggest movers Tuesday:

- European defense stocks rise while airlines slide after RBC Ukraine says Ukrainian armed forces carried out their first strike in a border region within Russian territory

- Imperial Brands shares rise as much as 3.5%, briefly hitting their highest level since 2019, after the tobacco giant reported annual results that were broadly in-line with its pre-close update

- Aéroports de Paris rises as much as 6.2% after Bank of America and Stifel upgrade the stock to buy, predicting that earnings momentum and the group’s strong international platforms will provide upside

- Bodycote shares rise as much as 7.8%, marking its biggest jump in 20 months, after the heat treatment specialist said its full-year performance should meet market expectations

- Avon Technologies gains as much as 9.9% to a three-year high, after the respiratory-protection equipment maker reported preliminary full-year earnings, with mid-term targets a key positive

- Vesuvius shares rise as much as 8%, the most in almost 16 months, after the molten metal flow engineering firm delivered a resilient trading update despite tough conditions in its end markets

- Siemens falls as much as 4.1% after being downgraded to neutral at Bank of America, with the broker quoting “limited” 2025 momentum and a slow recovery for its key Digital Industries division

- Husqvarna drops as much as 6.8% after the Swedish gardening equipment manufacturer was cut to sell at SEB, with the broker no longer seeing any major recovery from 2024 lows

- Italian shares declined, with the FTSE MIB being the second-worst performer in the world. Large domestic lenders dragged the index down as investors took profit following YTD gains

- CaixaBank shares drop as much as 5.1% after the Spanish bank unveiled a new strategic plan. KBW noted that the capital distribution targets are now less clear

- Novo Nordisk shares erased what was left of this year’s once lofty gains as concerns around the impact of competition and supply constraints cool excitement around the Danish drugmaker’s obesity drugs

- Spie drops as much as 4.5%, briefly hitting their lowest level since January, after one of the company’s investors offered to sell shares at a discount compared to Monday’s close

Earlier in the session, Asian stocks rose, extending a rebound from recent losses, led by Taiwan and Australia after gains in US peers overnight. The MSCI Asia Pacific Index climbed 1.1%, with TSMC and Commonwealth Bank of Australia among the biggest boosts. Tech and financials were among the largest drivers amid broad advances across sectors. US and European stock futures rose as a decline in Treasury yields bolstered the appeal of holding equities. The rally follows a decline of 3.9% in the Asian benchmark last week, its worst in seven months. Investors remain focused on US President-elect Donald Trumps’ plans including the heavy tariffs he has vowed on China, as well as the response planned by the latter as it continues to try and revive its economy.

In FX, the Bloomberg Dollar index rose 0.1%, while USDJPY dropped as much as 0.9% to 153.29, before paring losses; one-week volatility spiked by 60 basis points to 10.34% after the Russia headlines hit the wires; the Swiss franc also inches higher.

In rates, treasuries held flight-to-quality gains garnered during London morning following report Ukraine had carried out its first strike on Russian territory with Western-supplied missiles. Yields, off session lows, remain 4bp-5bp richer across the curve. Scant US economic data and Fed speeches are slated. Treasury 10-year yields are around 4.37% vs session low 4.343%; gilts in the sector lag by around 1bp while bunds trade broadly in line; curve spreads are within 1pm of Monday’s closing levels

In commodities, natural-gas futures gained as much as 1.1%, trading near their highest levels in a year. Oil traders, meanwhile, appeared unfazed by the latest developments, with WTI falling 0.8% to $68.60 a barrel after Europe’s largest oil field gradually restarted following a power outage. Spot gold climbed 0.9% or $23 to around $2,634/oz.

Bitcoin is back in the vicinity of an all-time high, climbing above $92,000. The digital asset has been supported by a series of developments highlighting the deepening embrace of the digital-asset industry by Trump.

Today's economic data calendar includes October building starts and housing permits at 8:30am. Fed speaker slate includes Kansas City’s Schmid at 1:10pm

Market Snapshot

- S&P 500 futures down 0.6% to 5,885.75

- STOXX Europe 600 down 0.9% to 498.07

- MXAP up 1.0% to 183.95

- MXAPJ up 0.7% to 581.32

- Nikkei up 0.5% to 38,414.43

- Topix up 0.7% to 2,710.03

- Hang Seng Index up 0.4% to 19,663.67

- Shanghai Composite up 0.7% to 3,346.01

- Sensex up 0.5% to 77,692.91

- Australia S&P/ASX 200 up 0.9% to 8,374.03

- Kospi up 0.1% to 2,471.95

- German 10Y yield little changed at 2.29%

- Euro down 0.6% to $1.0535

- Brent Futures down 0.8% to $72.74/bbl

- Gold spot up 0.8% to $2,631.64

- US Dollar Index up 0.28% to 106.57

Top Overnight News

- Haven assets gained as Vladimir Putin signed a decree allowing Russia to use nuclear weapons in the event of a massive conventional attack on its soil. It will also view aggression against itself or allies by a non-nuclear state backed by other nuclear powers as a joint attack. Adding to the tension, Ukrainian forces carried out their first strike within Russian territory with a Western-supplied ATACMS missile. BBG

- Japan and China sold Treasuries last quarter ahead of the US election. Japanese investors sold a record $61.9 billion, while funds in China offloaded $51.3 billion, the second biggest sum on record. BBG

- China is “scrambling” to secure meetings w/members of the incoming Trump administration. FT

- The BOJ may raise policy rates to “a neutral rate” of 1% by March 2026, MUFG Chairman Kanetsugu Mike said. BBG

- Lebanon and Hezbollah agreed to a US proposal for a cease-fire with Israel with some comments on the content. Reuters

- NATO’s 15 largest European members may have to double defense spending to $720 billion annually to meet the challenge of Russia’s war in Ukraine and the possibility of less American support. BBG

- Trump is leaning towards Warsh as Treasury Sec with Bessent as head of the White House’s National Economic Council. BBG

- Trump is said to be pressuring senators to confirm Matt Gaetz as Attorney General, according to Axios. However, it was also reported that Trump admitted Gaetz may not be confirmed by the Senate, according to NYT.

- Trump’s cabinet picks could face obstacles from as many as 9 Republican Senators. The Hill

- Alphabet shares down ~70bps premarket after people familiar said the DOJ will push for Google to sell its Chrome browser to break its monopoly. Officials are also seeking action on data licensing and AI. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly in the green following the similar performance stateside although gains were capped amid relatively quiet newsflow with no major fresh macro catalysts to drive price action. ASX 200 outperformed and notched a fresh record high with all sectors in the green and the advances led by a tech resurgence and strength in gold miners, while there were recent amiable Xi-Albanese comments and Morgan Stanley raised its ASX 200 target. Nikkei 225 traded higher and shrugged off a firmer currency as Japan aims for cabinet approval of an economic package soon. Hang Seng and Shanghai Comp swung between gains and losses despite better-than-expected earnings from Xiaomi which failed to lift shares in the smartphone/EV maker, while support pledges by regulators did little to boost sentiment and the EU is also reportedly to demand tech transfers from Chinese companies in return for EU subsidies which would apply to batteries but could be expanded to other green sectors.

Top Asian News

- PBoC asks financial institutions to stop buying offshore Local Government Financing Vehicle (LGFV) bond under southbound connect scheme, via Reuters citing sources

- PBoC's Zhu said China will deepen Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor reforms, while it will support Hong Kong to develop the offshore yuan market.

- Chinese Vice Premier He Lifeng said they will support more quality enterprises to list and issue bonds in Hong Kong, as well as support Chinese financial institutions in Hong Kong to expand their business.

- China's NFRA chief said Chinese banks have sufficient buffers for risk and they will implement the new CNY 60bln limit on local government debt and support financial institutions in debt restructuring to ease pressure on local governments. Furthermore, efforts will focus on improving financial service facilitation in the Greater Bay Area through interoperability of regulatory mechanisms and targeted policy issuance, while there are encouraging Chinese-funded banks and insurance institutions to set up their regional headquarters in Hong Kong to support its economic development.

- China CSRC Chairman Wu Qing said they will support listings inside and outside of the mainland.

- EU is reportedly to demand technology transfers from Chinese companies in return for EU subsidies, while the requirements would apply to batteries but could be expanded to other green sectors, according to FT.

- Hong Kong jailed all 45 Hong Kong pro-democracy campaigners in the city's largest security trial with legal scholar Benny Tai sentenced to 10 years in prison for subversion and student leader Joshua Wong sentenced to 4 years and 8 months, while it was later reported that the US strongly condemned the jailing of the democracy activists, according to AFP.

- Japanese Economic Revitalisation Minister Akazawa said they are aiming for cabinet approval of the economic package soon and it is crucial to boost pay for all generations with the package, while DPP head Tamaki also said that they aim for cabinet approval of economic measures by Friday.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner reflecting fundamentals and they will continue to take appropriate action against excessive forex moves. Kato stated there is absolutely no change to their stance on forex and they have been seeing somewhat one-sided, sharp moves in the forex market since late September, while he reiterated they are closely watching FX moves with the utmost sense of urgency.

- RBA Minutes from the November 5th meeting stated the Board is vigilant to upside inflation risks and policy is needed to remain restrictive, while it saw no immediate need to change the Cash Rate and reiterated it is not possible to rule anything in or out on future changes in the Cash Rate. RBA Minutes noted their forecasts were based on the technical assumption for the Cash Rate to stay steady until mid-2025 and the Board considered what might warrant future change in cash rate or prolonged steady period, as well as discussed scenarios where policy would need to stay restrictive for longer or tighten further but also considered scenarios where a rate cut would be justified, including weak consumption. Furthermore, RBA noted the supply gap might be wider than assumed, necessitating tighter policy and rates might need to rise if the Board judged policy was not as restrictive as assumed, while it also stated that the Board had "minimal tolerance" for inflation above forecasts and would need more than one good quarterly inflation report to justify rate cut.

- Xpeng (XPEV/ 9868 HK) Q3 (RMB): adj eps -1.62 (prev. -1.61), revenue 10.1bln (prev. 9.91bln), vehicle deliveries 87-91k (+44.6-51.3% Y/Y).

- China's chip advances stall as US curbs hit Huawei AI products, via Bloomberg.

European bourses opened on a mixed/modestly firmer footing. Thereafter, Russia’s Kremlin said "Russia reserves the right to use nuclear weapons in an event of aggression". This sparked a safe-haven bid, with equities selling-off to session lows, whilst the JPY and bonds soared to highs. This move has since stabilised, with equities currently residing at lows. European sectors opened entirely in the green, but sentiment has since slipped and now shows a mostly negative picture in Europe. A clear defensive bias is seen in Europe; Utilities top, whilst Autos and Consumer Products lags. US equity futures are entirely in the red, with sentiment hit following comments via Russian Kremlin that noted it could respond to aggression in a nuclear manner. Goldman Sachs lowers its 12 month Stoxx 600 target to 530 from 540 (currently 502). Cuts FTSE 100 target to 8500 from 8800 (currently 8138)

Top European News

- UK PM Starmer announced the relaunch of UK-India free trade talks, while it was also reported that Starmer met with Japanese PM Ishiba and agreed to start "2 + 2" economic and trade cooperation talks between the UK and Japan.

- ECB's Panetta says the ECB should move to a neutral monetary stance, or expansionary if necessary; forthcoming change in the US govt adds uncertainty to the inflation outlook. Still a long way from the neutral rate. ECB needs to give more explicit indications of its policy rate intention.

- BoE Governor Bailey says services inflation is still above level that is compatible with on-target inflation. Says BoE must watch services inflation carefully. Says a gradual approach to removing monpol restraint will help observe risks to the inflation outlook.

- BoE Deputy Governor Lombardelli says we have seen a fall in services inflation and wage settlements; sees risks to inflation on both sides.

- BoE's Taylor says disinflation is unfolding as we should expect.

- BoE's Mann says forward-looking price and wage indicators have been flat and above target for four months, raises risk of inflation persistence. Says financial market inflation expectations suggest BoE will not get to 2% inflation in the forecast horizon. Latest Budget offers opportunity for firms to realise price increases that are inconsistent with 2% inflation target. Even before the Budget, higher minimum wage was causing firms problems in maintaining wage differentials.

- Moody's says total industry costs from Britain's review into motor finance commissions could reach GBP 30bln

FX

- DXY is firmer vs. peers (ex-JPY) after a sluggish start to the session which appeared to be a signal of USD consolidation from its post-election run of gains. However, the risk-off move prompted by Russian Kremlin comments managed to provide some reprieve.

- EUR/USD has been swept up in the broader risk-averse move which provided the USD some reprieve. Today's EZ HICP (Final) metrics were unrevised, and as such had little impact on the Single-currency. EUR/USD briefly slipped below the bottom end of yesterday's 1.0529-1.0607 range.

- JPY attempting to claw back some of yesterday's lost ground vs. the USD with Japanese Finance Minister Kato attempting to lend a helping hand, with familiar jawboning overnight. USD/JPY selling exacerbated with the pair breaking below the bottom end of yesterday's 153.84-155.35 range due to risk-aversion prompted by comments from the Russian Kremlin.

- GBP struggling against the USD, pulling back below the 1.2650 level and hovers just above yesterday's trough at 1.2611. The TSC Hearing is currently ongoing at time of publish; so far, BoE's Mann has repeated her familiar hawkish rhetoric, whilst Governor Bailey largely reiterated comments made at the last BoE meeting.

- Antipodeans are both softer vs. the USD with both currencies hampered by the current risk environment and scaling back some of yesterday's gains. AUD/USD managed to advance to a high of 0.6523 earlier but has since pulled back below 0.65 (vs. yesterday's trough at 0.6447).

- PBoC set USD/CNY mid-point at 7.1911 vs exp. 7.2305 (prev. 7.1907).

Fixed Income

- USTs have marched higher in early trade with a safe-haven bid emerging from comments by the Russian Kremlin that it could respond to aggression in a nuclear manner. Fresh US-specific macro drivers are currently lacking in what is set to be a week that contains a light data slate. Dec'24 UST cleared a slew of highs from last week as well as the 110 mark and matched the 12th November high at 110.04.

- Bunds are higher in-fitting with global counterparts as macro updates from the Eurozone remain light for today's session thus far; focus ultimately lies on Flash PMIs on Friday. Bunds have taken out a slew of highs from last week with the next upside target coming via the 133 mark with the 30th October high just above at 133.02.

- Ahead of the BoE TSC Hearing, the 2038 Gilt auction was fairly weak vs the prior outing (pre-Budget). Gilts topped 94.50, but has since edged back below that level to a current 94.25. The TSC Hearing is currently ongoing at time of publish; so far, BoE's Mann has repeated her familiar hawkish rhetoric, whilst Governor Bailey largely reiterated comments made at the last BoE meeting.

- UK sells GBP 3.25bln 3.75% 2038 Gilt: b/c 2.74x (prev. 3.28x), average yield 4.558% (prev. 4.131%) & tail 0.6bps (prev. 0.1bps)

Commodities

- WTI and Brent are on the back foot, having initially started the European session with incremental losses. Pressure in the complex accelerated following commentary from Russia’s Kremlin which noted that, "Russia reserves the right to use nuclear weapons in an event of aggression". On the supply front, Equinor said production has restarted at its Johan Sverdrup oilfield. Brent’Jan 25 sits towards the bottom end of a USD 72.72-73.53/bbl range.

- Precious metals are on a firmer footing continuing the price action seen overnight. XAU specifically caught a bid owing to its safe-haven status, following the aforementioned geopolitical updates via Russia’s Kremlin.

- Base metals began the European session entirely in the green, benefiting from the positive risk tone overnight and amid support pledges by Chinese officials. Some pressure, with sentiment hit following the above geopolitical related headlines.

- Equinor (EQNR NO) says production has restarted at its Johan Sverdrup oilfield; expects the oilfield to produce at 2/3 of normal capacity during morning hours today. Still working to restore full output capacity.

- Chinese October crude iron ore output -4.1% Y/Y at 86.45mln tonnes, according to stats bureau. Alumina output +5.4% Y/Y at 7.43mln metric tons. Lead output -5.3% Y/Y at 661k tons. Zinc output -9.5% at 565k tons.

Geopolitics: Middle East

- Against the backdrop of Amos Hochstein's visit to Beirut - the US administration is warning "not to read too much" his visit as a sign that a deal may be imminent - as negotiations are ongoing, via Kann News's Stein

- Iranian Foreign Minister says "We consider the recent Israeli aggression on our territory a new attack and deserves a response from our side"

- Lebanon and Hezbollah agreed to the US proposal for a ceasefire with Israel with 'some comments' on content, according to a senior Lebanese politician who stated the US ceasefire proposal is the most serious attempt yet to end the fighting.

- Hezbollah said it bombarded a gathering of Israeli enemy forces south of the town of Khiam, according to Al Jazeera.

- Israeli Foreign Minister urged the UN to pressure Iraq after attacks by pro-Iran factions and said the government of Iraq is responsible for any actions that occur within or from its territory, according to Sky News Arabia and Asharq News.

- Iran's Foreign Ministry said new EU and UK sanctions against Iran are unjustified, baseless and contradict international law.

- Iranian Ambassador to Russia said there are no obstacles to concluding a strategic cooperation agreement between Russia and Iran, according to Asharq News.

Geopolitics: Ukraine

- Russia's Kremlin says the updated nuclear doctrine signed by Putin is a "very important text", "Russia reserves the right to use nuclear weapons in an event of aggression"

- Ukraine reportedly makes first ATACMS strike inside Russia, according to Ukraine press.

- US Ambassador to the UN said on Monday that the US will announce additional security assistance for Ukraine in the coming days, according to Reuters.

- French President Macron said US President Biden's decision to allow Ukraine the use of US-provided weapons to strike inside of Russia is a good decision, according to Reuters.

- Kremlin spokesperson said Russia is ready to normalise ties with the US but will not tango alone, while a spokesperson also said that Russia's amendments to its nuclear doctrine have been formulated but not formalised yet, according to TASS.

- Russia and Chinese foreign ministers discussed 'unprecedented' strategic bilateral relations on the sidelines of the G20 meeting in Brazil, according to Russian agencies cited by Reuters.

- EU foreign chief Borrell said the role of China is becoming bigger and bigger in the Ukraine war and without Iran and China, Russia could not support its military effort.

US Event Calendar

- 08:30: Oct. Housing Starts MoM, est. -1.5%, prior -0.5%

- 08:30: Oct. Housing Starts, est. 1.33m, prior 1.35m

- 08:30: Oct. Building Permits MoM, est. 0.7%, prior -2.9%, revised -3.1%

- 08:30: Oct. Building Permits, est. 1.44m, prior 1.43m, revised 1.43m

Central Bank Speakers

- 13:10: Fed’s Schmid Speaks on Economic Outlook , Policy

DB's Jim Reid concludes the overnight wrap

One thing we pointed out in our LT Study was how this era has some uncanny parallels to the end of the last quarter-century 25 years ago. For instance, equities have surged over the last couple of years, with a narrow rally that’s been driven by tech stocks, just like in the dot com bubble. Moreover, the Fed are easing policy in that environment, just like they did in 1998, whilst valuation metrics like the CAPE are currently sitting at historic highs. In light of that, Henry took a look at how the current situation resembles three other periods when valuations were historically high: the dot com bubble, the pre-GFC era, and 2021. You can see the report here.

Risk assets began to stabilise yesterday, with the S&P 500 (+0.39%) picking up again after its decline of more than -2% last week. There wasn’t really a major catalyst behind the moves and it was a fairly quiet day on the whole. But the Magnificent 7 (+1.22%) saw a sizeable outperformance thanks to a +5.62% surge in Tesla’s share price, so that helped to drag up equities more broadly. Those moves for Tesla followed a Bloomberg report that the Trump transition team had said to advisers they’d make a federal framework for self-driving cars a priority for the Transportation Department, so that was very good news from their perspective. The equity gains were reasonably broad beyond tech, with nearly two thirds of the S&P 500 higher on the day, although the Dow Jones (-0.13%) lost ground amid underperformance for industrials. Over in Europe the story was one of small declines, with the STOXX 600 down -0.06%.

Government yields had a topsy-turvy day in the US. At the close 10yr Treasury yields (-2.5bps) and 30yr yields (-0.7bps) were lower and 6-8bps down from their intra-day highs, which saw 30yr yields touch their highest levels since May. The reversal was driven by a decline in real yields, with breakevens higher on the day and the US 2yr inflation swap up +3.1bps to a 7-month high of 2.66%. Overnight, yields on 10yr USTs have slipped -0.8bps lower trading at 4.406%.

This dialing up of investors’ inflation expectations came amid a strong day for oil prices with Brent crude up +3.18% to $73.30/bbl, which in large part reflected an increased focus on geopolitical tensions after the weekend’s news that President Biden authorised Ukraine to use US long-range missiles for strikes inside Russia. Gold (+1.84%) posted its best day in three months, with a stronger day for commodities also facilitated by a decline for the dollar index (-0.39%) for the first time in seven sessions.

Over in Europe, markets closed before the US bond rally took hold, with yields on 10yr bunds (+1.6bps), OATs (+1.1bps) and BTPs (+1.5bps) all inching higher. That came against the backdrop of several ECB speakers yesterday, but there wasn’t much deviation from expectations. For instance, Greece’s Stournaras said that for the December meeting, he thought “25 basis points is an optimal reduction.” And Ireland’s Makhlouf said that he believed “in a prudent and cautious approach”. So that seemed to steer away from speculation about a larger 50bps cut from the ECB in December, and investors moved to dial back the chance of a 50bp cut to just 17% yesterday, down from 23% on Friday.

Elsewhere, the question of appointments to the Trump administration remains a key focus, and we’re still waiting to see who’ll be nominated as the new Treasury Secretary. Interestingly, there was growing speculation about Kevin Warsh yesterday after an initial push over the weekend. He is a former Fed governor during the financial crisis from 2006-11, who previously served in the George W. Bush administration. The other names in the frame recently have been Scott Bessent and Howard Lutnick. A Bloomberg report yesterday evening said that Trump’s transition team is considering pairing Warsh as Treasury Secretary with Bessent as the director of the National Economic Council. Warsh is seen as more hawkish on monetary policy and less protectionist than the other candidates so on the former point the surge on Polymarket.com for the likelihood of him getting the Treasury job (45% as I type) may have been a big factor in the intra-day Treasury rally yeaterday.

Asian equity markets are higher outside of China this this morning with the S&P/ASX 200 (+0.89%) leading the gains with the Nikkei (+0.64%), the KOSPI (+0.14%), the Hang Seng (+0.12%) also higher. On the other hand, mainland Chinese stocks are lagging with the Shanghai Composite (-0.54%) edging lower ahead of the PBOC’s decision on its benchmark loan prime rate later this week. Outside of Asia, US stock futures are indicating a positive start with those on the S&P 500 (+0.13%) and NASDAQ 100 (+0.15%) trading slightly higher.

In central bank news, the minutes from the RBA’s recent policy meeting indicated that the board remains vigilant to upside inflation risks and believes policy needs to remain restrictive as it sees no “immediate need” to change the cash rate.

In FX, the Japanese yen (+0.14%) is has been edging higher (154.42) amid concern of possible government intervention given the current levels. Looking forward, the focus this week is on CPI data for October, due on Friday.

There was very little data to speak of yesterday, although we did get the NAHB’s housing market index from the US. That ticked up to 46 (vs. 42 expected), marking its third consecutive monthly increase, which took the index up to a 7-month high.

To the day ahead now, and data releases include US housing starts and building permits for October. Central bank speakers include BoE Governor Bailey, the BoE’s Lombardelli, Mann and Taylor, the ECB’s Elderson, Muller and Panetta, and the Fed’s Schmid. Finally, earnings releases include Walmart and Lowe’s.