After yesterday's mediocre 10Y auction, which in turn followed a stellar 3Y, moments ago we also got the first sale of long duration when the Treasury auctioned off $21BN in a 29-Y, 10-Month reopening. The 30Y auction was solid and went off without a glitch: it stopped at a high yield of 4.229%, down from 4.344% in December and the lowest since August. It also stopped through the 4.230% by a paltry 0.1 basis point, the smallest possible margin; this was the second consecutive tail for the tenor and followed 5 prior tails.

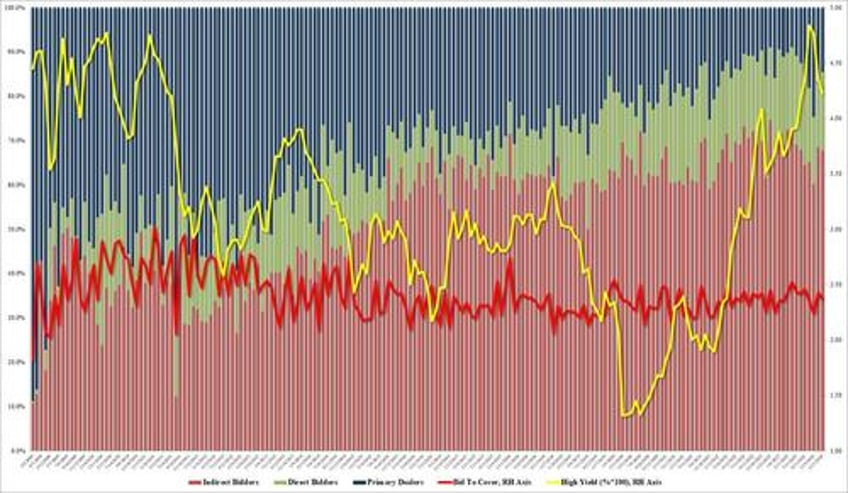

The bid to cover was 2.37, down from 2.43 but right on top of the six-auction average 2.39%.

The internals were even stronger with Indirects awarded 67.8% on behalf of foreign buyers; and with Directs awarded 17.7%, Dealers were left holding on to 14.5% of the auction, the smallest since August 2023.

Overall, this was a solid auction, perhaps thanks to the modest post-CPI concession which moved the entire yield curve wider, and the market reaction was subdued with 10Y yields trading around 4.03% both before and after the auction results were announced. The question is when does the market realize that there is a near record $2 trillion in duration coming just around the corner, and when do bond buyers stage another strike.