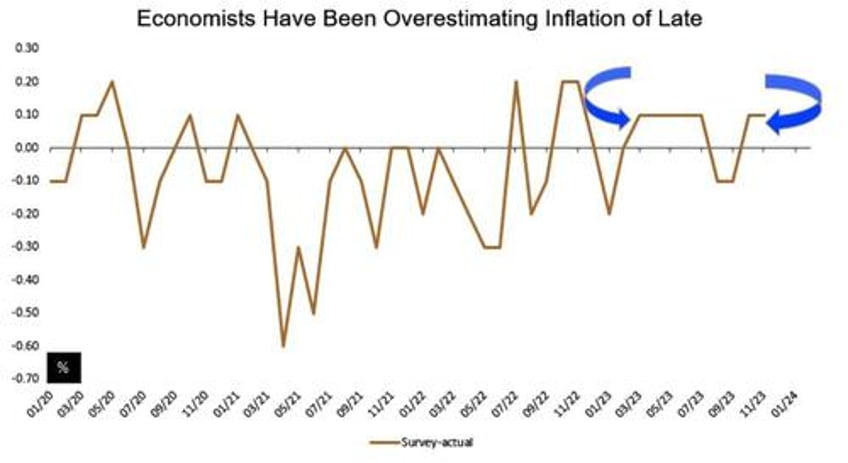

Warning: Treasury traders are primed for inflation to come in weaker than forecast, with economists overestimating headline consumer-price increases of late.

That suggests any exuberance in bonds after the release of the December data may be misplaced.

The median estimate of economists in Bloomberg’s survey projected inflation to be higher than the actual reading on seven of the past 12 readings, with the modal overestimation being 0.1 percentage point. The forecast for December’s year-on-year inflation is now 3.2%, with the projection for core being 3.8%.

Two-year Treasuries, already the richest part of the curve, may gain if the the modal overestimation prevails. However, there is no fundamental prescription for a huge rally absent a big undershoot of the actual number. With the US economy still largely resilient, particularly the labor market, any print that is around the forecasts is unlikely to suggest to the Fed that a rate cut may be warranted as soon as March.

In his speech overnight, New York Fed President John Williams didn’t quite give the impression that he is in a hurry to cut rates and spoke about the balance of risks. And earlier in the week, Raphael Bostic — who isn’t the most hawkish on the Fed’s policy committee — reiterated that he is looking at rate cuts starting in only the third quarter.

If the labor market continues to be as strong as it is, with a jobless rate still near the lowest in decades and growth in wage earnings running above 4%, the market’s current pricing that leans heavily toward a rate cut in the winter may be exaggerated.

As noted here, two-year Treasuries need to be trading around 4.56%, a level that would be in consonance with the December dot plot.

Barring a shock undershoot in the inflation numbers, the front-end should get there — but only gradually.