With the market urgently demanding a bazooka or some other "whatever-it-takes" policy reaction from Beijing in response to China's slow-motion economic and housing sector trainwreck, Xi's regime continues to play cat and mouse with traders and continues to trickle down tiny, piecemeal stimmies on a daily basis and this morning was no different when Bloomberg reported that China's largest banks are set to cut interest rates on trillions of yuan of outstanding home mortgages (and deposits) for the first time since the global financial crisis, as policymakers dig deeper into their toolkit to shore up growth in the world’s second-largest economy.

And indeed, shortly after the report, China - which one year ago suffered through a crippling mortgage payment boycott which brought many of the country's property developers to the brink of ruin - confirmed that its big (state-owned of course) lenders are reducing rates on the majority of the nation’s 38.6 trillion yuan ($5.3 trillion) of outstanding mortgages, with the reductions only affecting loans on first homes, two of the people said.

At the same time, lenders such as ICBC (Industrial & Commercial Bank of China) and China Construction Bank are poised to cut deposit rates later this week for the third time in a year, people familiar said.

The moves are part of a targeted push by Beijing to spur consumer spending, drive more funds into the stock market and alleviate pressure on lenders’ profit margins. The moves will also achieve none of that since nobody will allocate capital to - and in - a country where the largest asset, real estate, remains in freefall and where everyone is expecting some form of helicopter money to eventually emerge and contain the collapse.

The cuts to mortgage rates were highly anticipated by investors after the central bank hinted at support in mid-July. While China has reduced benchmark rates and pushed the average mortgage cost to a record low, most Chinese households didn’t benefit as banks won’t reprice existing loans until the beginning of next year.

“This is an incremental policy step, not a game changer because people’s confidence is still low,” said Macquarie head of China economic Larry Hu. “I think we’re going to see property easing come through in the coming weeks, I just don’t know if it’s going to be strong enough.”

While Chinese shares gained in offshore trading after Bloomberg reported the banks’ plans, it’s unclear whether the moves will be enough to spark a sustained revival in investor confidence. Authorities have so far avoided broader stimulus measures despite a deepening property crisis and growing deflation pressures that have put the government’s economic growth target of around 5% at risk.

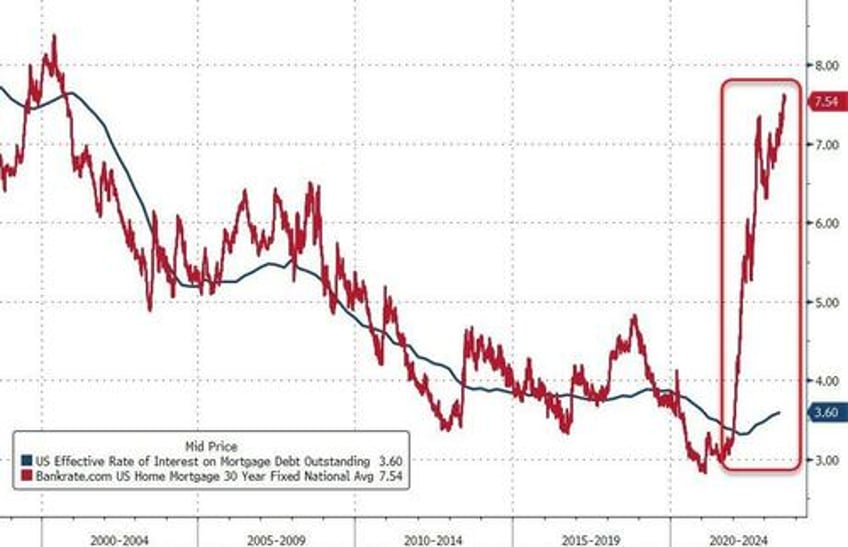

JPMorgan analysts estimated that the annualized rate on new mortgages stands at 4.18%, about 60 basis points lower than the outstanding borrowings. That has prompted some consumers to take out out short-term loans to repay mortgages early. This is a mirror image of the US where the effective mortgage rate is more than half below where the prevailing current 30Y mortgage yield is!

More than 90% of China’s outstanding mortgages were for first homes as of July 2021, according to the latest public data available from the banking regulator. In 2022, more than 80% of new home loans were on first homes, according to the housing ministry.

With lower mortgage rates, however, also come lower deposits rates, and the reduction in the latter is meant to help lenders protect their margins as they extend lower rates to homebuyers. Big state banks may cut rates on local-currency deposits across key tenors by between 5 and 20 basis points, according to the report. Regulators have signed off on the plan, the people added. The cut may come as soon as Friday, one of the people said.

Of course, none of this will make any difference for the big picture. China’s financial sector is already struggling with soaring defaults at shadow banks, which have triggered a fresh wave of anxiety about hidden stress and the potential spillover to state-owned lenders. A default by Chinese property giant Country Garden - said to have far more adverse consequences than the bankruptcy of Evergrande - is looming, and will further crush sentiment and spread deflationary shockwaves both domestically and across the globe. Analysts have also highlighted growing risks associated with debt-laden local government financing vehicles, with Goldman Sachs saying the exposure of banks could weaken their capital positions and lead to lower dividend payouts.

Among the various other piecemeal measures introduced by China, Bloomberg notes that as of June, 100 out of 343 Chinese cities have lowered the rate floor of new-home mortgages or removed the minimum required, the PBOC said in its quarterly monetary policy report on Thursday. That has brought the nation’s average mortgage rate to 4.11% in June, down 0.51 percentage point from a year earlier.

In an extreme scenario assuming the entire mortgage loan book is refinanced with a rate reduction of 60 basis points, earnings at Chinese bank for next year will be cut by 8%, with net interest margins narrowing by 7 basis points, according to JPMorgan. The US bank expects that about 50% of mortgage owners are likely to refinance and most of the impact on bank earnings will be in the near-term.

The last time China allowed a similar move was during early 2009, when some state-owned banks gave a discount on interest rates to qualified borrowers in certain areas in response to the global financial crisis, according to a Zhongtai Securities report.

Futures on the Hang Seng China Enterprises Index rose 0.8% in Hong Kong, building on a two-day rally that’s been fueled by a slew of market-boosting measures from authorities. The contracts are still down about 17% from this year’s high in January. And with consensus demanding helicopter money and nothing less to boost sentiment, don't expect the gains to stick.