By Bas van Geffen, senior macro strategist at Rabobank

In the land of the blind, they say, the one-eyed man is king. We have often accused Europe of being blissfully unaware of the shifting tectonic plates on the geopolitical sphere, but the eye patch that German Chancellor Scholz has to wear following an unfortunate accident while jogging has so far failed to give him the clarity that many of his European counterparts still seem to lack as well. While the Chancellor was busy soliciting memes on X, it is in fact his economy minister whose eyes have been opened.

In a speech to German ambassadors, Habeck went where Chancellor Scholz didn’t dare go. The minister warned that Europe’s external environment is vastly different than it has been over the past decades: Habeck concludes that trade and investment are now drenched in (geo)politics, and that Europe may not be able to continue to deal with both the US and China like it has in the past; Europe may be forced to choose sides.

Asian countries, meanwhile, are increasingly unhappy with the strength of the world’s reserve currency. US dollar strength has sent a number of Asian currencies to multi-month lows, prompting interventions.

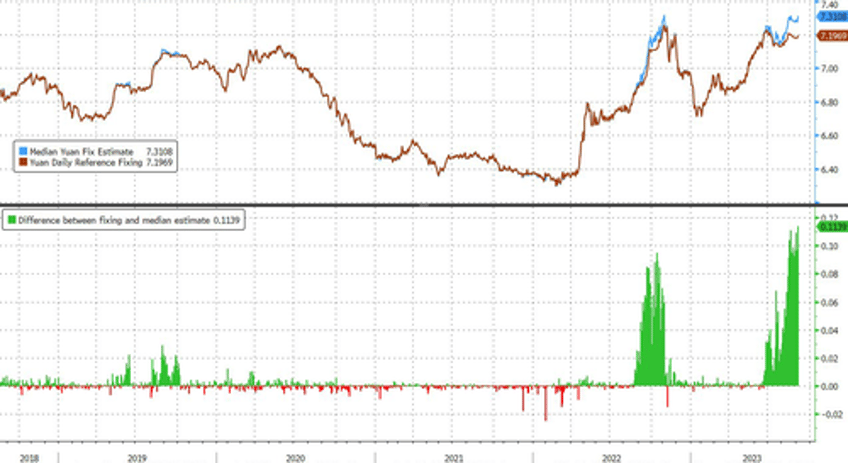

The PBOC fixed the yuan at 7.1969, which is a record gap to the spot rate and a record 1,139 pips stronger than a survey conducted by Bloomberg. Regardless of the interventions, CNY is trading around 7.31.

Not only the PBOC sought to stem the bleed from the strong dollar. The Japanese Ministry of Finance warned that they would not shy away from “any options if speculative moves persist”. Masato Kanda told reporters that it is important for the currency to reflect fundamentals. The Ministry of Finance issued a similar warning last month, when USD/JPY rose above the 145 level.

Yet, one can wonder which fundamentals are relevant if not the huge difference between US and Japanese monetary policy, which is likely to persist for some time. Risks are still skewed to a scenario where the Fed may have to tighten further than markets have been anticipating so far. Conversely, Bank of Japan officials continue to reiterate that their policy will have to stay accommodative, although Hajime Takata pointed out this morning that there had been some progress towards achieving the Bank’s inflation goal: “green shoots are finally emerging, [but] we need to continue patiently with large-scale easing as uncertainties are extremely high.”

Similar green shoots are visible in European inflation data, but there are equally red flags. According to the ECB’s Consumer Expectations Survey, expectations of medium-term inflation have risen slightly again. The median estimate of 3-years ahead inflation ticked up from 2.3% to 2.4%. Although consumer expectations are still trending down on a longer-term view, this uptick isn’t what the Governing Council would like to see. That said, it is difficult to attach much value to this survey, given that it is still very new and generally lags a bit. So Council members may prefer to look at other measures of inflation expectations, including the Survey of Professional Forecasters and market-based indicators.

Indeed, the market seemed to look through the survey’s release, arguably supported by further comments from ECB officials as they return from their holiday breaks. Chief Economist Lane focused on the positive elements of the inflation data, and he concluded that core inflation should fall throughout the fall.

Moreover, more hawks seem to be getting on board with a potentially very long hold at current levels. Bundesbank president Nagel cautioned against bets that the ECB would return to rate cuts shortly after the central bank is done hiking, which suggests he also sees the dangers of overshooting the mark. Recall that Ms. Schnabel recently noted that a higher terminal rate does not have the same effect as a longer period of high rates, considering that overdoing the hiking cycle could lead to a bigger economic downturn than necessary and a subsequent undershoot of inflation in the medium term, rather than a durable convergence to 2%.

And odds of a European recession remain fairly high, as re-confirmed by the German data this morning. Factory orders fell by a stunning 11.7% m/m in July, confirming the heavy weather that the manufacturing sector has hit – something that had already been flagged by the PMI surveys.

This sharp decline is the reversal of two months of strong gains, though, so the three month trend is not as bad as the headline print. For example, orders from Eurozone countries fell 24.4%, but that follows a 26.6% gain in June. This softens the July data somewhat, but overall the picture for the German industry remains quite bleak.