WeWork CEO David Tolley published a letter on Wednesday morning, indicating the struggling co-working start-up "will seek to negotiate terms with our landlords" and "part of these negotiations, we expect to exit unfit and underperforming locations and to reinvest in our strongest assets as we continuously improve our product."

"As when we've closed locations in the past, we will promptly inform members and offer alternative arrangements and additional support to minimize any disruption or inconvenience," Tolley wrote.

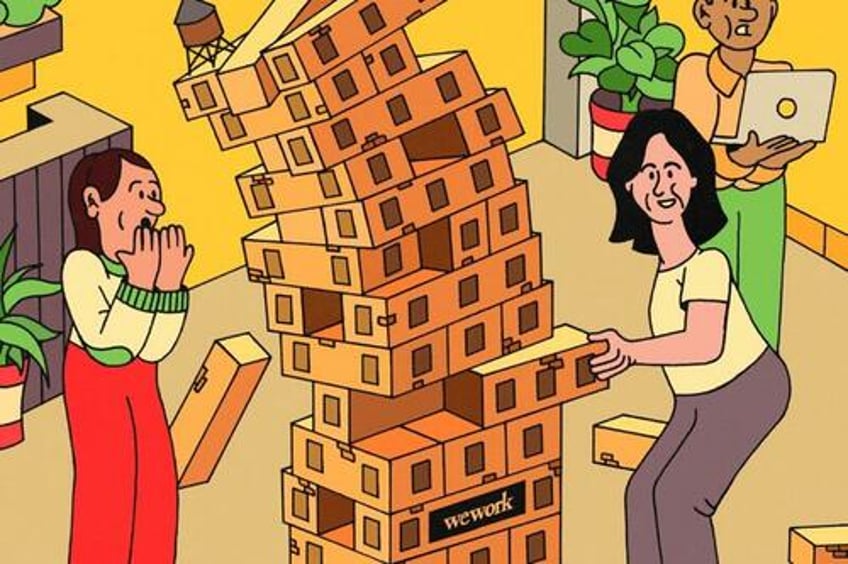

Last month, WeWork stated in a 10-Q filing that "substantial doubt exists about the company's ability to continue as a going concern." Since WeWork continues to hemorrhage cash and liquidity is running thin, the money-losing business appears to be on its last leg.

WeWork has shuttered locations in the past, and in those cases, it relocated members to other buildings and or towers that it leases. However, with the latest developments, cutting unprofitable office space might be an ominous sign that CRE markets are due for more turmoil.

We asked this question several weeks ago: Could WeWork's Potential Bankruptcy Be A Ticking Timebomb For CRE Markets?

* * *

Here's WeWork CEO David Tolley's full letter:

WeWork is and has always been an industry leader. Through world-class workspaces and services delivered by a team committed to a first-rate member experience, we defined a category of our own and started a new era in how work gets done. This progress, however, has not come without its challenges. Following a period of unsustainable hypergrowth, WeWork has been on a years-long transformation to resize our cost structure, grow sustainable revenue and strengthen our balance sheet. All this while navigating a global pandemic.

As I shared a few weeks ago, despite the important actions we've taken over time to improve our company and real estate footprint, our current lease liabilities – which were over two-thirds of total operating expenses in the second quarter – still remain too high and are dramatically out of step with current market conditions. We are taking immediate action to permanently fix our inflexible and high-cost lease portfolio to achieve the sustainable operating model that we need to serve our members for many years to come. By addressing this reality now, we will be able to continue investing in and innovating our business on behalf of our members.

Today, we are kicking off a process of global engagement with our landlords to renegotiate nearly all our leases. We will seek to negotiate terms with our landlords that allow WeWork to maintain our unmatched quality of service and global network, in a financially sustainable manner. As part of these negotiations, we expect to exit unfit and underperforming locations and to reinvest in our strongest assets as we continuously improve our product.

This process has no impact on our commitment to delivering for our members and, for the most part, we expect no changes to our day-to-day operations. We intend to remain in the majority of our buildings and markets. As when we've closed locations in the past, we will promptly inform members and offer alternative arrangements and additional support to minimize any disruption or inconvenience.

Let me finish by making one thing clear: WeWork is here to stay. We will remain a global flex space leader and trusted real estate partner to our members. As companies of all sizes seek flexibility in where and how their employees come to work, this initiative best enables us to continue to invest in our products, services, and member experiences to meet evolving workplace needs far into the future.

David Tolley

Chief Executive Officer, WeWork