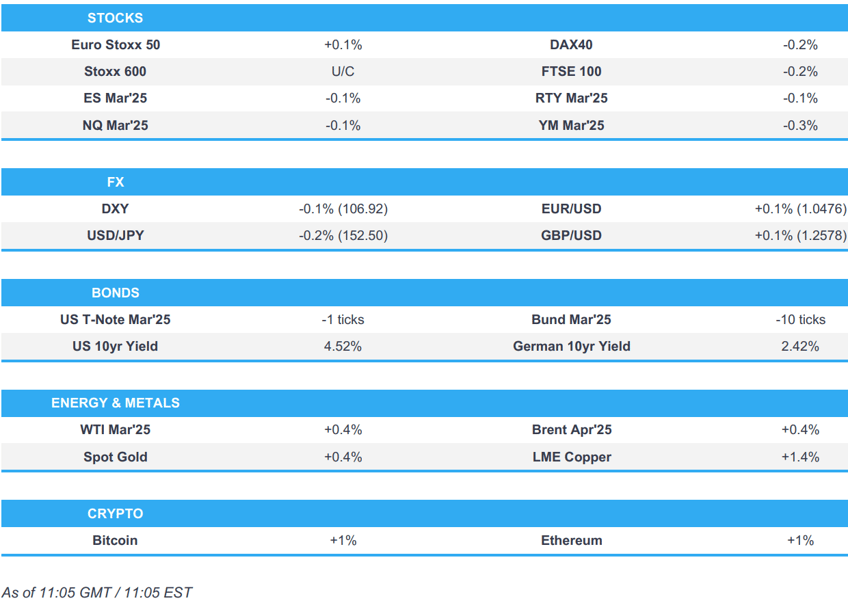

- European bourses & US futures began the session mixed but have deteriorated on geopols; Luxury lifted by Hermes post-earnings.

- USD remains pressured post-Trump tariff announcement, Antipodeans lead.

- Bonds retain a bearish bias but are off lows as geopolitics drives recent price action

- Gas continues to deflate, crude rangebound & metals advance.

- Russia has said its officials are not attending the Munich conference, US VP Vance & Ukraine's Zelensky set to meet at 11:00EST; recent remarks from Zelensky have tempered recent optimism

- Looking ahead, US Import/Export Prices, Retail Sales, Industrial Production, Capacity Utilisation & Manufacturing Output, BoC SLOOS, Speakers including & Fed's Logan.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- US President Trump said the US is to increase military sales to India and that India announced tariff reductions, while he and Modi are to begin talks on trade disparities, aiming for a trade agreement and the US plans to make up the trade deficit with oil and gas sales. Trump later commented that India will be purchasing US oil, as well as stated that India has the highest tariffs and whatever India charges, we will charge them.

- Indian PM Modi said India has set a target to double bilateral trade to USD 500bln by 2030, while he added that India and the US discussed increasing cooperation on small modular nuclear reactors and the US plays a role in India's defence preparedness. Modi also stated that US and India will work together on AI and semiconductors, as well as noted that the US and India will focus on establishing strong supply chains for strategic minerals.

- Taiwan's President Lai said Taiwan is willing to continue cooperation with the US across all fronts and will deepen collaboration with the US in AI and advanced semiconductors. Lai said Taiwan will strengthen communication with the US regarding concerns about the chip industry and plans to broaden US investments and purchases to balance trade.

- Japan's Industry Minister Muto said they started communicating with the US regarding the reciprocal tariff plan.

- UK Business Minister said the UK can engage with the US on steel and aluminium tariffs.

- European Commission says the EU will react firmly and immediately against new polices from the Trump administration.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 U/C) began the session mostly lower, despite a stronger session in APAC trade overnight; though sentiment gradually improved as the morning progressed, to display a mixed picture thus far. Some modest pressure was seen in the complex after the Ukrainian President Zelensky said he does not think that the US has a plan for peace in Ukraine yet.

- European sectors are mixed, and aside from the top performer, the breadth of the market is fairly narrow. Basic Resources finds itself right at the top of the pile, lifted by gains in metals prices, given the positive risk tone in APAC trade overnight; particularly in China. Consumer Products follows behind, with the sector buoyed by strength in Luxury names after both Hermes (+3.5%) and Moncler (+1%) reported strong results.

- US equity futures are modestly lower, ES -0.1%, taking a breather from the hefty upside seen in the prior session; sentiment on Thursday was lifted by US PPI (inner components which feed into PCE suggests a lower outturn) and then the delayed implementation of Trump’s reciprocal tariffs.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD has extended on yesterday's selling pressure which was seen in response to President Trump's reciprocal tariff memorandum in which he pledged to impose levies on “every country” that America has a trade deficit with and took aim at countries using VAT against the US. US Retail Sales is due alongside, Industrial Production and Fed's Logan. DXY down as low as 106.82 (matching the January 18th low) vs. Thursday's 107.79 peak.

- EUR/USD is up for a fifth session in a row and ventured as high as 1.0486 vs. the sub 1.03 levels seen at the start of the week. Optimism has been spurred by recent trade developments and how thus far, the worst case scenario of immediate and far-reaching tariffs on the EU has been avoided. If EUR/USD is able to clear 1.05, the YTD peak from January 27th sits at 1.0532. The Single-currency did dip a touch off best levels following remarks via Ukrainian President Zelensky said he does not think that the US has a plan for peace in Ukraine yet.

- JPY is marginally firmer in what has been a choppy week for USD/JPY. Currently trading within a tight 152.39-153.15 range.

- Cable has printed a fresh YTD peak in the wake of the softer USD with a current session high at 1.2594. For UK-specific drivers, strength was also observed yesterday on account of a better-than-expected outturn for UK GDP. Next upside target for Cable comes via the 30th December high at 1.2607.

- Antipodeans are both firmer vs. the broadly weaker USD. AUD/USD has printed a fresh YTD peak at 0.6340 with the next upside target coming via the 17th December high at 0.6377.

- PBoC set USD/CNY mid-point at 7.1706 vs exp. 7.2739 (prev. 7.1719).

- SNB Governing Board Member Tschudin said maintaining price stability is the most important task for the SNB and inflation can be outside the 0-2% target temporarily with the medium-term development more important. She also stated SNB's policy toolbox includes the use of foreign exchange interventions and that negative interest rates remain an important policy instrument if needed.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs, and the complex generally, have been pulling back from yesterday’s 109-01 peak but haven’t fallen significantly thus far with the current low just a handful of ticks below at 108-26. Import/Export prices, Retail Sales and Fed's Logan are on the docket for today; alongside some other Tier 2 US data. Continued bearish action brings into play support a 108-10 and then 108-04 before the figure.

- Bunds are softer directionally in-fitting with the above as the macro focus points are broadly the same, but does find itself under slightly more pressure than its US peer. Pressure which, while over 20 ticks at most, is relatively modest in the context of recent sessions. EZ GDP Flash Estimate Q/Q was revised a touch higher, but ultimately had little impact on German paper. Today we await updates on Trump tariffs and US data.

- Gilts are underperforming modestly, tested the 93.00 mark to the downside vs. a 93.50 peak on Thursday which itself was getting close to Monday’s 93.71 WTD peak. Technically, if the pressure continues then we look to lows from earlier in the week between 92.86-31. On the flip side, after the mentioned WTD peak last Friday’s best was 93.87 and then a gap until 94.35 from the prior day.

- Most recently, benchmarks have been lifting off worst, but still remain in the red, as some of the commentary from the Munich conference is less constructive on a Ukraine-Russia breakthrough.

- Click for a detailed summary

COMMODITIES

- Crude is firmer, but only very modestly with action contained to slim USD 0.50/bbl parameters throughout the European morning. On the geopolitical front for the Middle-East to see if the hostage release proceeds as planned on Saturday. On that, Axios’ Ravid cited an Israeli official saying "It seems that the crisis has been postponed until next week".

- Elsewhere, US VP Vance, said the option of sending US troops to Ukraine if Russia fails to negotiate in good faith remains “on the table”, a remark the WSJ highlights is much tougher than the Defence Secretary earlier in the week who said the US wouldn’t pledge troops. WTI and Brent currently find themselves holding in the middle of USD 71.26-74/bbl and USD 74.96-75.56/bbl parameters.

- As it stands, and reflecting the ongoing progress towards a ceasefire and potential resumption of flows following that, March TTF is under continued pressure and below the EUR 50/MW mark and approaching lows from end-January when TTF was sub EUR 48/MW. No real reaction seen just yet from the latest Zelensky, Kremlin & US remarks around today's meeting between the US and Ukraine.

- Gold likely continues to benefit from front-loading action, exacerbating haven appeal, as Trump continues to make tariff announcements. At a USD 2938/oz peak which is just shy of Tuesday’s USD 2942/oz WTD best.

- Base metals are firmer and benefitting from the delayed implementation of Trump’s latest tariff updates. A delay which provides hope for deals and/or exemptions to be made in the days/weeks ahead.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Wholesale Price Index MM (Jan) 0.9% (Prev. 0.1%); YY (Jan) 0.9% (Prev. 0.1%)

- Spanish CPI YY Final NSA (Jan) 2.9% vs. Exp. 3.0% (Prev. 3.0%); CPI MM Final NSA (Jan) 0.2% vs. Exp. 0.2% (Prev. 0.2%); HICP Final YY (Jan) 2.9% vs. Exp. 2.9% (Prev. 2.9%); HICP Final MM (Jan) -0.1% vs. Exp. -0.1% (Prev. -0.1%)

- EU Employment Flash YY (Q4) 0.6% vs. Exp. 0.8% (Prev. 1.0%); Employment Flash QQ (Q4) 0.1% vs. Exp. 0.1% (Prev. 0.2%); GDP Flash Estimate YY (Q4) 0.9% vs. Exp. 0.9% (Prev. 0.9%); GDP Flash Estimate QQ (Q4) 0.1% vs Exp. 0.0% (prev. 0.0%)

NOTABLE EUROPEAN HEADLINES

- EU is cutting back tech rules to boost AI investment, according to the bloc's digital chief cited by FT.

NOTABLE US HEADLINES

- US President Trump signed an executive order to establish a Make America Healthy Again Commission and is scheduled to sign executive orders on Friday at 13:00EST/18:00GMT.

- US Treasury Secretary Bessent said if tariffs create inflation, it would be a one-time slight increase, while he also commented that he was barred from looking at payment systems for a few days, according to a Fox interview.

- US judge ordered the Trump administration to restore funds for foreign aid programs, according to Politico.

- US State Department said the plane carrying US Secretary of State Rubio to Munich experienced a mechanical issue and was forced to turn around.

- US Pentagon is preparing a list of potential cost cuts ahead of the DOGE teams arrival, via WSJ; some military sections are generating lists of weapons they have wanted to cancel but couldn't get political approval to do so.

- "Senate Republicans are still leaning toward bringing their own budget resolution to the floor next week, according to GOP senators and aides", despite the House Budget Committee’s action, via Punchbowl News

GEOPOLITICS

RUSSIA-UKRAINE

- US Defence Secretary Hegseth says the shape of Ukrainian borders remains to be seen. Hegseth says cannot make an assumption that US presence in Europe will last forever.

- "Moscow says that Russian officials will not attend the Munich Security Conference because Russia has not been invited to the event, in contrast to what Trump said about meetings with Ukrainian and Russian officials.", via journalist Elster

- Ukraine President Zelensky says discussion with US President Trump was good and positive; adds that he does not think that the US has a plan for peace in Ukraine yet. Says he does not know about meeting with Russian side at the Munich conference; there will be talks with Russia after positions agreed with allies. Says as many as 3k North Korean troops could be deployed additionally to the Kursk front. Says he does not know about meeting with Russian side at the Munich conference; there will be talks with Russia after positions agreed with allies.

- US VP Vance is using the threat of sanctions and military action to push Russian President Putin into a Ukraine deal, according to WSJ. VP Vance says there are economic and military tools of leverage available to the US to use against Putin. President Trump is approaching negotiations openly, stating that everything is on the table to reach a deal. There is a deal that is going to come out of this that’s going to shock a lot of people.

- US VP Vance says will discuss the Ukraine conflict and how to bring it to a negotiated settlement.

- Ukraine finished work on draft minerals agreement and handed it over to the US side, via Reuters citing a delegation source; US side asked for time until later in the afternoon to work on it.

- Ukrainian President Zelenskiy and US Vice-President Vance meeting in Munich has been postponed to 16:00 GMT, according to Reuters citing sources

- US President Trump said officials from the US and Russia are to meet in Munich on Friday and Ukraine is also invited. Trump also stated that he had a good conversation with Russian President Putin the other day, while he added that the US is working with Ukrainian President Zelensky and that Russian Putin wants to make a deal but later commented that it is too soon to say what will happen in negotiations on Ukraine.

- Ukrainian President Zelensky's advisor said Ukraine does not plan talks with the Russian side at the Munich conference, while the adviser stated the US, Europe, and Ukraine need a common position before engaging in talks with Russia.

OTHER

- Turkish President Erdogan says there are now signs of a ceasefire in Gaza despite the agreement.

- Chinese Defence Ministry said Australia deliberately provoked China in the South China Sea on February 11th and has spread false narratives, while it is "invading and breaking into the homes of others". It also stated that Australia must strictly restrain the actions of its front-line naval and air forces and avoid stirring up trouble in the South China Sea, as well as warned that Australia would only harm others and itself.

CRYPTO

- Bitcoin is a little firmer and holds just above USD 97k.

APAC TRADE

- APAC stocks were mostly higher following the positive handover from Wall St, where yields declined following the latest PPI data and stocks benefitted despite US President Trump's reciprocal tariff plan, as the delayed implementation provided optimism regarding negotiations.

- ASX 200 touched a record high with the index led by strength in gold miners, tech and some defensive sectors.

- Nikkei 225 bucked the trend and was pressured by recent currency strength although Sony, Nissan and Honda were among the biggest gainers in the index post-earnings.

- Hang Seng and Shanghai Comp were positive with continued strong momentum in Hong Kong amid a tech surge, although the gains in the mainland were only modest despite the PBoC's recent policy implementation pledges, while this week's open market operations resulted in a net weekly drain of around CNY 575bln.

NOTABLE ASIA-PAC HEADLINES

- Chinese Foreign Minister Wang said in a meeting with UK PM Starmer that China and the UK need to strengthen strategic communication and mutual trust, while they need to strengthen cooperation in climate change, AI, and green development. Wang also stated in a meeting with the UK Foreign Secretary that both sides will seek cooperation in financial services, clean energy and AI, while they reached a consensus on a roadmap for bilateral exchanges and cooperation. Furthermore, Wang stated that preparations are underway for dialogues on economy, trade, health, and industry.

- US President Trump said the TikTok deadline could be extended and he hopes to make a deal on TikTok, while they will make it worthwhile for China to approve the TikTok sale. It was separately reported that TikTok's CEO plans more streamlining as talks with the Trump team continue and it is working with a 'key person' in the Trump administration on the US ban issue.

- Japan's lower house voted to approve government nominee Junko Koeda for the BoJ board.

DATA RECAP

- China January (YTD) Aggregate Financing (CNY): 7.06tln (exp. 6.5tln); New Yuan Loans 5.13tln (exp. 4.53tln); M2 Money Supply 7% (exp. 7.3%)