Commercial real estate building owners face significant headwinds as they try to refinance maturing loans in an environment of high rates and tightening credit conditions. New data reveals more rumblings in the commercial-backed securities (CMBS) market, as well as a 'deep freeze' spreading across the CRE space.

The new report by real estate company Trepp shows a significant surge in industrial CMBS delinquency rates. This spike is in addition to the rising delinquency rates in office tower CMBS, which have increased since the regional banking turmoil in March. Moreover, there's a slight uptick in multi-family CMBS delinquency as well.

Clients📢 check your inbox, our #CMBS delinquency report is in with some nuances. A large industrial delinquency blew up the rate for that sector. #Trepp has more to share on that...

— Trepp (@TreppWire) October 30, 2023

"Delinquency Rate Moves Higher, Hits New Post-COVID Peak." Learn more: https://t.co/PSejfzYMnU pic.twitter.com/KD6ATpDJaC

In a separate report, The Wall Street Journal cites Trepp data that shows a deep freeze has engulfed the entire CRE market:

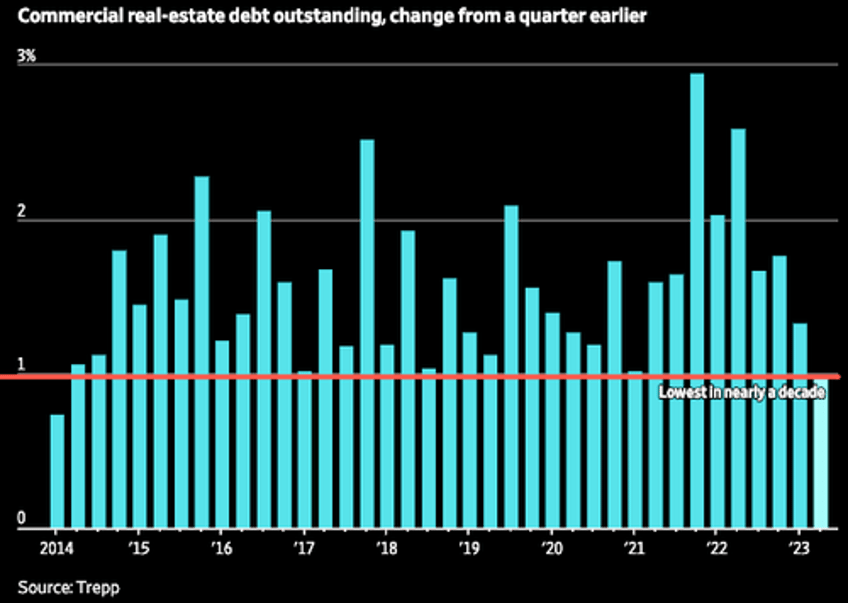

Total volume of commercial real-estate loans held by banks, the largest source of debt financing, declined during the first two weeks of October, according to analysis of Federal Reserve figures by Trepp, a data provider. Bank commercial property lending has declined for only two months since 2014. Most other two-week periods since 2014 have shown positive growth.

Other debt providers are also in retreat. Only $28.2 billion of loans converted into commercial mortgage-backed securities have been issued this year, the lowest figure since 2011, according to Trepp. Additionally, the largest mortgage REITs halted loans to new borrowers in the first half of the year.

Overall, the entire commercial property debt market—including banks, commercial mortgage securities and nonbank lenders and others—increased less than 1% in the second quarter. That was the lowest quarterly rise since the first quarter of 2014, said Matthew Anderson, managing director of Trepp.

As previously noted, the majority of CRE debt is held by small to mid-size banks. A Goldman report said banks with less than $250 billion in assets hold more than 80% of these loans. These smaller banks are facing the most strain due to the ongoing pressures of deposit flight and high-interest rates.

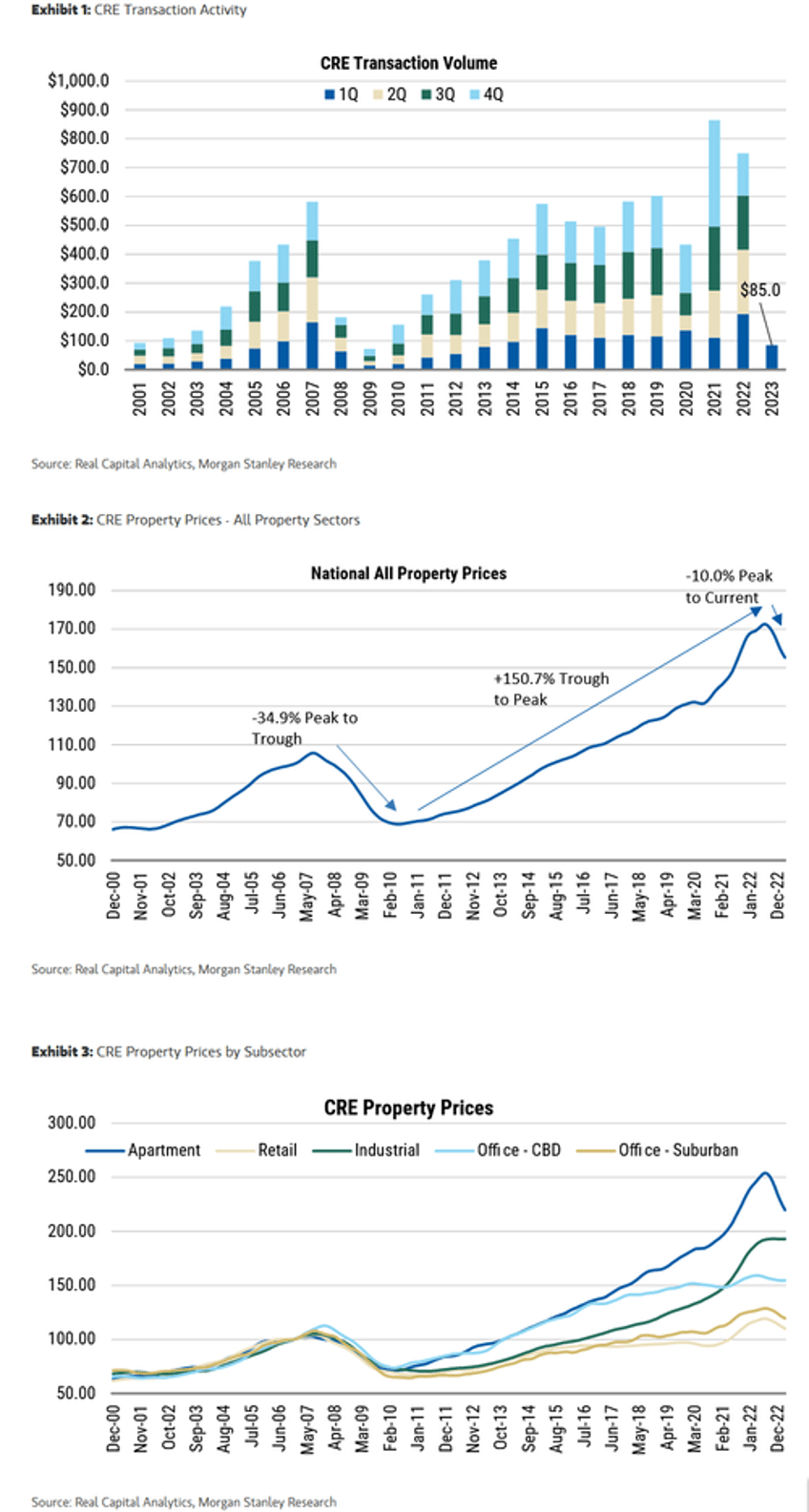

In March, we pointed out ("New "Big Short" Hits Record Low As Focus Turns To $400 Billion CRE Debt Maturity Wall") that the regional banking crisis kick-started CRE turmoil. At the time, JPM, Morgan Stanley, and Goldman Sachs all joined the CRE gloom parade.

A more recent note from Morgan Stanley expects CRE office prices to slide 27.4% from peak to trough in 18 to 24 months this cycle, not that far off from the -34.9% during the GFC in 34 months, which will range from a decline of 15% for apartments to a stunning plunge of 40% for office.

Michael Levy, chief executive of Crow Holdings, one of the country's largest developers of rental apartments and industrial space, told WSJ that yield shocks in treasuries have "spooked the marketplace." He warned: "Capital market malaise is crushing everybody."

Bankers and mortgage brokers told WSJ:

"Conditions aren't as bad as during the global financial crisis when lenders had almost completely vanished and buyers disappeared. Loans are still available today but from fewer players and at a higher price."

In places like San Francisco and Baltimore, some office tower prices have already crashed:

- Downtown San Fran Office Tower Sells At 66% Off As CRE Crisis Claims Another Victim

- Baltimore Sun Editorial Board Tells Everyone 'Keep Calm' Amid CRE Panic

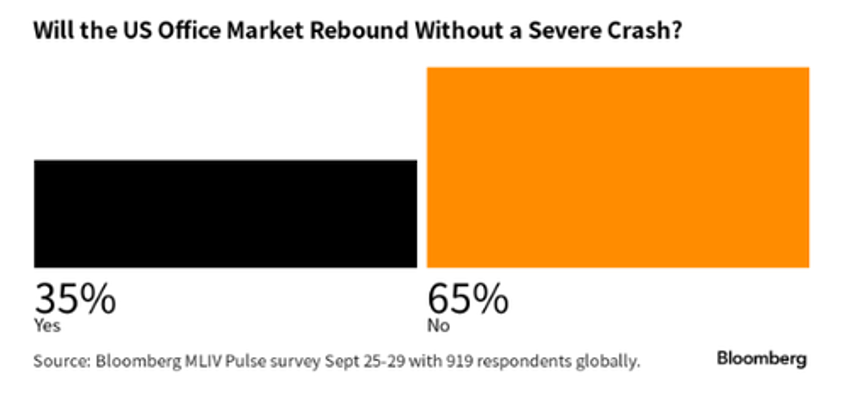

A recent survey by Blomberg of Terminal users revealed two-thirds of the 919 respondents believe the office tower market needs to crash before a rebound can be seen.

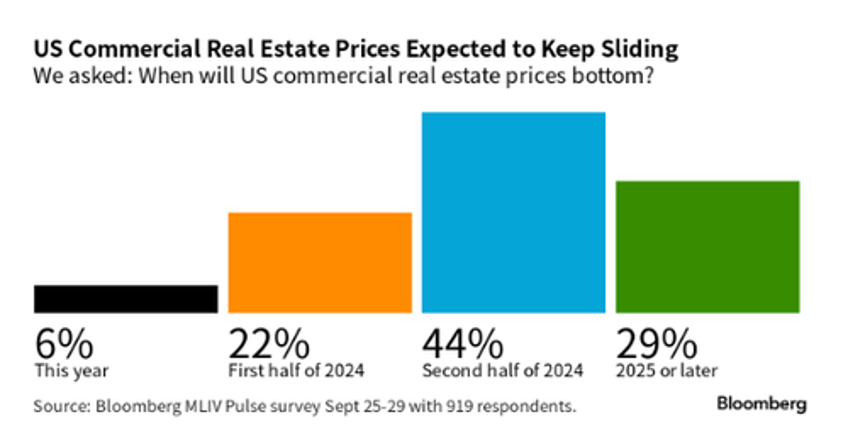

Nearly half (44%) of respondents said tower prices will trough in the second half of 2024. About 29% believe 2025 or later.

This slow-moving CRE train wreck is gaining momentum.