About seven months ago, panic gripped financial markets over the regional bank meltdown, primarily due to exposure to the commercial real estate space, specifically office towers. Since then, many market participants have forgotten the turmoil, but not all have done so.

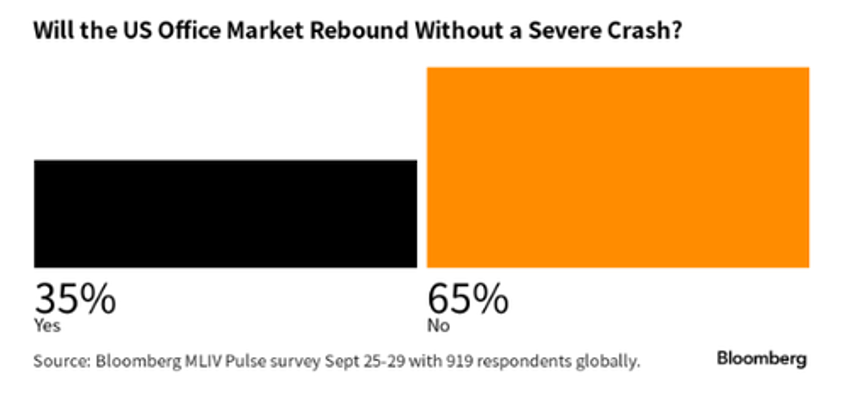

A new weekly survey of Terminal users by Bloomberg's Markets Live team finds two-thirds of the 919 respondents believe the office tower market needs to crash before a rebound can be seen.

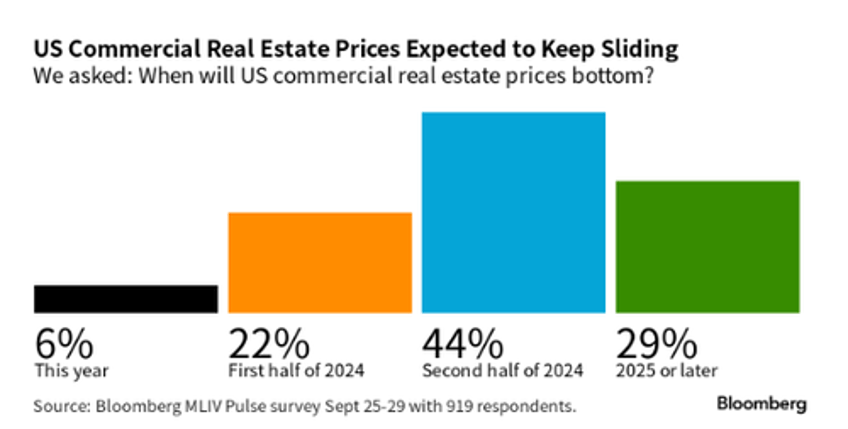

Nearly half (44%) of respondents said tower prices will trough in the second half of 2024. About 29% believe 2025 or later.

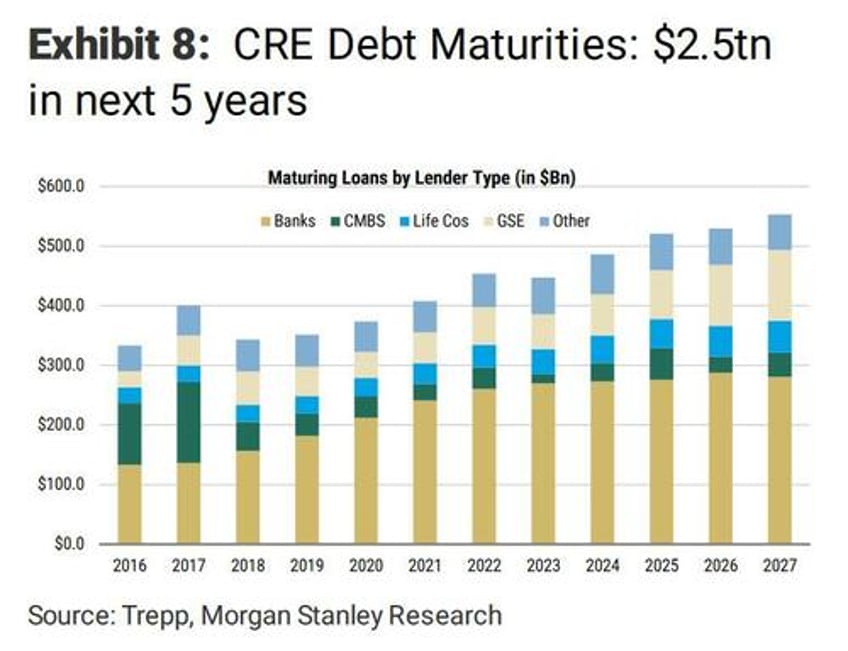

Terminal users likely understand what Morgan Stanley pointed out earlier this year: a staggering $2.5 trillion in debt maturities and rollovers at much higher rates over the next five years:

Last month, Kyle Bass told Bloomberg TV that the US banking industry will lose hundreds of billions of dollars from exposure to the office market amid shifting workplace trends and elevated interest rates.

"Banks in the US will lose $200, $250 billion in office over time here," Bass, founder of Hayman Capital Management, best known for correctly predicting and profiting from the bursting of the subprime housing bubble. He noted, "And there's about $2 trillion of equity in the banks so it's like a 10% hit to US banking equity."

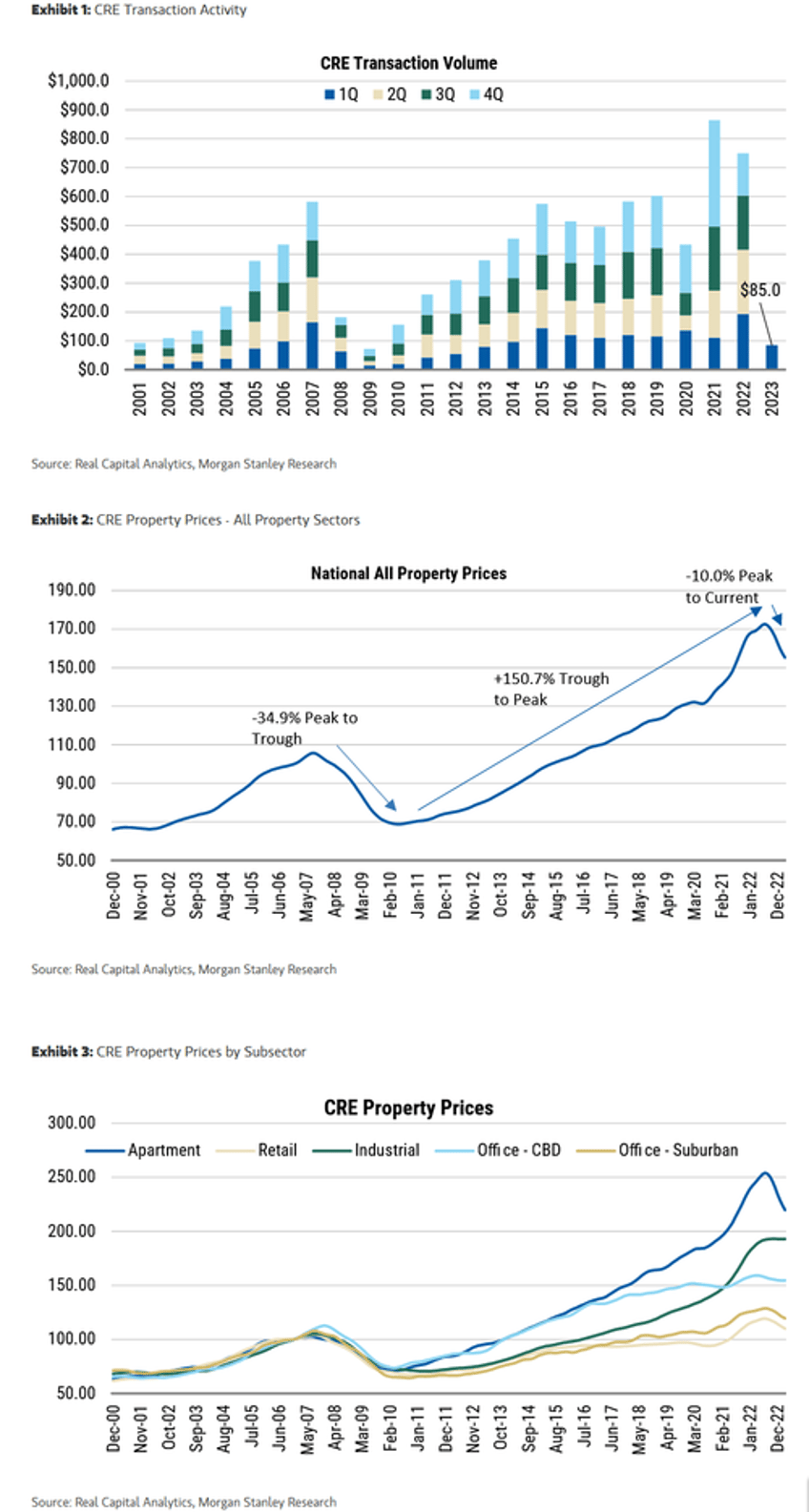

What's clear is that refinancing won't be pretty for building owners. A Green Street commercial property index shows towers have already fallen 16% from a peak in March 2022.

"Nobody wants to sell at a huge loss," said Lea Overby, an analyst at Barclays Plc. "These are properties that don't need to be sold for long periods of time, and that means holders are likely to delay a sale as long as they can."

According to a March report from Goldman Sachs, regional banks hold about 30% of office tower debt as of 2022. Small banks have seen deposits shrink 2% over the last 12 months ending August. That means less funding.

Bloomberg noted it could take several years for some building owners to experience pressure from higher rates:

Pain from higher interest rates can take years to filter through to owners of the US commercial real estate, which Morgan Stanley values at $11 trillion in total. Investors in office buildings, for example, often have long-term fixed-rate financing in place, and their tenants can be subject to long- term leases as well.

It will take until 2027 for leases that are in place today to roll over to lower revenue expectations, according to research by Moody's Investors Service published in March. If current trends hold, then revenues by then will be 10% lower than today.

Barclays's Overby said the office tower market "will take a long time to work out," adding she isn't too worried about the threat of the overall CRE market because "debt is spread across a wide enough array of investors to absorb losses."

Meanwhile, a recent report from the Morgan Stanley team expects CRE prices to be down 27.4% from peak to trough in 18 to 24 months this cycle, not that far off from the -34.9% during the GFC in 34 months, which will range from a decline of 15% for apartments to a stunning plunge of 40% for office.

In places like San Francisco and Baltimore, some office tower prices have already crashed:

- Downtown San Fran Office Tower Sells At 66% Off As CRE Crisis Claims Another Victim

- Baltimore Sun Editorial Board Tells Everyone 'Keep Calm' Amid CRE Panic

While progressive corporate media outlets tend to attribute the decline of office towers in metro areas to Covid and the rise of remote work, there's another seldom-discussed factor at play: disastrous social justice reforms that have triggered lawlessness, forcing companies to move to the suburbs or even to states that embrace law and order.

To sum up, office districts in Democrat cities will be dead for years. This will have significant impacts on recovery and taxes.