Inflation may have fallen from its peak around the world, but in the inflationary regime in which we remain, upside surprises are more likely.

That would worsen already weak liquidity in global bonds and heighten the risk of rising yields.

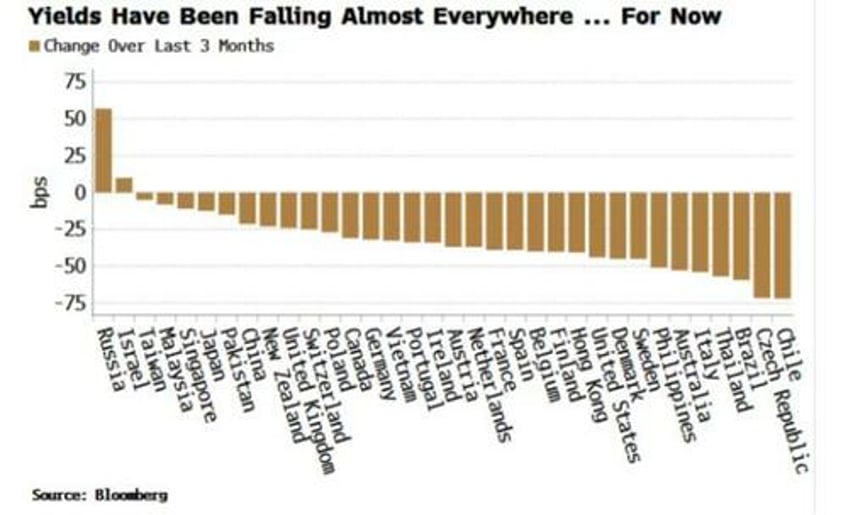

Global bond yields have fallen almost everywhere in recent months, but that shouldn’t distract from the fact that underlying conditions remain combustible, and a seemingly (relatively) benign environment for yields could be abruptly upended.

Bond yields are driven by term premium -- in which we can lump all the other risks inherent to owning longer-term bonds such as liquidity and inflation -- and by rate expectations.

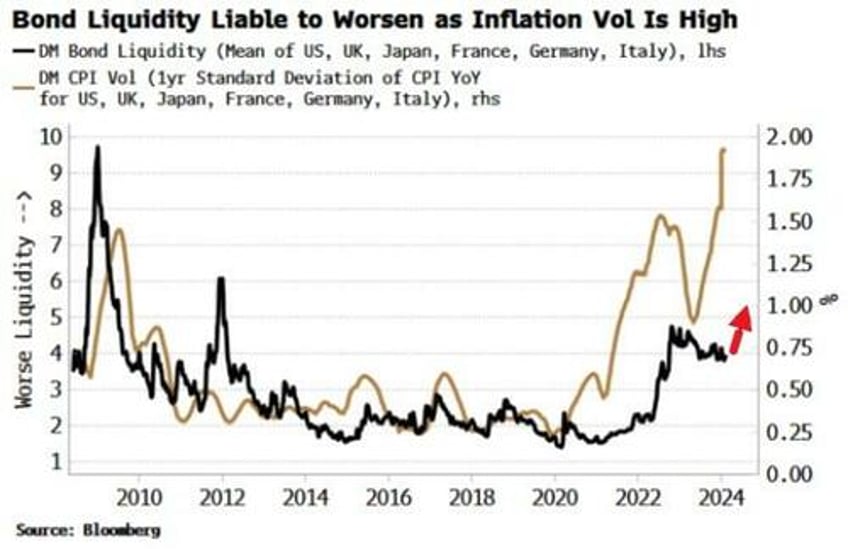

Liquidity and inflation are related.

The volatility of inflation, which rises when inflation rises, tracks bond liquidity. Higher inflation volatility typically goes with poorer liquidity in bonds.

As we can see from the chart above, developed-market inflation volatility remains elevated, leaving bond liquidity liable to deteriorate.

Bonds have been trading with a negative skew, shown for the TLT (ETF of long-term USTs) below, which means that poor liquidity is more likely to lead to lower prices, higher yields.

This comes at a time when there are compelling signs of a cyclical upswing in global growth.

The combination of supported growth, receding US recession risk, heightened inflation uncertainty, and a deterioration in bond liquidity is a complete recipe for higher bond yields.

The risk is compounded when taking account of the rarefied view that US bond yields – which have a significant influence on DM yields – will move much higher this year, according to bank surveys.