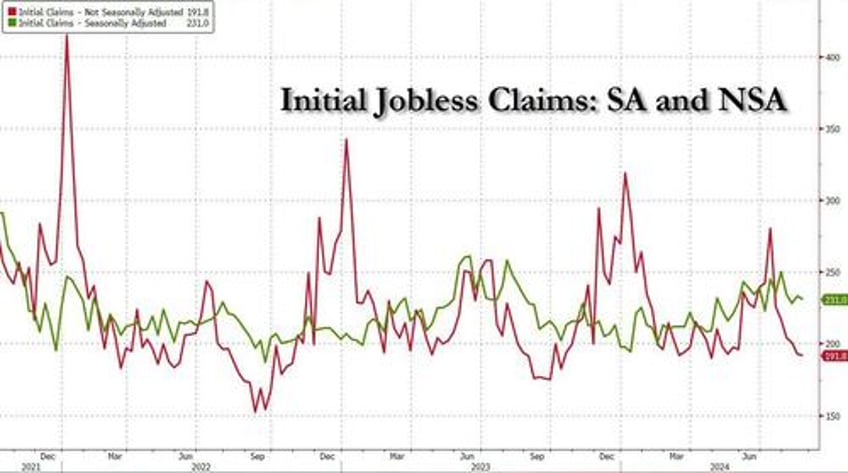

Initial jobless claims continue to drift along in the same range it has been in for three years, with unadjusted claims literally near record lows, just in time for the Fed to cut rates following the recent near-record revision to payrolls. Almost as if one hand of the Dept of Labor (initial claims reports) is unaware of what the other hand (Payrolls and especially revisions) is doing.

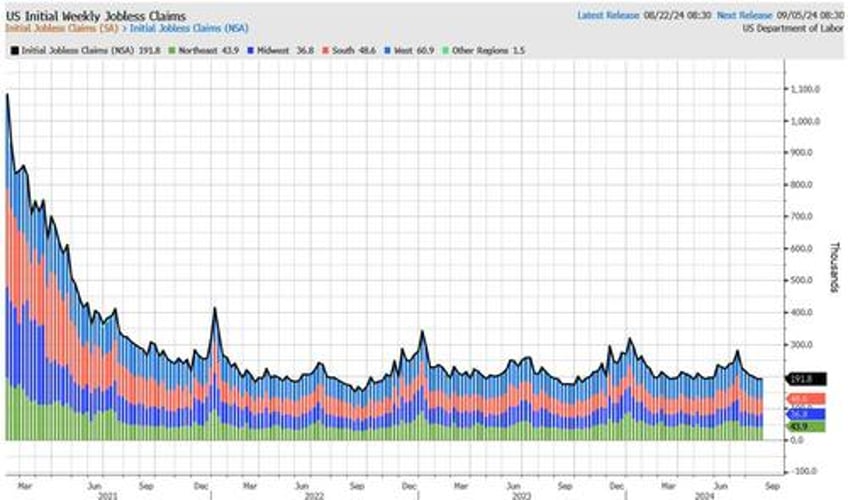

Broken down by region, the bulk of initial claims (unadjusted) was in the West, followed by the South and Northeast.

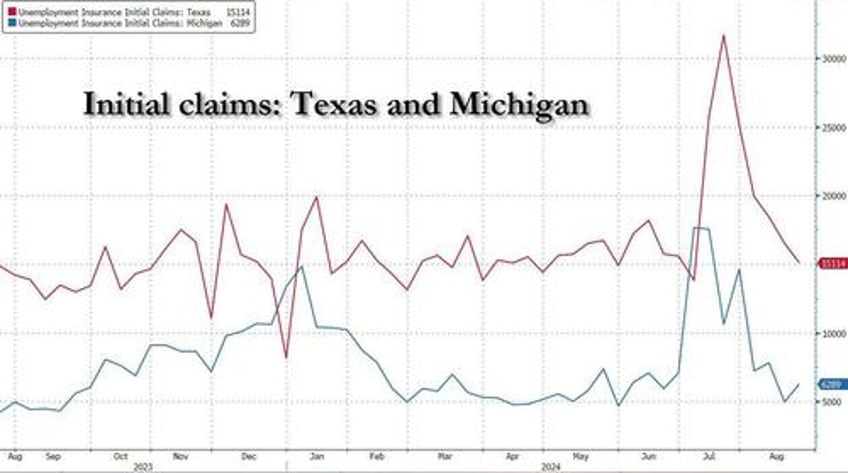

The decline in SA and NSA claims appears driven by the normalization of Texas claim post-Beryl...

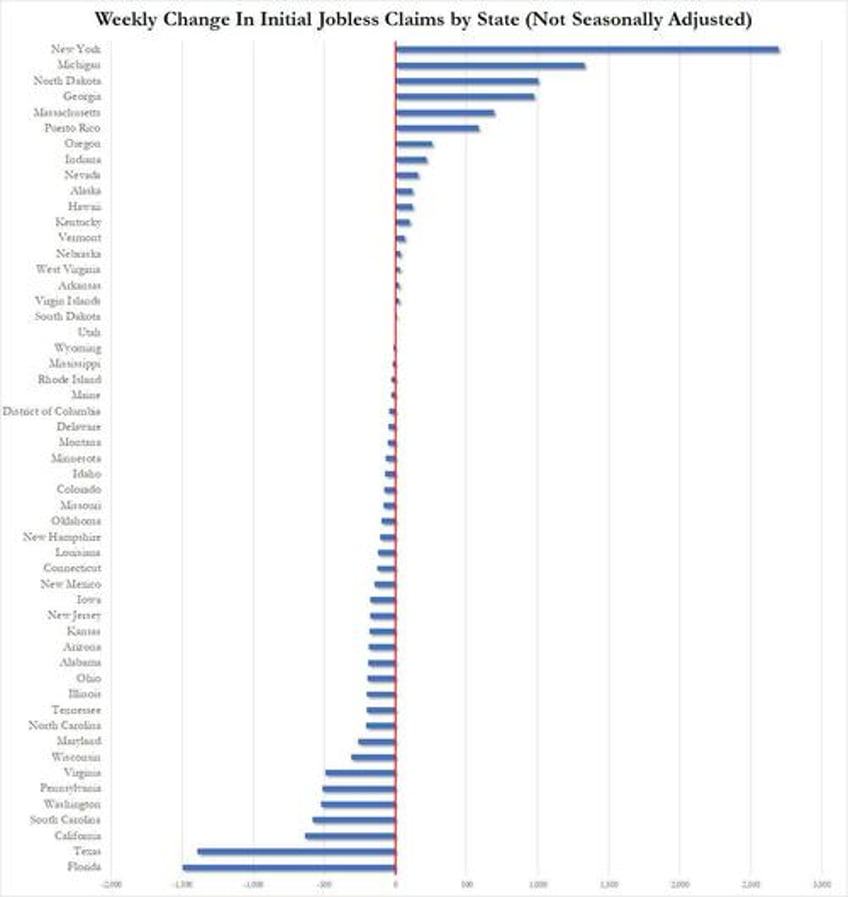

The weekly change in claims, broken down by state, shows no notable outliers this week.

But we note that continuing jobless claims remains at its highest since Nov 2021...

With all the attention piled on to initial claims to support bullish-narrative-supporting thesis, how the hell can The Fed then turn around and cut rates to 'save the labor market' before it's too late?