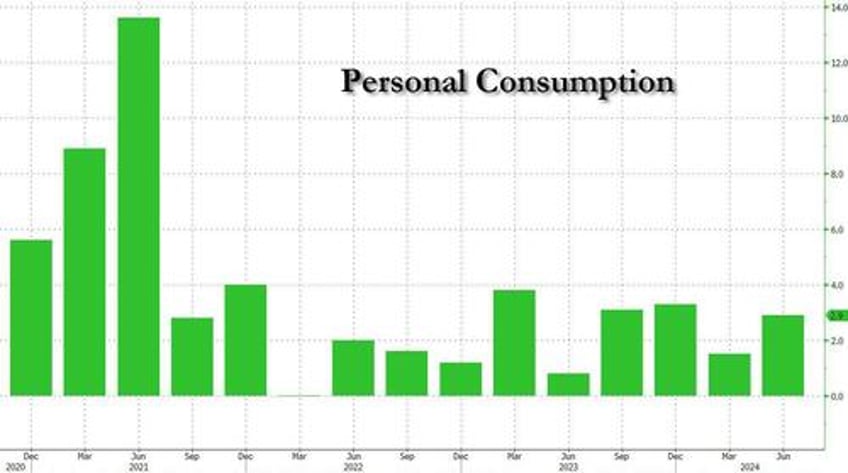

Just two hours after (ultra) discount retailer Dollar General reported catastrophic earnings, moments ago the Biden Bureau of Economic analysis decided to pull a BLS, and reported in its first revision of Q2 GDP that the US actually grew much stronger than expected on the back of - drumroll - an unexpected surge in personal consumption.

According to the BEA, Q2 GDP was revised to 3.0% from the 2.8% advance estimate, and beat estimates of a 2.8% print.

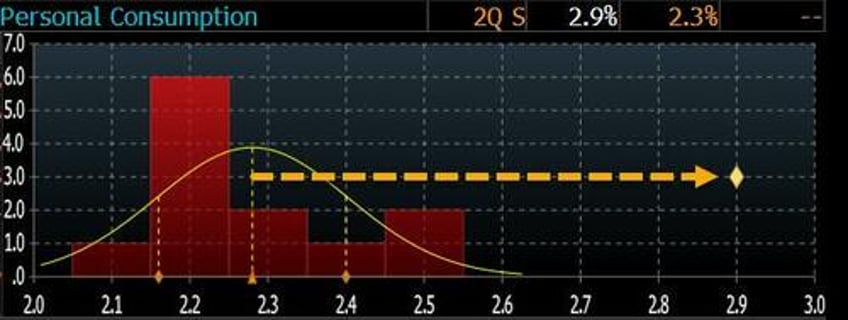

The number was more than double the 1.4% growth reported in Q1, and was driven almost entirely by a bizarro surge in personal consumption, which jumped 2.9%, up from 2.3% in the first estimate, and smashed consensus estimates of a 2.2% print.

That's right: just moments after Dollar General nuked its outlook, blaming a "financially constrained core consumer", which in this day and age is pretty much any one in what was once the US middle class, the BEA reported that Personal Consumption was a six-sigma beat to expectations!

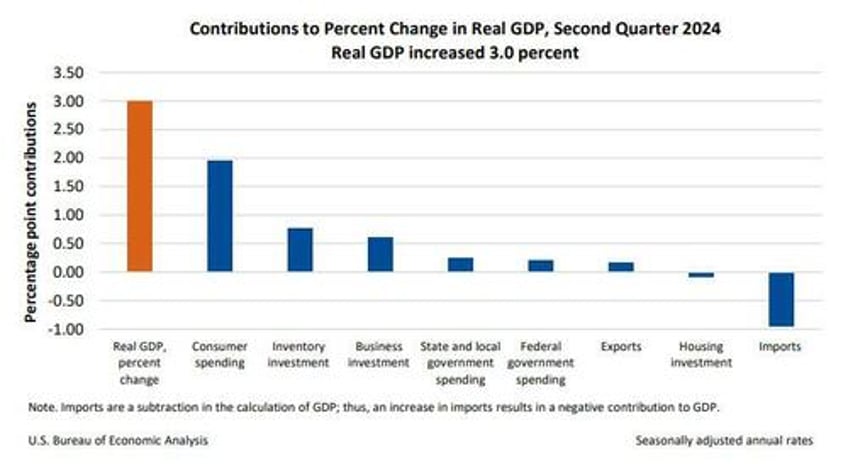

Looking at the breakdown of GDP components, the BEA reports that the increase in the second quarter primarily reflected increases in consumer spending, private inventory investment, and business investment. Imports, which are a subtraction in the calculation of GDP, increased.

- The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors to the increase were health care, housing and utilities, and recreation services. Within goods, the leading contributors to the increase were gasoline and other energy goods, furnishings and durable household equipment, and recreational goods and vehicles.

- The increase in inventory investment was led by increases in retail trade and wholesale trade industries that were partly offset by a decrease in mining, utilities, and construction industries.

- The increase in business investment reflected increases in equipment and intellectual property products that were partly offset by a decrease in structures.

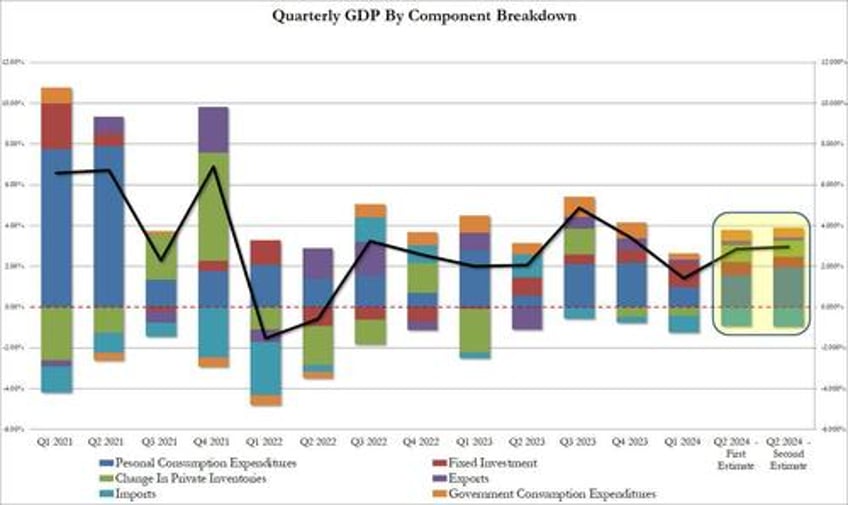

Compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in inventory investment and an acceleration in consumer spending. These movements were partly offset by a downturn in housing investment.

Taking a closer look at the various segments we find that aside from personal spending, every other GDP component was revised lower.

- Personal consumption contributed 1.95% to the bottom line GDP, up from 1.57% in the first estimate.

- Fixed Investment was revised modestly lower, to 0.64% in the second revision from 0.53% a month ago.

- The Change in private inventories was also revised modestly lower, from 0.82% to 0.78%.

- Net trade also ended up detracting more from the bottom line print, with exports less imports reducing GDP by -0.77%, a modest deterioration from -0.71% originally reported.

- Finally, the contribution from government was also revised lower, to 0.46% from 0.53%

And visually

While it is far less relevant now, the BEA also reported that in Q2, prices actually rose more than expected, up 2.5%, vs estimates of 2.3%, and down from 3.4% in Q1. Core PCE dipped slightly from the 2.9% reported initially, to 2.8%, and also down from 3.7% in Q1.

In light of the unexpectedly strong spending data, and following up on the continued decline in initial claims reported earlier, one can kiss a 50bps September rate cut goodbye. Commenting on the numbers, UBS trader Simon Penn writes that while the market is pricing 100bp of cuts in the remaining three FOMC meetings of 2024, the economy probably only needs 50bp to recalibrate policy to the appropriate stance, and that "the Fed is likely to deliver 75bp to avoid causing a market upset and to ensure it stays ahead of the growth curve."

Penn also says that while the upward revision to Q2 GDP might be somewhat rearview but back in June, the FOMC said the economy was sufficiently robust to switch the dot plot from 75bp of cuts to 25bp. Chair Powell noted at the time it was an incredibly fine decision and could have easily been 50bp of cuts. Since then the economy has slowed, but no more than the Fed had been expecting – and as pointed out by UBS chief US economist Jonathan Pingle, employment growth is likely just on the top side of the Fed's forecasts.

Bottom line from UBS is that "yes, the US economy has slowed, but not to the extent the Fed should be very worried. It seems likely the Fed will cut too much this year (members like Bostic are talking about this concern) but that will mean less cuts next year. Yields should be higher and the curve should be bear steepening."