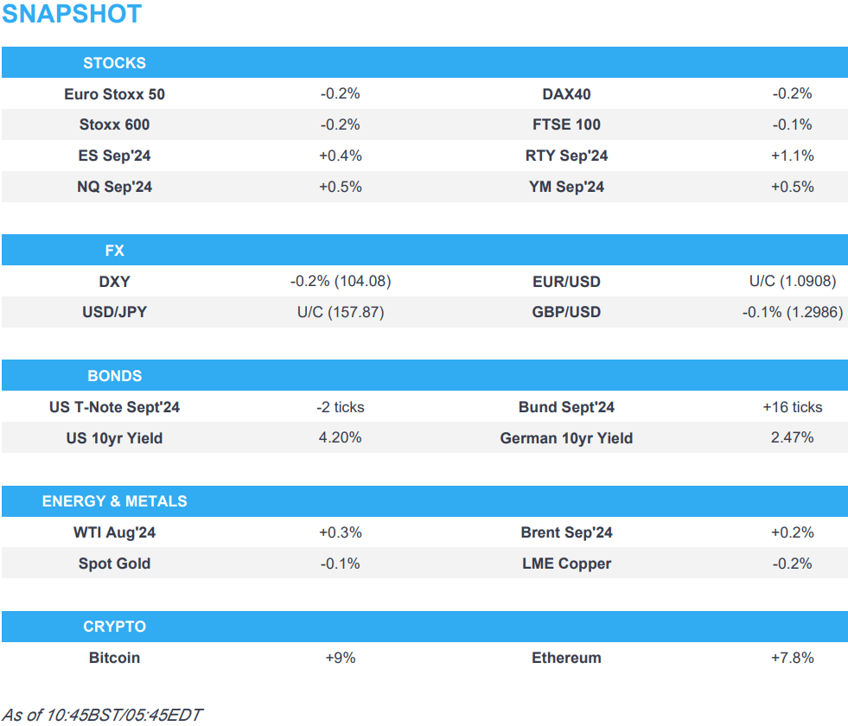

- European bourses are mostly lower, but sentiment has improved in recent trade; Burberry -15% and Swatch -10% both warn on China weakness; US equity futures gain

- Dollar is subdued but still holds just above 104.00, EUR/USD at 1.09 & the Kiwi lags

- Bonds were initially subdued in reaction to the assassination attempt on former President Trump, pressure which has since pared

- Crude is choppy and modestly higher, XAU holds onto USD 2400/oz, Bitcoin soars past USD 62k

- Looking ahead, US NY Fed Manufacturing, Canadian Wholesale Trade, Comments from Fed Chair Powell & Daly. Earnings from BlackRock & Goldman Sachs

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.2%) are almost entirely in the red, with sentiment hit following negative updates from Luxury names Burberry (-15%) and Swatch (-10%), alongside the downbeat Chinese data overnight.

- European sectors hold a strong negative bias; Media takes the spot alongside Travel & Leisure; Consumer Products is dragged down by the Luxury sector amid post-earning losses in Burberry & Swatch, with weak Chinese growth data also not helping; data which has also weighed on Basic Resources.

- US Equity Futures (ES +0.4%, NQ +5%, RTY 1%) are entirely in the green, with clear outperformance in the RTY, a continuation of the rotation play seen following US CPI last week; significant strength in Bitcoin is also helping.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is pressured again and down as low as 104.09 but holding above last Friday's 104.04 trough, and seemingly fading some of the initial strength overnight as the markets digested an assassination attempt on former President Trump.

- EUR/USD is oscillating around the 1.09 mark and respecting Friday's 1.0862-1.0911 range. Focus will be on the ECB this week, however, the gathering is set to be a non-event with officials set to sit on their hands and most likely wait until September to enact further policy easing.

- GBP is marginally softer vs. the USD in what was an impressive run for Cable last week. 1.2990 was the high from last week with 1.30 yet to be breached.

- Steady trade for the USD/JPY after an eventful last week which was dominated by suspected intervention by Japanese officials. The pair currently holds around 157.80.

- Antipodeans are mixed with the Kiwi the laggard of the two, losing on the AUD/NZD cross which has climbed above 1.11.

- PBoC set USD/CNY mid-point at 7.1313 vs exp. 7.2548 (prev. 7.1315).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs were pressured overnight after the attempted assassination of former President Trump and the strengthening of his betting odds for the November election; USTs went as low as 110-24+, but were then lifted alongside a bid in EGBs in the European morning.

- Bunds were initially subdued, in tandem with the UST weakness, but has since lifted across the board with Bunds leading and approaching Friday's 132.08 peak, a turnaround which has seemingly been driven by poor European equity performance and an easing of selling price and wage pressures in an ECB survey on Access to Finance of Enterprises.

- Gilts are firmer and following Bunds/EGBs with specifics light, but ahead of a busy data-driven docket. Gilts in a 98.07-98.32 band, unable to extend convincingly above Friday's 98.31 peak with resistance thereafter at 98.53.

- Click for a detailed summary

COMMODITIES

- Crude has been choppy and off best levels overnight in the aftermath of the below-forecast Chinese GDP metrics. Since, a slight pickup has been seen in the complex, in tandem with recent Dollar weakness. Brent September trades on either side of USD 85/bbl.

- Precious metals are lower but with the downside limited amid a lack of newsflow during the European morning. XAU/USD resides in a narrow USD 2,401.40-2,414.03/oz range.

- Base metals are lower across the board as a function of the downbeat Chinese data overnight which saw GDP miss forecasts after the disappointing inflation and import metrics last week.

- Iraq’s crude oil production was above the agreed quota by 184k bpd in June, while it will adhere to the required production level in the agreement, which is 4mln bpd, for July and the coming months, according to the Iraqi Oil Minister. Furthermore, the Oil Ministry stated that Iraq will compensate for any overproduction since the beginning of the year during the compensation period that extends until the end of September 2025.

- Kuwait Petroleum Corporation announced a new ‘giant’ oil discovery with oil reserves exceeding 3bln barrels and said the newly discovered oil field’s reserves are equivalent to the country’s entire production in three years.

- India's June Gold imports up at USD 3.06bln (prev. 3.33bln M/M), via Trade Ministry

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Rightmove House Price Index MM (Jul) -0.4% (Prev. 0.0%); YY 0.4% (Prev. 0.6%)

- Swiss Producer/Import Price MM (Jun) 0.0% (Prev. -0.3%); Producer/Import Price YY (Jun) -1.9% (Prev. -1.8%)

NOTABLE EUROPEAN HEADLINES

- BoE's Dhingra said on The Rest is Money podcast that demand is too soft for inflation to rise sharply and now is the time to start normalising interest rates so we can finally stop squeezing living standards.

- UK PM Starmer is expected to introduce an AI bill as part of 35 bills to be included in the King’s Speech on Wednesday, according to FT. It was reported by Bloomberg that Starmer will use the upcoming King’s Speech to showcase his government’s efforts to spur economic growth in the UK. Furthermore, the UK government said it will strengthen the role of the Office for Budget Responsibility and enforce new spending rules in the legislative agenda in the week ahead, according to Reuters.

- Airbus (AIR FP) upgrades 20yr demand forecasts led by wide-body craft.

- Germany Economy Ministry monthly report says budget deal lays the foundation for reliable politics which should build confidence in H2.

- Italy has reportedly voted in favour of EU tariffs on Chinese EVs via written procedure, according to a diplomatic source via Reuters

NOTABLE EARNINGS

- Swatch (UHR SW) H1 2024 (CHF): Operating Profit 204mln (exp. 500.2mln). Net Sales 3.445bln (-14.3% Y/Y). Operating Margin 5.9% (prev. 17.1%); "Decline in sales triggered by the sharp drop in demand for luxury goods in China", Hong Kong, and Macau.

- Burberry (BRBY LN) Q1 (GBP): Retail Revenue 458mln (prev. 589mln). Q1 FY25 performance is disappointing; luxury market proved more challenging than expected, Co. suspends dividend; expects to report an operating loss for H1 if weakness persist through Q2

NOTABLE US HEADLINES

- A person was killed and two people were wounded in a suspected assassination attempt that took place at a Trump rally in Pennsylvania on Saturday which injured Donald Trump in the ear although Trump was said to be okay. It was later announced that the gunman who was killed by the Secret Service was identified as 20-year-old registered Republican Thomas Matthew Crooks. Furthermore, Trump said that he looks forward to speaking from Wisconsin this week and that it is more important than ever that they stand united.

- US President Biden said he is grateful that Trump is doing well and they had a short and good conversation on Saturday night, while Biden added an assassination attempt is contrary to everything they stand for and there is no information yet of the shooter’s motive.

- US President Biden said need to lower the temperature in politics and that 'we are neighbours, friends, not enemies,' while he added the Trump rally shooting calls for all to take a step back and he was thankful that Trump was not seriously injured.

- FBI Director Wray said they have committed the full force of the bureau to the investigation and that the shooter acted alone, while they have not yet identified an ideology in connection with the suspect. Furthermore, Wray said bomb specialists secured a suspicious device in the suspect’s car and the shooting is being looked at as both a domestic terrorism act and an assassination attempt.

- US House Democrats confronted President Biden directly in a virtual meeting on Friday and told him it was time for someone else to lead, according to Politico.

- Alphabet’s (GOOG) Google is near a USD 23bln deal for cybersecurity start-up Wiz, according to WSJ.

- Apple's (AAPL) annual India revenue lifts to near USD 8bln, +33% Y/Y, via Bloomberg citing sources. Elsewhere, Apple price target lifted to USD 273/shr from USD 216/shr at Morgan Stanley, maintains the Overweight rating.

- Goldman Sachs (GS) targets to raise USD 2bln in first Asia-focused private equity fund, via Reuters citing sources.

GEOPOLITICS

MIDDLE EAST

- Two Egyptian sources said Gaza talks have stopped until the Israeli side demonstrates that it is serious, while a senior source cited by Egypt’s Al Qahera News TV stated that Egypt called for Israel to not obstruct ongoing Gaza ceasefire negotiations and not to put forward new principles that contradict what was previously agreed upon. Furthermore, a senior source claimed Israel is wasting time in formal meetings to lure the Israeli public opinion away from reaching a deal, while a Hamas senior official cited by Al Jazeera said that Hamas awaits a response from mediators on proposals introduced to Israel.

- Israeli strikes on Gaza City killed at least 17 and wounded 50, according to health officials. It was also reported that at least 71 Palestinians were killed and 289 injured in an Israeli attack on Khan Younis which targeted Hamas military chief Mohammed Deif. Furthermore, Hamas said that those killed in Khan Younis were civilians and the attack was a grave escalation, while it added that the attack showed Israel wasn’t interested in reaching a ceasefire agreement.

- Israeli military official said it was still verifying the result of a strike on Hamas military chief Mohammed Deif, while Hamas denied the killing of its top commander. It was later reported that the Israeli military said Khan Younis Brigade commander Rafa Salama was killed on Saturday by the Israeli strike on Gaza and Israel’s military chief said Hamas is trying to hide the results of the strike on its armed wing commander Deif.

- Syrian army said one soldier was killed and three others were injured in Israeli strikes on military sites and a residential building in Damascus.

- Yemen’s Houthis said they conducted military operations in the Gulf of Aden and Israel’s Eilat.

- US State Department announced on Friday new sanctions targeting Iran's chemical weapons research and development.

OTHER

- Kremlin spokesman Peskov said Russia is able to respond to the US deploying long-range missiles in Europe, while he warned that European capitals could be victims of the US placing long-range missiles in Europe, according to TASS.

- Chinese and Russian naval fleets recently conducted the 4th joint sea patrol in the western and northern Pacific Ocean, according to Chinese state media.

- China Maritime Safety Administration issued a navigational warning barring entry into some waters of the South China Sea where military exercises will be held from 12:00 local time on July 16th to 11:00 local time on July 17th.

- North Korean Defence Ministry condemned a joint statement by South Korea and the US on nuclear guidelines, according to KCNA.

CRYPTO

- Bitcoin soars past USD 62k and sits just beneath USD 63k as markets reacted to the Trump assassination attempt which boosted the odds of his re-election; the former President is seen as being pro-crypto.

APAC TRADE

- APAC stocks traded mixed as participants reflected on the Trump assassination attempt over the weekend and a slew of Chinese data including disappointing GDP, Retail Sales and House Prices, while Japanese markets remained closed for Marine Day.

- ASX 200 rose above the 8,000 level for the first time with tech and telecoms leading the gains across sectors.

- Hang Seng and Shanghai Comp. were mixed with the former dragged lower by losses in tech, property and consumer stocks amid mostly weak Chinese data, while the mainland just about remained afloat despite the disappointing releases in which GDP and Retail Sales missed forecasts, while House Prices further deteriorated but Industrial Production topped estimates. Furthermore, the PBoC maintained its 1-year MLF Rate and injected funds through 7-day reverse repos, while top Chinese Communist Party officials kicked off the third plenum.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 100bln (CNY 103bln maturing) 1-year MLF operation with the rate kept unchanged at 2.50%, as expected.

- China's stats bureau said China's economic operations were generally steady in H1 but the external environment is complex and external demand is still not sufficient, while it added that the economic recovery foundation still needs to be consolidated. The stats bureau also said 5% GDP growth in H1 was 'hard won' and Q2 economic growth was affected by short-term factors such as extreme weather and flooding. Furthermore, it stated the Chinese economy's medium- to long-term improving trend remains unchanged but it faces increasing external uncertainties and many domestic difficulties and challenges in H2, while it noted the property market is still in the process of adjustments.

- Goldman Sachs cuts China's 2024 GDP growth forecast to 4.9% (prev. view of 5.0%).

- JPMorgan cuts China's 2024 GDP growth forecast to 4.7% (prev. view 5.2%).

DATA RECAP

- Chinese GDP QQ SA (Q2) 0.7% vs. Exp. 1.1% (Prev. 1.6%); YY 4.7% vs. Exp. 5.1% (Prev. 5.3%)

- Chinese Industrial Output YY (Jun) 5.3% vs. Exp. 5.0% (Prev. 5.6%)

- Chinese Retail Sales YY (Jun) 2.0% vs. Exp. 3.3% (Prev. 3.7%)

- Chinese New House Prices MM (Jun) -0.7% (Prev. -0.7%); YY -4.5% (Prev. -3.9%)