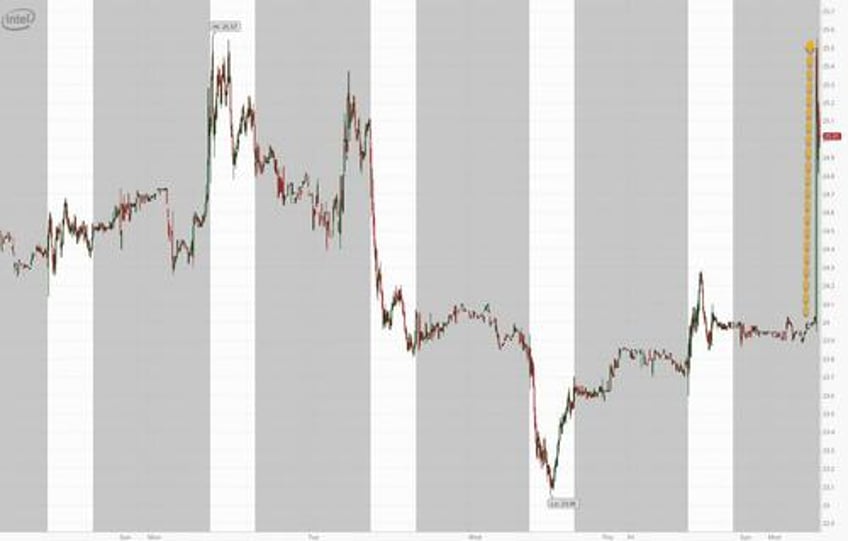

Back in April, when Intel stock was in freefall and yet still about 50% higher than where it is today, we said that it was time for the company's well-meaning if absolutely clueless CEO, Pat Gelsinger, to resign.

Pat Gelsinger, it's time pic.twitter.com/I421ZwSV9c

— zerohedge (@zerohedge) April 25, 2024

A few months later we followed up with an appeal that was pretty clear:

*INTEL SUSPENDING DIVIDEND STARTING 4Q 2024

— zerohedge (@zerohedge) August 1, 2024

*INTEL ANNOUNCES $10B COST REDUCTION PLAN

Someone. Fire. Gelsinger.

If only he had listened to us then, the once-iconic chipmaker would have been in a far better place today, and the outcome would still be the same because early on Monday Intel reported that Pat Gelsinger fired himself, when he and retired from the company and stepped down from its board of directors just as the company is in the middle of trying to execute on a turnaround plan.

Intel CFO David Zinsner and Intel Products CEO Michelle Johnston Holthaus are serving as interim co-CEOs while the board searches for Gelsinger’s replacement, the company said in a statement. Frank Yeary, independent chair of the board of Intel, will serve as interim executive chair.

Gelsinger’s departure is hitting at a tumultuous time for the US chipmaker. Once the industry leader in computer processors, the company is now working to preserve cash to fund a turnaround plan — one Gelsinger called the “most audacious rebuilding plan” in corporate history. The company has fallen out of investor favor amid a shift in the semiconductor industry toward artificial intelligence hardware. Companies are spending on computers built around accelerator chips for AI, an area where Intel’s offerings have barely made a dent.

“We know that we have much more work to do at the company and are committed to restoring investor confidence,” Yeary said.

“As a board, we know first and foremost that we must put our product group at the center of all we do. Our customers demand this from us, and we will deliver for them.”

It would have delivered for them long ago by firing Gelsinger, as the spike in the stock this morning makes abundantly clear.

And now just find a willing buyer since the stock is trading at a 50% discount just to the SOTP liquidation value of the foundries.