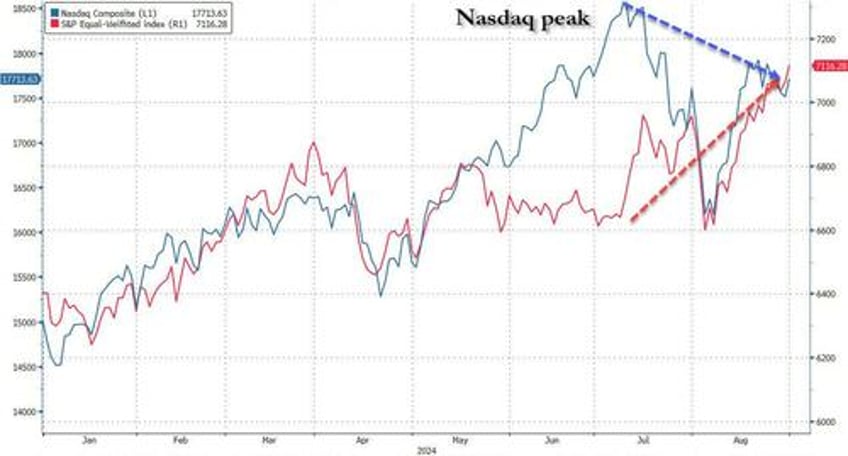

With summer now officially in the rearview mirror, and as we enter the final stretch of the year where the Fed's rate cuts and the November elections, guarantee plenty of excitement and another volatility quake, Goldman's top tech trader Peter Callahan lays out the 10 big storylines that TMT investors have to wrestle with in the last 4 months of the year. But first, some big picture observations from Callahan, who notes that as we head into the post Labor Day push, the Nasdaq is up 16% on the year, although it is tracking down ~1% through the first 2 months of 3Q (vs REITs, Utes, Fins all up 10%+ thus far in 3Q), indicative of the less directional TMT tape we’ve been in lately.

Callahan then notes that last week was indeed a big one for Tech investors, even if volumes didn’t muster up to the story lines, with all eyes on NVDA. Nvidia earnings and price action largely supported the local view here that the GenAI theme has become a bit more two sided: