By Peter Tchir of Academy Securities

I’ve been thinking a lot about one of the first lessons I was taught as a junior trader. We were warned that when something happens, say a piece of economic data comes out, and the market doesn’t respond as you expected, to cut positions and be very careful. It is a sign that “something” is wrong in how you are thinking.

On Friday, Treasuries rallied strongly on data that didn’t seem that great for rates. But the reality is (or so I believe) that Thursday’s sell-off was overdone, the “whisper” number was much worse than what came out, there are no longer term Treasury auctions, and the month-end index “extension” is usually good for bonds. So that doesn’t bother me much. What bothers me is that we had:

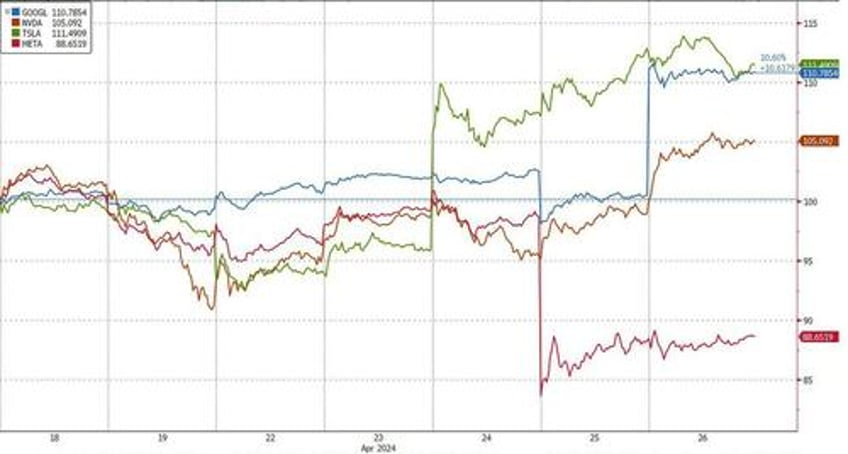

NVDA, a $2.2 trillion market cap company, drop 10% last Friday.

TSLA, a $500 billion market cap company, rise 10% on Wednesday.

META, a $1.1 trillion market cap company, drop 10% on Thursday.

GOOG, a $2.1 trillion market cap company, rise 10% on Friday.

Four "megacap" companies moved around 10% (or more) in a day!

I understand small cap companies do that. I understand that periodically something happens that is highly unusual – M&A, a scientific breakthrough, FDA approval, fraud, or something so unusual (but so profound) that a well-followed company gaps by that much. This was “just” earnings. Maybe I’m being overly dramatic? Maybe I haven’t adjusted my thought process to how large companies really are (probably part of the issue)? In any case it feels completely strange (even unnatural) for such large companies to move so much in a single session (let alone seeing it occur 4 times in 6 days)!

I am willing to believe that this is just my perception, and maybe it is more common than I perceive, but it is so different than how I’ve been thinking, that I have to respect it. As a “macro” strategist, I think about broad indices. Normally that is quite “macro,” but when some of the largest components of these indices (and associated ETFs) move so much more than I tend to think they can, then I need to question if it is still macro.

I can hear my first boss telling me that it is time to cut, sit back with less risk on the table, and think about what is going on. Maybe it is nothing. Maybe it is the new norm? Maybe 10% is the new 1%? Maybe moves close to 10% have always happened with market leaders and I just failed to notice that? I find it hard to believe, but knowing the T-Report audience, someone will likely send me a chart showing how common it is and that I need to “get over it.”

But I don’t think in terms of megacaps moving like that. To me, it reduces the macro, and is highly relevant as we have some other megacaps reporting this week. Should I assume 10% in either direction is a valid range? MSFT, for example, followed a more “normal” pattern. Some wild swings post-earnings in the after-market and pre-market. Stops getting triggered. Options at play. Digesting the first headlines, reading the details, listening to the call. All things that have conditioned me to see reasonably large moves in after-hours sometimes continuing into the next day of trading, typically ending with a meaningful change, but not a 10% change – especially for megacaps.

If this T-Report sounds like a broken record fixating on something that maybe isn’t important, I apologize, but it is bothering me a lot.

China

For the past 3 months, the CSI 300 (one measure of Chinese stocks) is up 8.5% versus 3.5% for the S&P 500 and 2% for the Nasdaq Composite.

One could look at this and say that:

The Chinese economy has turned the corner, helping stocks.

If China is doing better, it should help the global economy and sales into China, which should be good for all markets.

I remain firmly in the camp that:

Investors were too pessimistic on the Chinese market and positioning was too underweight or short. The unwind of structured notes sold to retail (that had leverage) was happening, but that has slowed.

It hasn’t taken much on the economic side to help the stock market (and there are some direct intervention techniques being used to help the stock market, without doing much for the economy). Less about the market.

Some of this is also linked to the performance of Chinese companies. Some are selling more products (Huawei phones in China, for example).

Since I think:

The reasons for the Chinese market rise have little to do with the economy (and I have recommended to clients to cut exposure here to FXI/KWEB).

The Threat of Made By China 2025 is real, so any rebound in China is not going to benefit global companies as much as it would have in prior years.

I have to caution against betting on global stocks because of what we are seeing in China.

Geopolitics

The pressure from global leaders calling on Israel to be cautious is mounting.

Iran, assuming they had hoped for a modicum of success with their 300+ missile and drone strike, is unlikely to do anything while they figure out why their attack was such a failure. See my base case in Should I Stay or Should I Go.

It would be a surprise if a geopolitical event caused problems for the markets this week, but then that is often the case. It is interesting that last weekend’s question of “Should I Stay or Should I Go” is as relevant as before, with some new factors added to the mix.

Bottom Line

Rates.

I am most comfortable with my view on rates.

We will get some “soft” data and Powell won’t be hawkish enough to convince the market that we are only going to get 1 cut (basically what is currently priced in). I do not see how we get to 0 and think that we could see the case for 2 to 3 (what the dots had, depending on whether you use median or average). Buy 2s at 5% (or 4.98% as the case may be).

While I expect fears of the deficit, supply, etc. to push us higher at some point, I like owning 10s above 4.6% and think that 4.45% is a reasonable near-term target. As mentioned earlier, there are a number of factors that could take us there as early as this week.

Equities

Since I’m bullish on Treasuries, should I in theory be bullish on equities? Maybe, but that correlation has been weak to nonexistent of late. We’ve addressed this in Changing Times Impacting Signals and Correlations and Rorschach Test. I’m hesitant to be bearish stocks, but bullish on Treasuries. More importantly, I’m reluctant to be too committed in any direction until I can make better sense of these large, single day moves for megacaps. When something is bothering me and I should have a better idea of what is going on (but I don’t), then it is prudent to be cautious.

So, I will remain bearish on equities and expect us to break the lows set on April 19th. It briefly looked like that was possible as recently as Thursday morning, but it seems less realistic now as the S&P gained 2.7% and the Nasdaq rallied 4.2%. I just cannot be too aggressive on this because I could easily see some additional 10% moves, which I’ve never really accounted for. Those moves could go in either direction.

The one thing that does make some sense about 10% moves is that if we really are on the cusp of a viable revolution in technology, the entire market seems cheap. But, if the cost/benefit ratio is not great right now (less than revolutionary improvements at rapidly rising prices), then we could move down rapidly. So maybe 10% moves, even in megacaps, is normal when we are at an inflection point in technology and potential valuations? That is plausible, though I’m not sure how to incorporate that into my framework, other than moving more and more into options to express long and short bets.

Credit.

Yawn. Not a lot of room to tighten. Can widen a bit more, but primarily as a function of stocks going down than any obvious change in fundamentals. With supply likely slowing, relative to cash earmarked for new issues, I’m biased to be mildly bullish credit spreads, even while moderately bearish equities.

May the stocks you own all go up 10% every day. I don’t completely understand it, but cannot ignore it, and might as well hope people benefit!