While everyone continues to watch the slow-motion trainwreck that is the Japanese yen, where the BOJ epically fucked up its latest monetary policy intervention, sending the yen plunging to a 34 year low despite its first rate hike in 17 years, the real action overnight was in the Chinese yuan, which abruptly tumbled below the key support level of 7.22 despite lower US yields and dovish comments by Powell at this week's FOMC, hinting at a possible imminent change in PBoC FX policy, read currency devaluation driven by the relentless crash in the yen and ascent in the US dollar.

On Friday, China’s tentative loosening of its vise-like grip on the yuan unleashed a slide in the currency and pulled down its Asian and EM currency peers lower. The onshore yuan dropped the most in more than two months after the authorities set a weaker-than-expected daily fixing, sparking speculation they would tolerate further losses, i.e. proceed with a soft or not so soft yuan devaluation.

The onshore yuan slid as much as 0.4% to 7.2299 per dollar Friday, breaching the 7.2 level that Beijing had been defending for months. The tumble came after the PBOC lowered its daily fixing by the most since early February; the decline took the currency to within 0.2% of the end of its allowed daily trading band of plus or minus 2% from the fixing.

Once the 7.22 level was breached, it immediately sent the offshore renminbi, the USDCNH, tumblinf to a five month low level, not seen since mid-November.

The declines in the yuan were “triggered by the weaker fix,” said Fiona Lim, a senior foreign-exchange strategist at Malayan Banking in Singapore. That sent a signal the “PBOC is willing to allow some weakness in the yuan as the dollar has gained a bit of a bullish bias recently,” she said

The unexpected easing in Beijing’s FX stance underscores the challenges China's mercantilist policymakers face as they try to stimulate a fragile economy through monetary easing, while also keeping the yuan broadly steady to prevent capital outflows. Needless to say, the reversal in the tone suggests that China is willing to risk another surge in capital outflows if it means a domestic rebound in the economy... which is natural since the alternative is a riot by China's 1+ billion middle class. That said, a decision to completely loosen currency control wouldn’t be straightforward as the People’s Bank of China will need to maintain some support to make sure the depreciation is orderly and doesn’t endanger financial stability. It would also mean a flood of buying of gold and bitcoin (as Reuters reported a few weeks ago).

To be sure, the renewed weakness in the yuan - after it had largely flat-lined for nearly two months - has implications beyond China’s foreign-exchange market. A sudden or sustained slide may weigh on regional peers already under pressure from a buoyant dollar... in fact it already is, with emerging market and regional FX (such as the AUD) tumbling overnight. It would also make the nation’s struggling stock market even less appealing to overseas investors.

While the initial selling was sparked by the much weaker than expected fixing, the selling then accelerated after state banks refrained from selling dollars in large amounts at the market open. Sentiment was further soured after PBOC Deputy Governor Xuan Changneng said Thursday the nation still has room to lower the reserve-requirement ratio for banks, a move that may further widen the US-China monetary policy divergence.

“The aggressive market reaction immediately after a slight scaling back of the strengthening bias may lead to a more cautious move ahead,” said Becky Liu, head of China macro strategy at Standard Chartered Bank. “The PBOC may need to step up foreign-exchange management in the near term.”

Bloomberg also notes that adding to the bearish sentiment surrounding the yuan is a proposed bill being considered by the US Congress that would block mutual funds from investing in some products that track Chinese stock indexes. Key equity gauges on the mainland slipped some 1% Friday

Finally, the renewed strength in the dollar is also hurting the yuan. Despite Powell's dovish FOMC press conference, the Bloomberg dollar index was set for its biggest weekly gain in two months largely thanks to a plunge in other G7 currencies as several central banks unexpectedly eased. And then there is the ridiculous cartoon that is the BOJ, whose "hike" and end to NIRP failed to boost the yen, a further sign of the dollar’s underlying strength.

“The hurdle for the PBOC to allow the dollar-yuan fixing to follow spot to move a little higher to 7.2 to 7.25 into the summer is not too high,” said Ju Wang, head of greater China foreign-exchange and rates strategy at BNP Paribas. “This could allow spot to test 7.3 again.”

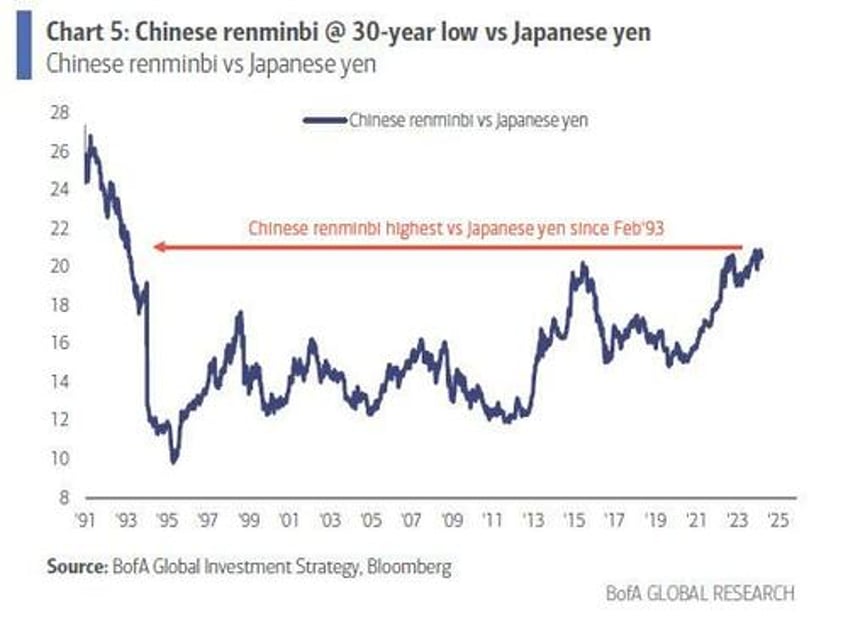

It could test much lower too, especially if the yen keeps crashing. As BofA's Michael Hartnett writes in his weekly flow show today, while "central banks are tolerant of higher inflation, they are intolerant of currency appreciation" and he then shows that the yen is trading at a 30-year low vs the yuan, suggesting it's only a matter of time before China has to aggressively devalue itself to catch down to its exporting neighbor.

Still, further and steeper losses in the yuan would increase the prospect of additional support from the PBOC, such as state bank selling of the dollar or verbal intervention. The central bank may also tighten liquidity in offshore markets to make betting against the currency more expensive.

The reason: if and when Chinese resident suffer enough losses on their savings, they will accelerate conversions to gold (see "China Splurges on Gold For a 16th Month as Price Hits Record") and especially bitcoin, as Reuters profiled two months ago in "Bruised by stock market, Chinese rush into banned bitcoin" when the yuan was still stable

Meanwhile, as markets wait to see how much lower Beijing will allow the yuan to drop, traders around the region are keenly watching moves in the yuan as it has long been considered an anchor currency. The Australian dollar and South Korean won - both considered proxies for China sentiment - slumped at least 0.7% Friday.

“The yuan depreciation has negative spillovers to the low-yielding ones, such as the Korean won, Taiwan dollar and Thai baht,” said Lemon Zhang, a strategist at Barclays Bank in Singapore. “We would expect offshore yuan liquidity could tighten,” if bets against the currency accumulate further, she said.

It would be delightfully ironic if Biden's fake "strong economic data", which has been the key catalyst recent behind dollar strength, ends up being the trigger for the next Asian currency crisis, not to mention the next round of record highs in both gold and bitcoin.