It’s been nothing short of a historic week for the global financial markets, but the yen continues to stay unloved, while front-end Treasuries will continue to be the winners given the Fed’s clear bias to cut interest rates.

The Bank of Japan took one small step to raise rates, but one that nevertheless marked a giant leap in terms of its faith on having found sustained inflation.

And Thursday, the Swiss National Bank surprised the markets with a rate cut that only a handful had expected, and just a few hours later Turkey’s central bank stunned observers by showing its willingness to take on domestic inflation that has been running on steroids with a gigantic rate increase.

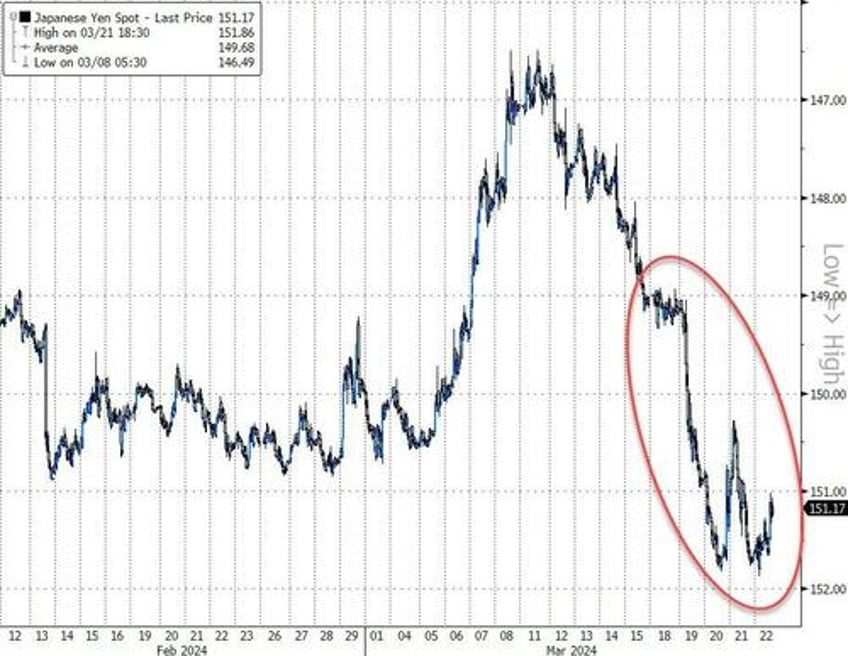

Despite the BOJ’s vote of confidence on the economy, the yen has slumped about 1.5% this week — with still-lofty inflation-adjusted rates in the US hoisting up the dollar.

The yen is undervalued by a country mile and then some even on the basis of factors that tend to hold a sway over currencies in the short term, so it’s a bit of an irony that the BOJ kept its date with investors, but the yen didn’t.

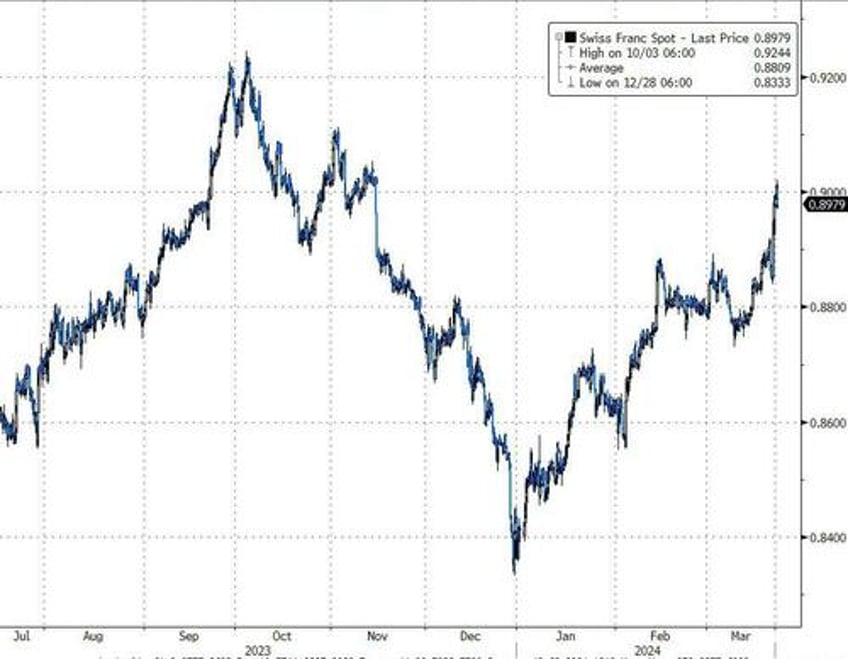

The SNB’s proclivity to surprise is something of a habit.

About 13 years ago, it ruffled the markets by setting what it called a minimum exchange rate — effectively capping a stronger franc. Four years later, it scrapped that experiment, again unleashing a tsunami in the markets.

In 2022, it went one-up on the European Central Bank by raising rates by a punchy 50 basis points that few expected. So in a sense, yesterday’s move shouldn’t really have come as a surprise to anyone.

The upshot of its actions will be a weaker franc, but it makes sense to pick your crosses wisely.

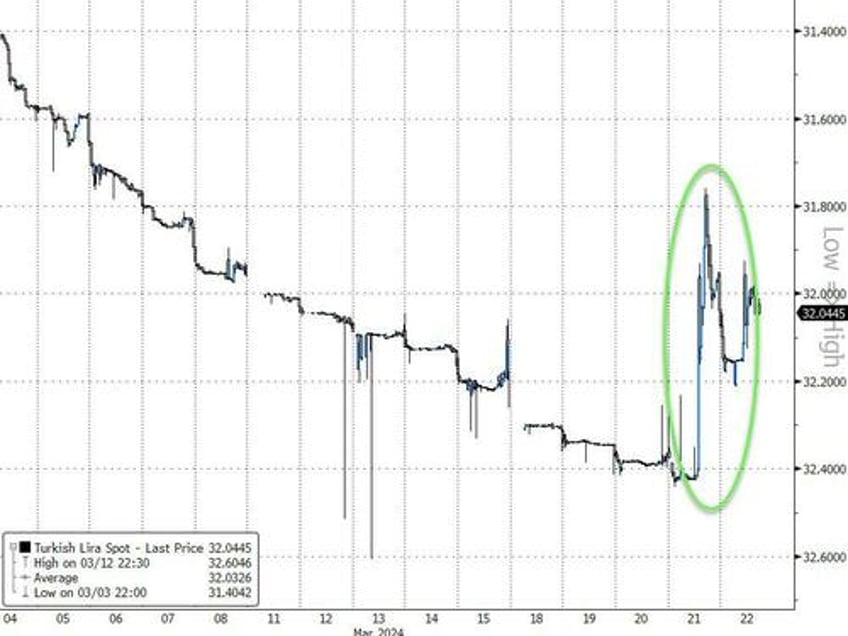

While the lira rallied more than 1% on Turkey’s 500-basis point increase in its benchmark rate, it’s surrendered some of those gains partly today — underscoring how brittle sentiment can be when you try to catch up after falling behind in the battle against inflation.

The Fed’s dot plot left observers tearing their hair out: policymakers thought the economy this year will be way stronger than they had estimated in December by revising up their growth projection all the way to 2.1% from 1.4%.

They also expect core PCE to be higher and unemployment to be lower. And yet they expect to be able to cut rates no fewer than three times, revealing an unmistakable preference to cut no matter what. While two-year Treasury yields are have declined some 12 basis points so far this week, there is room for them to trend lower.