By Rystad Energy, via Oilprice.com

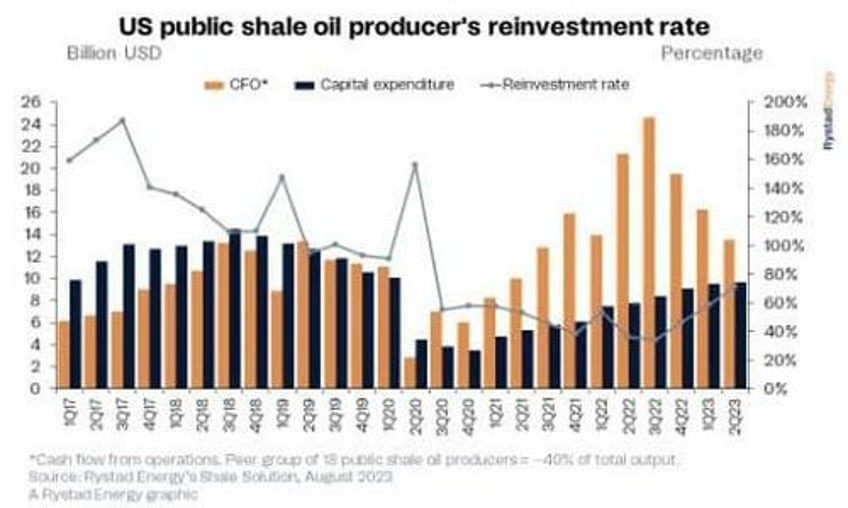

The reinvestment rate of US shale oil producers hit its highest level in three years in the second quarter of 2023, but the recent trajectory will not last, according to Rystad Energy research. Our analysis focuses on a peer group of 18 public companies, excluding majors, that collectively accounted for about 40% of total US shale oil output in 2022.

The group’s reinvestment rate was 72% in the second quarter of the year, up from 58% in the first quarter and the highest since the 150% seen in the second quarter of 2020. The reinvestment rate is the ratio between capital expenditure and cash flow from operations (CFO).

In years gone by, reinvestment rates often exceeded 100% and served as a clear indicator of the industry’s willingness to spend freely to rapidly grow volumes, a key driver of the early stages of the shale revolution. However, in the current era of capital discipline, public shale companies prioritize shareholder value and exercise caution over a gung-ho investment strategy. As a result, the reinvestment rate only tells part of the story.

Inflation has been pushing up drilling and completion costs and contributing to a rise in capital expenditure, while muted oil prices are dampening cash flow. Capital expenditure among the peer group has risen for 10 straight quarters, reaching $9.7 billion in the second quarter of this year, up from $7.8 billion over the same period in 2022. Meanwhile, the group’s CFO fell to $13.5 billion, continuing its steady decline since the third quarter of 2022, when it peaked at $24.6 billion, around the same time that oil prices spiked on the back of Russia’s invasion of Ukraine.

However, we expect this trend to reverse by the end of 2023. As inflation eases and global oil prices tick up due to ongoing tight supply, our forecasts predict a declining reinvestment rate before we reach 2024. The vast majority of operators have spent more than 50% of their guided 2023 budgets during the first two quarters, with several having only 45% or less to invest. Earnings call guidance from management also suggests that cost deflation across the board is imminent.

At first glance, a rising reinvestment rate might point to a return to the old days of aggressive capital expenditure and rapid production growth. However, discipline is the name of the game for public shale companies now, which ensures this trend will not last. As inflationary pressures ease in the coming quarters and oil prices rebound, this spike will be a short-term anomaly instead of a shift of strategy.

The peer group has shrunk due to recent merger and acquisition activity and is likely to shrink further as consolidation continues, and the number of public upstream companies dwindles. Ranger Oil Corporation was excluded from the peer group recently following the completion of its acquisition by Baytex Energy. Chevron’s recent deal to buy PDC Energy and Permian Resources’ acquisition of Earthstone will further reduce the peer group.

As with CFO, all other metrics declined in the second quarter. Earnings before interest, tax, depreciation and amortization (EBITDA) for the peer group fell by about half from its peak of $30.7 billion a year ago, while headline net income dropped for the third consecutive quarter. Both EBITDA and net income were down in the quarter for nearly every company in the group. Free cash flow was slightly more than $4 billion, the lowest level since 2020 and a measly 25% of the $16 billion in the third quarter of 2022.

Shareholder payouts for the group also fell during the second quarter, although the ratio of returns to capital expenditure remained extremely high in the historical context for both buybacks and dividends. Dividends as a ratio to capital spending was 28% in the second quarter, down from a high of 75% in the third quarter of 2022. Still, operators issued over $2.7 billion in dividend payments in the three months. To put that value in perspective, the sector had never paid more than $1 billion in dividends in a single quarter prior to the third quarter of 2021.

Stock repurchases were also down, at $1.7 billion, equal to 17% of capital expenditure. Investors have grown used to the previously unthinkable level of cash returns being provided by operators, a centerpiece of the re-branded public shale business model. Yet, they have also been generally understanding of the market conditions that have thus far inhibited further cash generation, and thus payouts. As many operators have bound themselves to cash return pledges and issued modest guidance for organic growth, investors have largely aligned their expectations to market conditions.