One of the biggest market mysteries since the early summer, is who or what has been behind the relentless dump in Treasuries, and resulting surge in yields: some of the proposed reasons have included the "stronger than expected" US economy (i.e. Bidenomics), the market' long overdue realization that the US fiscal trajectory, debt and deficit is unsustainable (i.e., Bideficitnomics), term premium, CTA selling, aggressive basis trades and so on. What was lost in this list of growing sophistication was the simplest reason of all: current holders selling Treasuries.

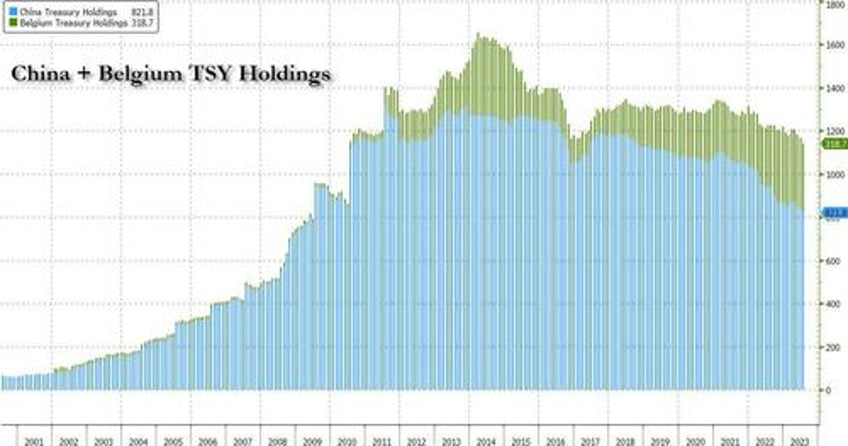

To be sure, many had suggested that as part of the world's response to the US weaponization of the dollar, none other than China (and/or other anti-Western nations) have followed Russia's example and sent the Biden admin a not so subtle message with relentless, coordinated selling of US paper. Indeed, according to the latest just released TIC data report, Chinese holdings of US Treasuries dropped again, sliding by $14 billion to $821.8 billion, the lowest since 2009. Some will counter - not incorrectly - that China is using Belgium, i.e. Euroclear, as custodian for many of its TSY holdings, and indeed overlaying Belgium (assuming most of these holdings belong to China) show a far more gradual decline in Chinese Treasury holdings.