Recent data has highlighted inflation is sticky, and retail sales this week could confirm the consumer is far from tapped-out. But it will take more than that - perhaps a coordinated response from Federal Reserve speakers - to disabuse the market of the multiple interest rate cuts priced in for this year.

The market continues to gun for the Fed’s cutting cycle to begin in March.

Consumer prices came in higher-than-expected, yet this barely moved the dial on those expectations.

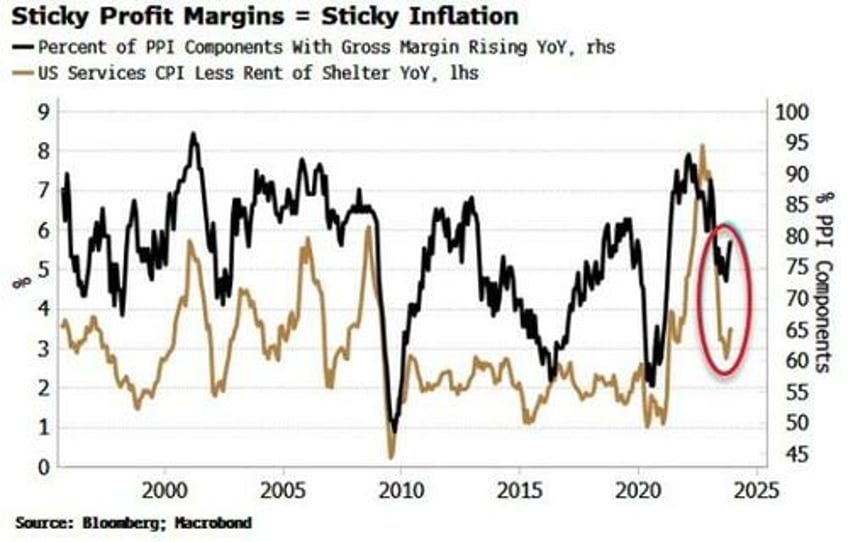

Soft producer prices data on Friday was seen as a post hoc justification for dovish pricing. But even there, under the surface, are clear signs of inflation that is becoming entrenched.

PPI measures prices received for non-retail firms. But for wholesalers, who do not buy raw materials, this is not directly measurable. In this case the Bureau of Labor Statistics estimates the value-add, i.e. the gross margin, for such companies.

The black line in the chart below shows the percentage of industries whose gross margin is rising on an annual basis. It reflects a reasonable correspondence with services CPI excluding rent. The gross margin measure is rising, which is consistent with CPI rising again.

Profits, since the pandemic, have been the biggest contributor to corporate prices, rather than labor.

It’s not a wage-price spiral that is the main worry in this cycle, but a profit-price-wage spiral.

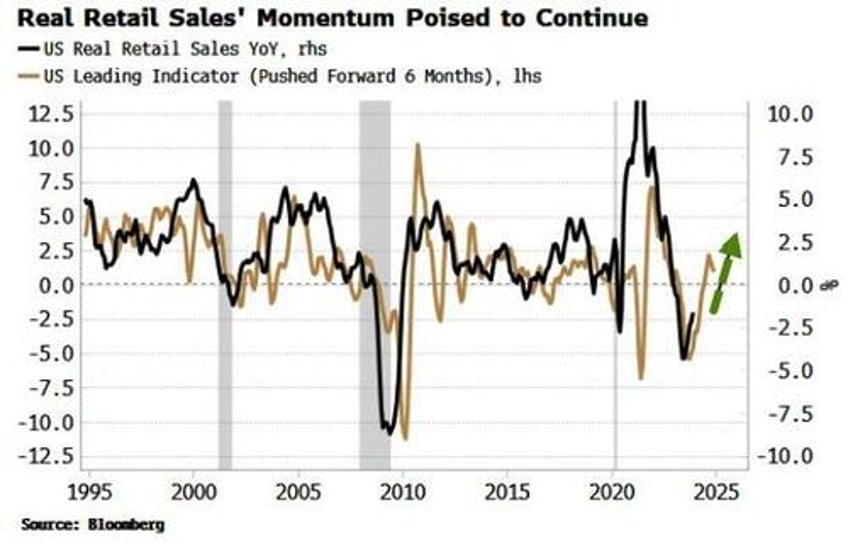

We will also get an update on retail sales this week. They have been much better than anticipated given the Fed’s aggressive rate-hiking cycle. Leading data suggests that momentum should continue well into this year.

In normal circumstances, that might mean a reappraisal by the market and a shift to less dovish pricing. But that has not been the case lately, with the economy - and even Fed-speak explicitly talking down a March cut - seemingly ignored.

It will likely take a more coordinated response from the Fed if they want to take an early cut off the table.

There are at least six Fed board members and bank presidents due to speak this week, so we will find out how fervent is the desire to push back against the market’s current dovish outlook.