After what has been a boring start to the week, where the biggest event so far was yesterday's start of corporate buyback frontrunning (as we first detailed and bottom ticked the market, which is now 100 points higher since our comment), investors are bracing for some serious fireworks after the close with Tesla, which coming into today was down a record-matching 7 consecutive days although today may finally be a green close, set to report after the close and launch the Mag 7 earnings train in motion.

And while we detailed what one can expect from Tesla earlier, here is another look at the all-important Mag 7 earnings parade, which starts today and continues tomorrow with META and Thursday with GOOGL and MSFT, amid an earnings bonanza that includes 180 companies or 40% of the S&P500 by market value.

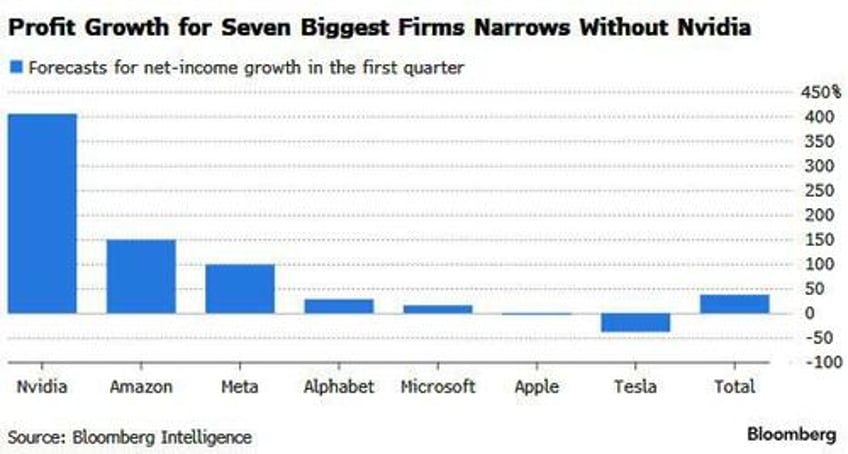

To say that these matter a lot is an understatement: as shown in the chart below, profits for the Magnificent Seven are forecast to rise 38% in the first quarter from a year ago (only TSLA is expected to show a drop in profit), dwarfing the overall S&P 500’s puny 2.4% anticipated year-over-year earnings growth. That said, excluding Nvidia net income growth for the Mag7s falls to just 23%.

Some more detail comes from DataTrek's Nick Colas who writes that without the 5 Big Tech names, S&P 500 earnings would be down 6.0% in Q1 rather than the consensus estimate of +0.5 pct growth: "AMZN, GOOG, META, MSFT and NVDA are the difference." Colas also notes that the S&P 495” are expected to turn the corner later this year, supporting current equity market valuations.

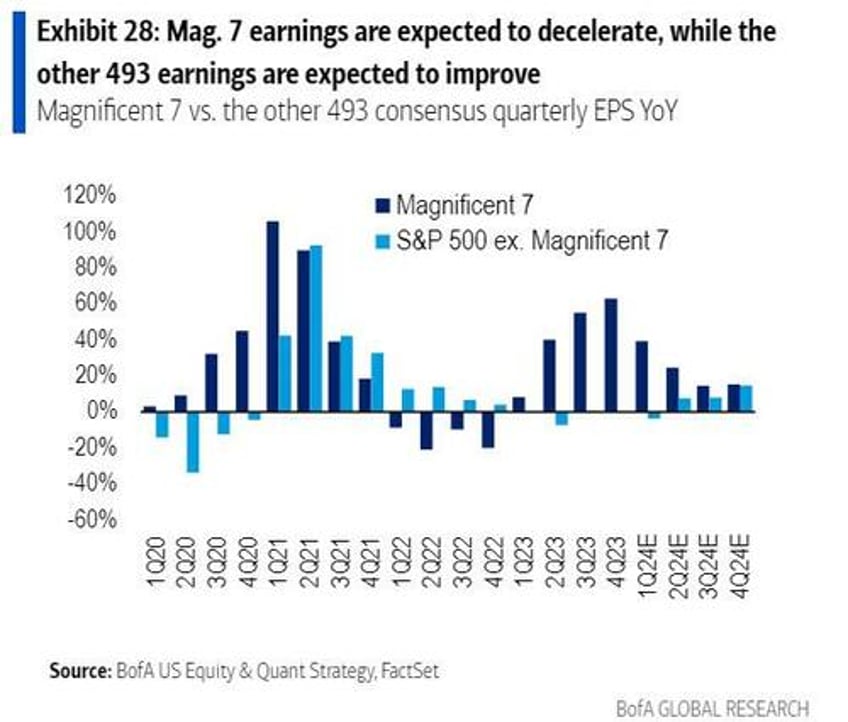

They better: while the Mag. 7 (really NVDA) are reporting blowing earnings growth, they are slowing down to +38% YoY this quarter vs. +63% in 4Q 2023, with all seven companies expected to see either decelerating EPS growth or an EPS decline YoY.

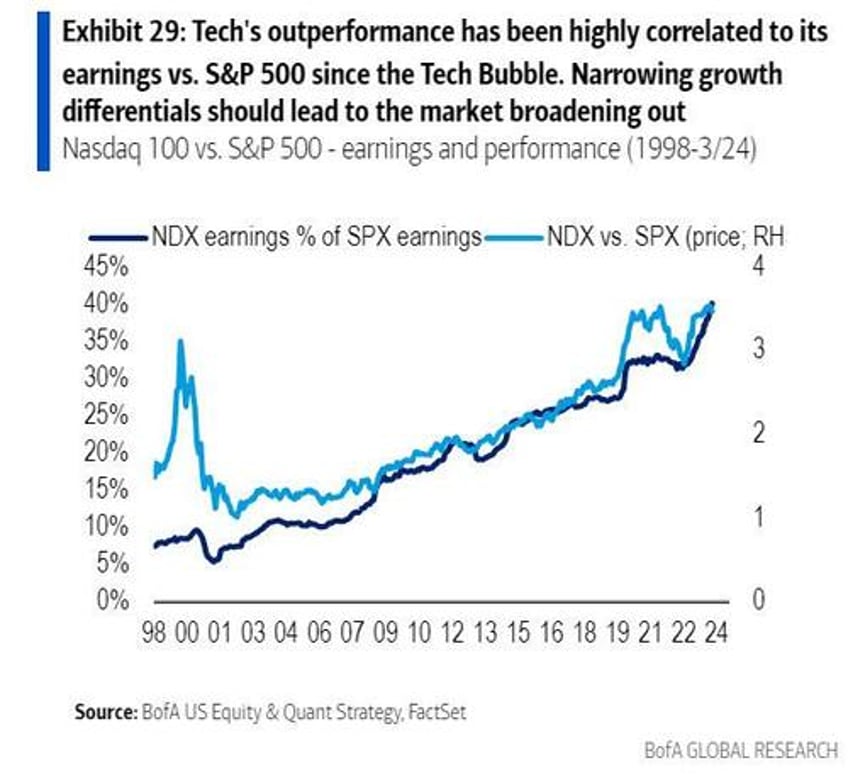

And, as noted above, the other 493's earnings are expected to further decline to -6% YoY (vs. flat in 4Q), but 1Q is expected to be the trough (consensus +8% YoY in 2Q). According to BofA's latest earnings tracker (full note available to pro subs in the usual place), 25% of stocks are also expected to see positive and accelerating EPS growth in 1Q. Bottom line: the growth differential between the Mag. 7 and the other 493 is expected to close by 4Q...

... which should lead to a rotation out of Tech and into more Value-oriented stocks.

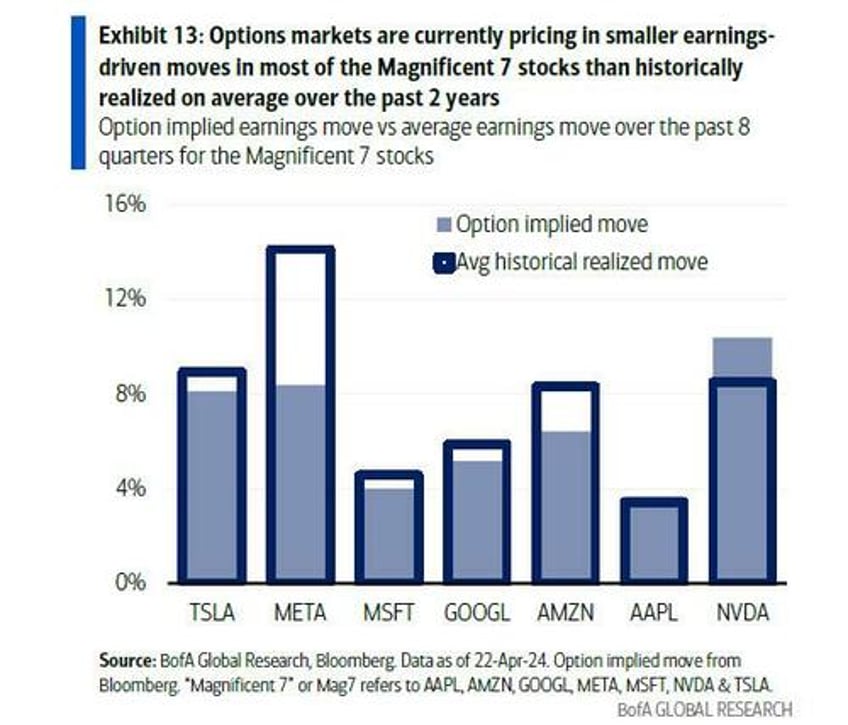

And so, with Mag7 earnings about to start, almost all the Magnificent 7 stocks still sitting below their price levels from two weeks ago despite Monday’s rebound, BofA's derivatives team notes that further upside driven by favorable earnings results in these stocks is certainly possible. To position for this upside with asymmetry, the bank likes using options-based structures rather than buying the stocks outright.

Interestingly, the BofA derivatives desk points out that compared to historical earnings day reactions, options markets are currently pricing in a smaller earnings-driven move for the upcoming season for five out of seven of the megacap tech stocks...

... which also motivates buying optionality to position for a rally.

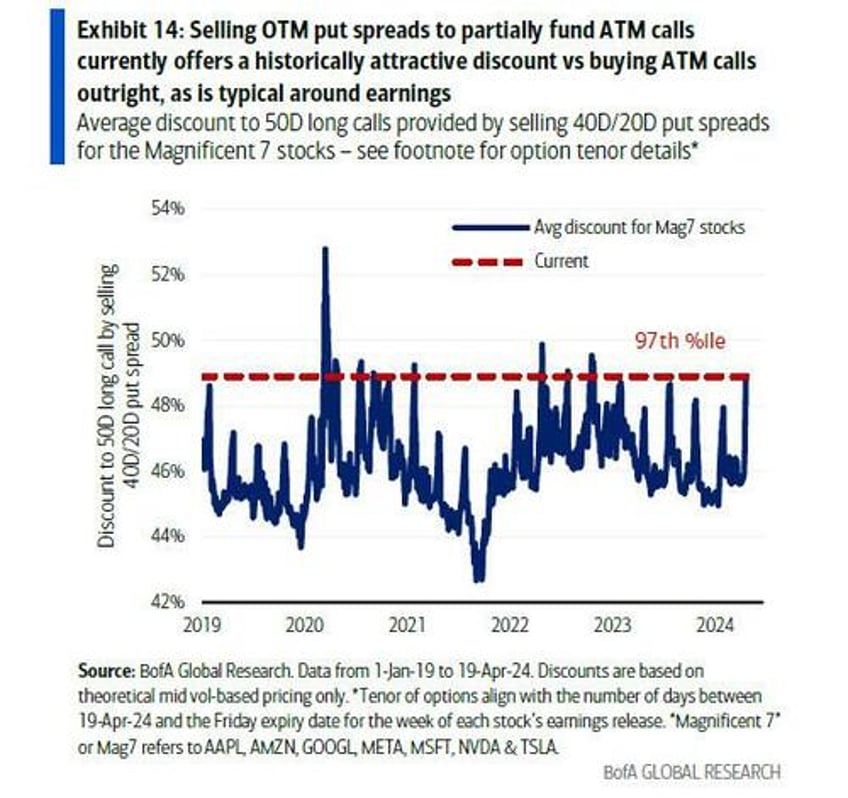

While the simplest expression of this would be to buy call options on each of these stocks, BofA also likes funding the calls by selling OTM put spreads of the same tenor. Specifically, the bank is considering partially funding 50-delta calls (expiring on the Friday of the week that the stock releases earnings) with 40-delta/20-delta put spreads of the same tenor. While this introduces some degree of downside risk, the structure remains limited risk while offering a historically attractive discount vs buying an outright 50D call for these seven stocks.

Finally going back to Tesla, Goldman cautions that while there is clearly skepticism on both TSLA and the EV market as a whole, with deliveries already announced for 1Q (stock was down 5% on this and another -14% additionally since), much of this has been priced in with short interest is at 3-year highs. Goldman thinks the key focus for investors will be

- Can they grow volumes in 2024? We think investors were at +10-15% y/y to start the year and are GIR is now in the 1-2% range and

- What are gross margins and how low do they need to go? Consensus looks to be 15.8% (ex-credits) tonight and bogey seems to be below 15% for the quarter.

More in the full BofA note available to pro subs.