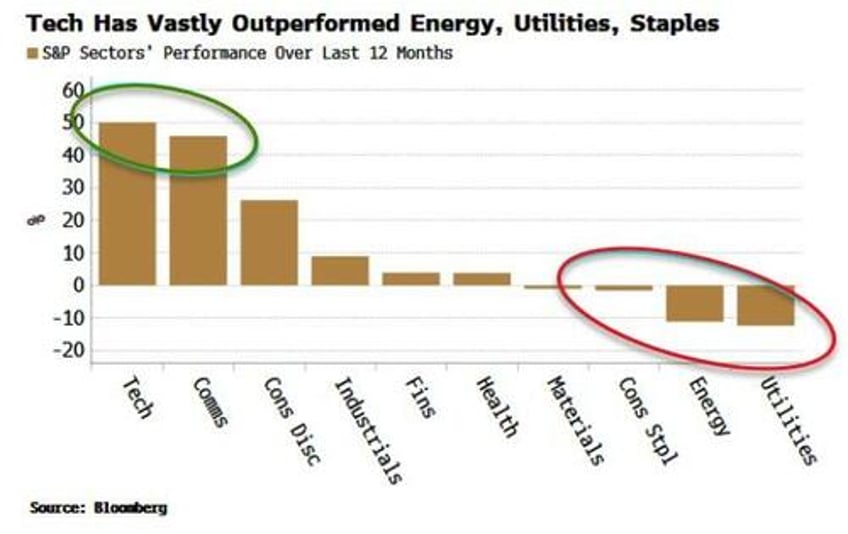

The long-duration, tech-focused trade is looking increasingly fragile, while low-duration sectors such as energy, utilities, as well as small caps and value, are becoming cheaper.

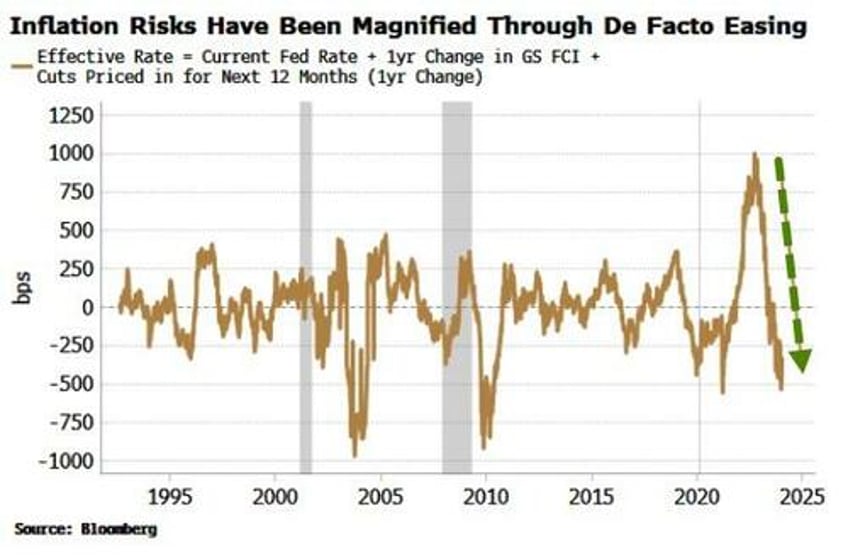

Federal Reserve rate cuts will amplify already-burgeoning inflation pressures, leaving duration-heavy portfolios exposed to mounting risks.

This is poised to be a year of forest fires.

Each Fed cut will snuff out a small fire, but the natural burning of undergrowth that allows ultimately increases the risk of a bigger inferno, i.e. a re-acceleration of inflation.

“Anti-fragile” portfolios are the ones that will use the likely knee-jerk move higher in tech and similar sectors as rates fall to reduce duration risk, and take advantage of increasingly cheap low-duration sectors.

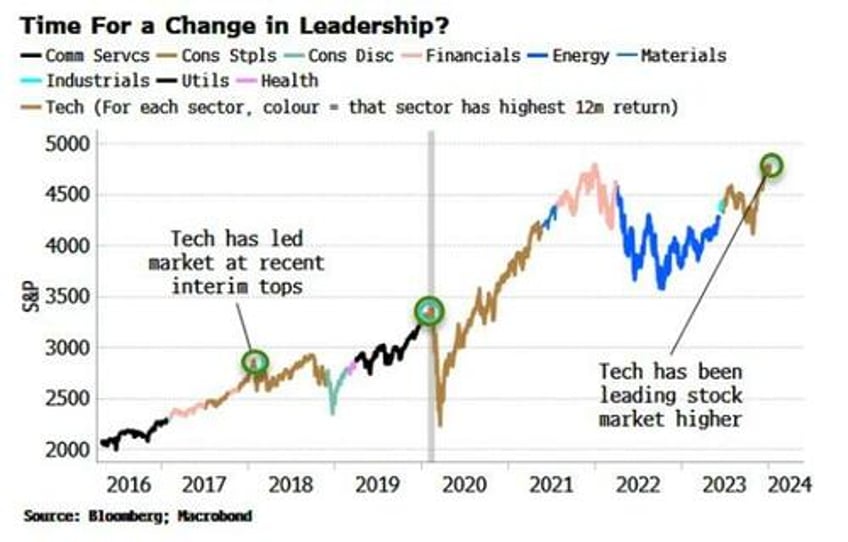

“The trend is your friend until it ends” is an old market saw.

2024 is shaping up to be the year that the trend in US equities, especially the tech sector, hits turbulence, after the strong tailwinds in the latter part of last year. The general consensus in the annual Barron’s Roundtable is a “-5% to +5%” year for the index.

That’s not much to get excited about. But under the hood could be a very different story as inflation rears its head again and leadership shifts away from tech toward lower-duration sectors. Depending on how eager investors are to reduce their duration exposure, that obviously presents a risk the market could fall by more than the 5% mooted by the Barron’s Roundtable panelists.

Either way, what worked last year is unlikely to work this year.

There are several risks to stocks that a restructuring of equity portfolios toward lower-duration, more undervalued sectors, such as energy and small caps, will help mitigate against:

A re-acceleration in inflation — now even more probable in the wake of the Fed’s pivot — is likely to lead to investors reducing their duration exposure in bonds and equities, in a replay of positioning behavior in 2020/2021

Liquidity conditions are going to become less friendly for stocks, leaving more overvalued sectors such as tech at risk of greater declines

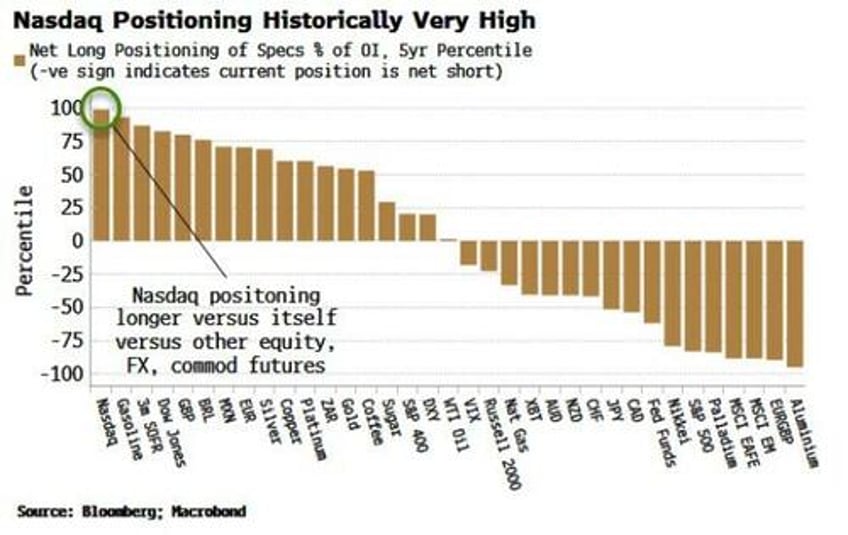

Tech is not only overbought and at risk of a correction, it is over-owned, with positioning very long, as well as being a consensus trade in response to Fed cuts

Low-duration sectors such as energy and utilities, on the other hand, are relatively cheap, under-owned and non-consensus

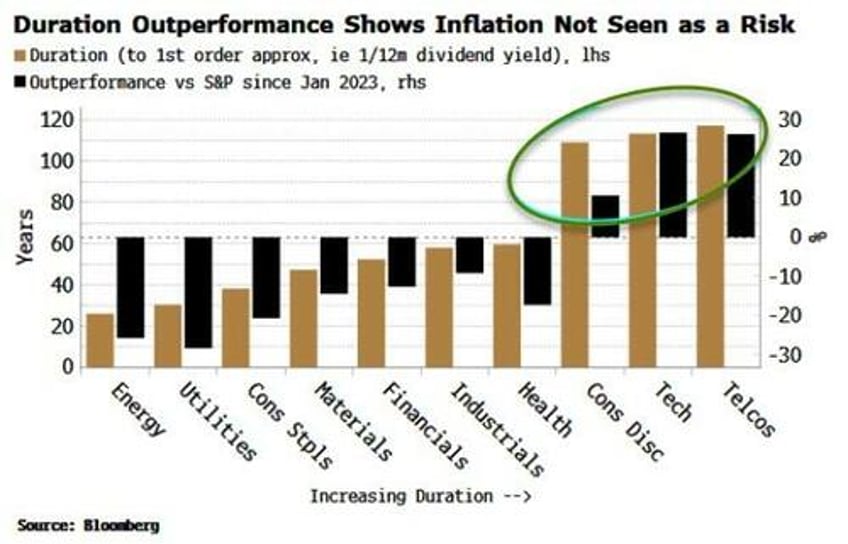

It’s a return of inflation that presents the most underpriced risk for duration-heavy portfolios. In the initial burst of price growth through 2020 and 2021, higher-duration sectors such as tech and consumer discretionary were shunned in favor of energy, utilities and staples — sectors with lower duration and therefore with less chunky future cash flows at risk of being ravaged by inflation.

But that began to reverse in late 2022, with the tech trade galvanized by the release of ChatGPT 3.5, and energy exposure seen as no longer necessary due to the assertive disinflationary trend.

A turn back up in inflation is poised to see a re-establishment of the 2020/21 theme as investors become wary of duration again.

Make no mistake: inflation risks have multiplied and risen in recent months. Not only do a swathe of leading indicators for profits, wages and supply chains point firmly in the direction of a resurgence in price growth this year, the Fed’s unexpected pivot and thus higher likelihood of near-term rate cuts has added kerosene to the inflation fire set to re-ignite in 2024.

The effective Fed rate - that is the policy rate adjusted for the expected rate cuts this year, as well as for the loosening in financial conditions from higher stock prices, tighter credit spreads, lower volatility, etc - has already fallen considerably. Inflationary risks have been heightened even before the Fed has loosened policy.

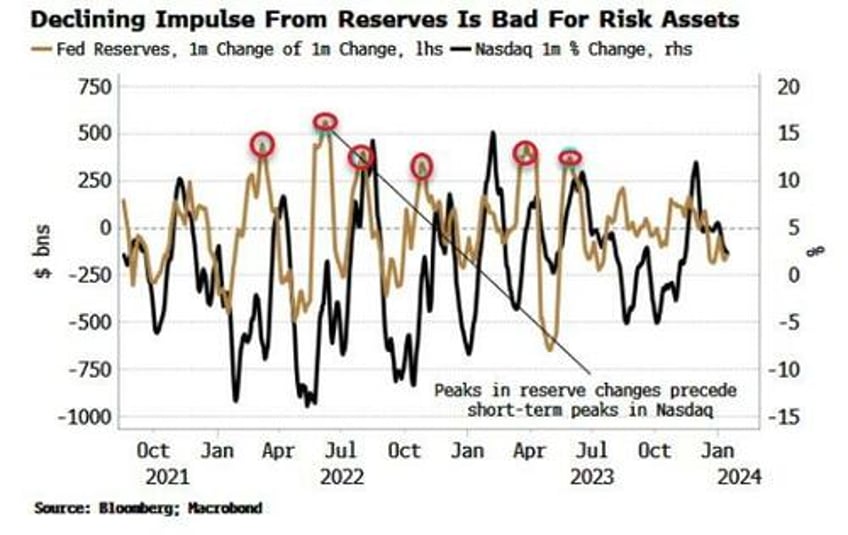

On top of that, liquidity conditions are becoming less favorable at the margin for risk assets, leaving those that have rallied the most, such as tech and communication services, the most exposed. As quantitative tightening persists and the Fed’s reverse repo facility (RRP) drops, the system will move toward the “event horizon” for reserves, where funding issues could abruptly manifest themselves.

Already the impulse from reserves — i.e. the change in their change — is fading, pointing to declining tech returns.

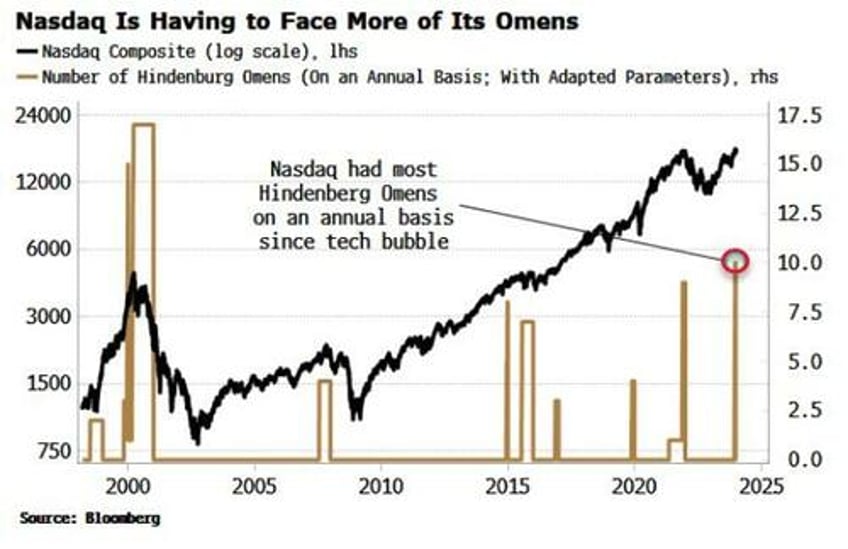

Furthermore, Hindenberg Omens, a sell signal based on the percentage of new highs and lows in the index, are becoming more frequent for the Nasdaq, with the highest number seen on an annual basis in December since the 2000 tech bubble.

Tech-sector risks are being exacerbated by enthusiastic investor sponsorship in recent weeks. Speculators’ positioning in Nasdaq futures has gone from flat in November to a net long of 7% of open interest, the most in at least five years, and longer than any other FX, equity or commodity future versus its five-year history.

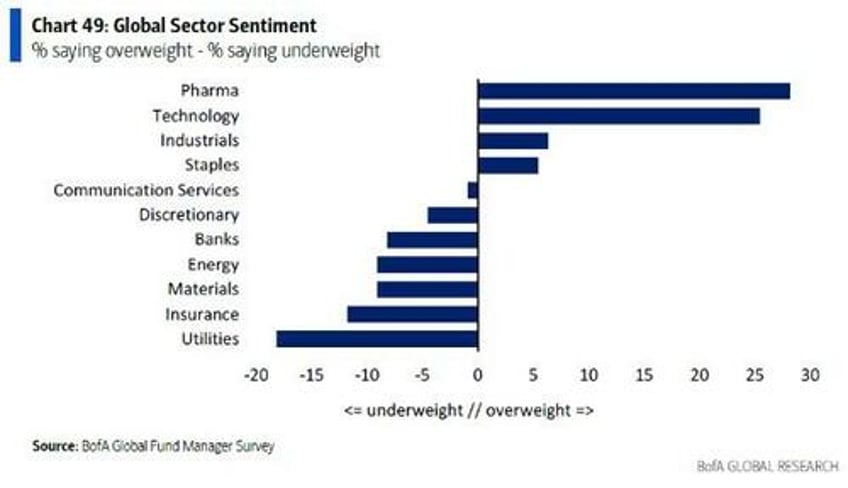

Going long high-duration tech this year in the face of Fed rate cuts has become consensus, with that sector expected to perform the best, according to the BofA Global Fund Manager Survey (GFMS). Exposure to low-duration sectors such as energy or utilities didn’t appear as a response in a sign of how out-of-consensus low-duration sectors have become.

Energy and utilities are the worst performing sectors over the last year (see chart above), and they and other low-duration industry groups continue to be under-owned by investors, again according to BofA’s GFMS. They are also relatively cheap, with P/E and P/B ratios lower than the S&P’s. Higher-duration sectors such as tech and industrials are expensively valued versus the index as well as being — perhaps unsurprisingly given insouciance to inflation — the most over-owned sectors ex-pharma.

Source: Bank of America

Large forest fires are notoriously difficult to put out once they start. But in a year of great potential uncertainty, stock portfolios with slimmed down durations stand a better chance of withstanding the heat.