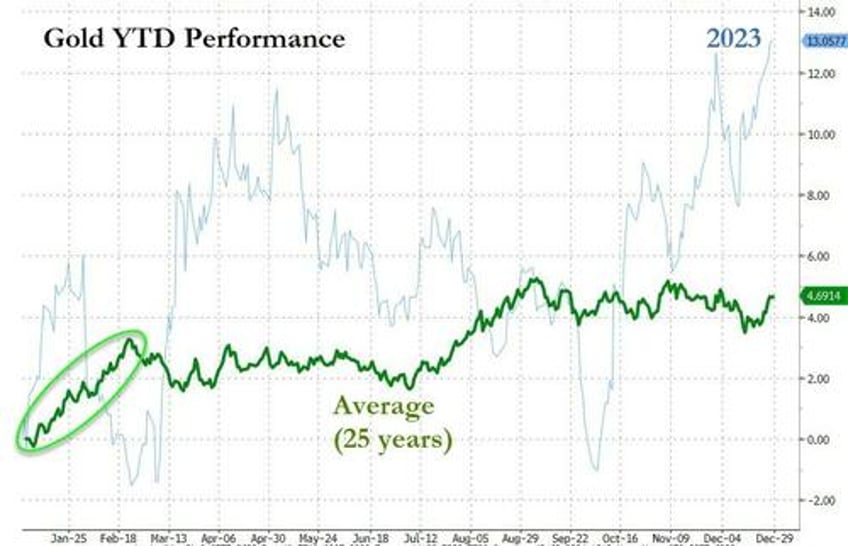

If history is any indication, January will be a good month for gold.

According to analysis by the World Gold Council, gold tends to perform well in the first month of the year.

Since 1971, gold has had an average return of 1.79% in January. That’s nearly three times the long-term monthly average.

Over that same period, gold has charted positive returns in January almost 60% of the time. Going back to 2000, gold has gained in 70% of Januaries.

The World Gold Council points to three factors that may boost gold’s January performance.

Beginning of the year portfolio rebalancing

Season weakness in real yields

Gold restocking in East Asia ahead of the Lunar New Year

The World Gold Council does advise a bit of caution.

“This doesn’t mean that gold prices rise every January. There’ve been several years when it hasn’t, most recently in 2021 and 2022. Years with negative returns in January generally coincided with periods when the US dollar has strengthened – often significantly.”

But as we move into 2024, there appears to be a good setup for gold to have another strong January.

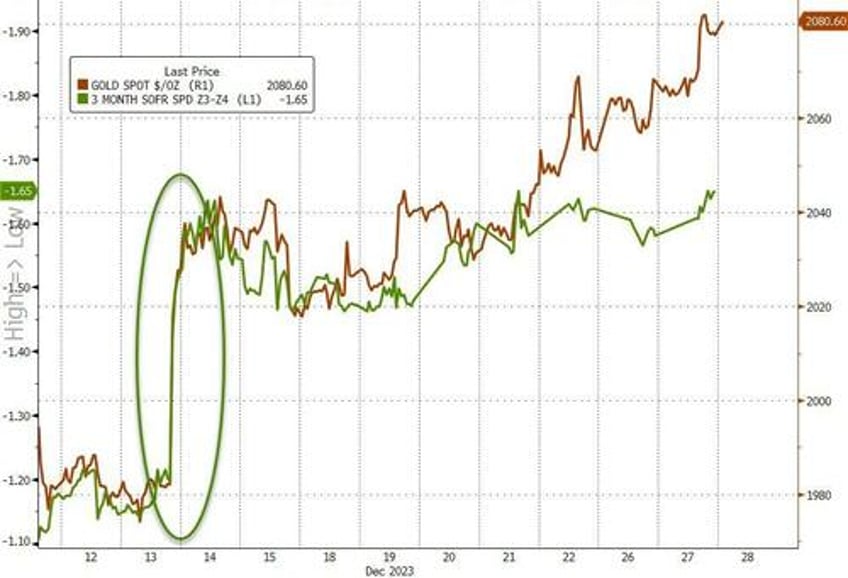

In the first place, Federal Reserve rate hikes are on hold, and most people expect the central bank to start cutting rates next year. This should put a damper on dollar strength. In fact, we could see significant dollar weakness as we move into 2024. This would eliminate a major headwind for gold that persisted through most of 2023.

We’ve also seen strength in the Chinese gold market. This could mean an increase in demand as we move into the Chinese new year.

Gold has rallied since the Fed effectively surrendered to inflation, despite Fed officials trying to walk back rate cut expectations. Gold hit a low of $1,980 per ounce on Dec. 12. From that point, the price climbed to $2,080 as of Wednesday.

If historical trends hold, we may well see a continuing rally through the first month of 2024.

That means this might be a good buying opportunity.