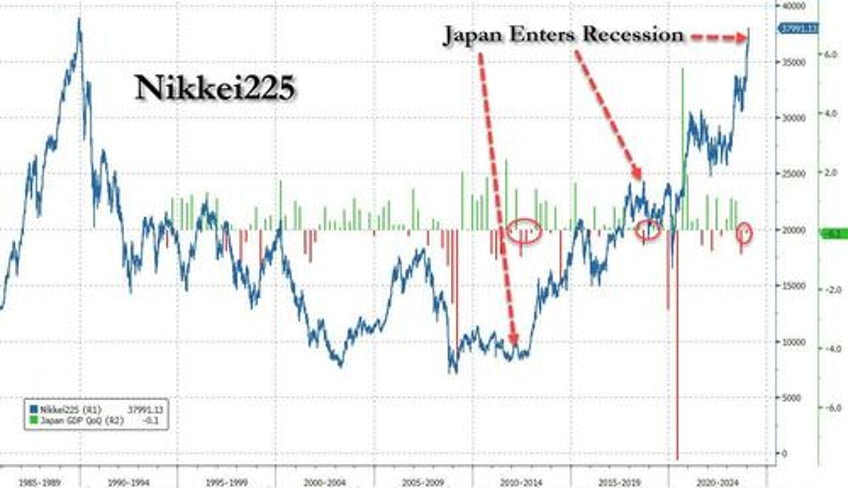

It's not like anyone actually believes it any more, but if anyone needed the most clear and concise proof that there is no, zero, zilch connection between the economy and stock market, look no further than Japan where the Nikkei has more than doubled from the covid lows and is about to breach its all time bubble highs set in in the last days of 1989... and moments ago Japan entered a recession. In fact, From its generational low set a decade ago, the Nikkei has almost quadrupled even as Japan's economy has slumped into recession three times!

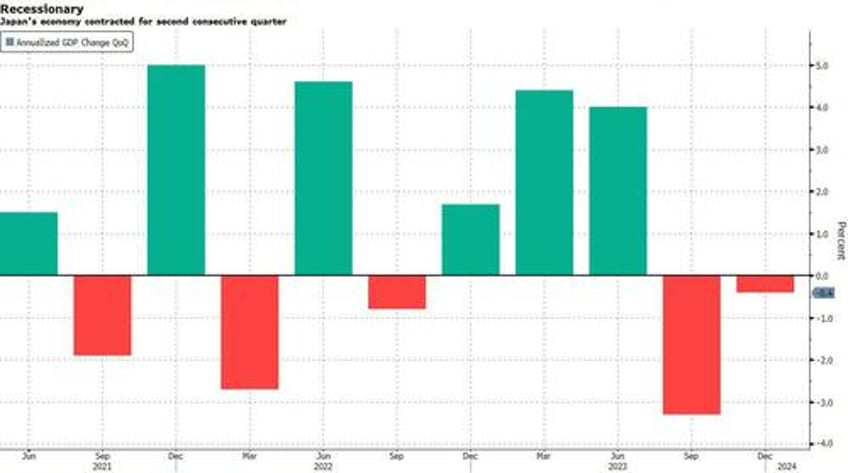

So anyway, confirming that only central banks matter in a world where the economy clearly does not, moments ago Tokyo reported that Japan’s economy "unexpectedly" contracted for a second quarter at the end of 2023, slipping into recession and significantly clouding the Bank of Japan’s path toward ending its negative interest rate policy (as it was supposedly preparing to do, even if it really had no intention at all of hiking).

Japan's GDP shrank at an annualized pace of 0.4% in the final three months of last year, following a revised 3.3% contraction in the previous quarter, as both households and businesses cut spending. Economists had expected the economy to expand by 1.1%.

According to Bloomberg, the data also confirmed that Japan’s economy slipped to fourth-largest in the world in dollar terms last year. Germany - which is also in recession but has at least learned how to manipulate its data and is pretending to not be in contraction at this moment - is now has the world’s third-largest economy.

Hilariously, the striking miss - and slide into contraction - will "complicate" the BOJ’s case to conduct the first rate hike in Japan since 2007, a step most economists surveyed last month predicted the bank will take by April, but it clearly won't be doing any time now. Pretending like it still has control, the BOJ’s policy board has recently ramped up discussions surrounding an exit from the subzero rate policy and sought to assure markets that a rate hike wouldn’t signal a sharp shift in policy.

What is laughable is not that the BOJ won't be hiking - it never planned on doing that anyway since tightening would immediately blow up its entire bond market - but that despite NIRP, endless QE and purchases of equity ETFs, Japan has still gone through three recessions in the past decade. Of course, recessions don't matter for the market; what does are central banks, and since the BOJ has injected trillions over the same decade, well... that's why stocks are where they are now.

Thursday’s data underscored the case for keeping policy loose by reflecting Japan’s reliance on external demand. Net exports contributed 0.2% to growth. Exports jumped in December, led by automobiles to the US and chip manufacturing gear to China. Inbound tourism, classified as service exports, also saw continued growth, with the number of visitors setting a record for the month in December.

At the same time, domestic consumption has been crushed, and the figures showed that domestic activity remains anemic, with inflation crimping spending as private consumption subtracted 0.2 percentage point, and as households contend with rising costs of living tightened their budgets. Making things worse, household spending fell 2.5% in December versus a year earlier, a 10th straight month of declines, as wage gains lagged inflation.

This is why the BOJ is completely trapped, as unless it does hike rates, and thus pushes the economy into an even deeper contraction and sparks a bond market crisis to boot, the yen continue to plummet and runaway inflation will turn into hyperinflation.

In fact, the only thing Japan has going for it is that the population is too old and diapered to start a revolution at the cartoonish and incompetent government and central bank which will do nothing as hyperinflation slowly takes hold.