A gold-buying frenzy in hyperinflating banana-republic basket cases such as Venezuela, Zimbabwe, Argentina or Turkey makes sense; one can also imagine Indians and Chinese liquidating rushing to buy the precious metal, as they periodically do (for other, not less relevant, reasons). But Japan?

That's right: the otherwise quiet (and rapidly aging) population of Japan has found a new infatuation with gold, and it has the relentless money-printing juggernaut that is the BOJ to thank for it.

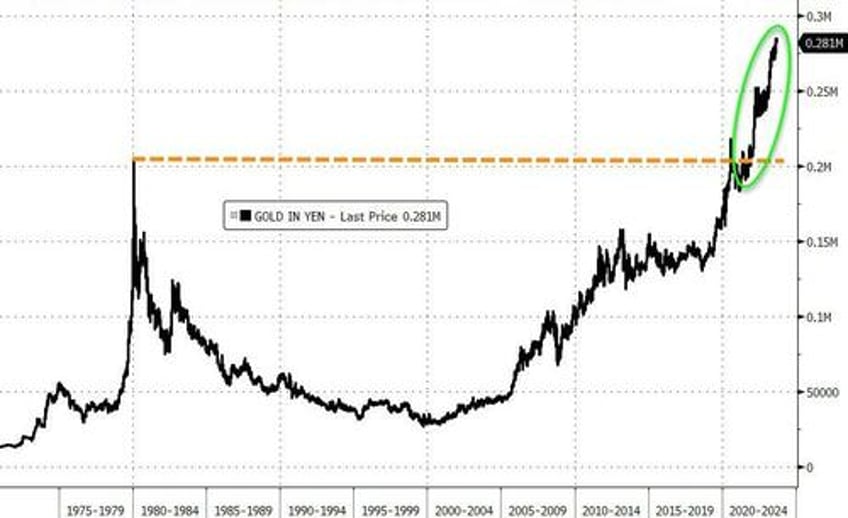

As the FT reports, the price of gold in Japan (denominated in that joke of a currency, the Japanese lira yen) has jumped to an all-time high as the yen extends its historic slide against the US dollar, vaporizing the purchasing power of residents and forcing cash-rich households to find a hedge against ubiquitous inflation.

Buying of yen-denominated gold at the nation’s largest dealer has driven the price of the yellow metal above the ¥10,000 per gramme level for the first time in recent days. It was trading at ¥10,100 last week, according to retail prices published by Tanaka Kikinzoku, one of Japan’s largest gold retailers.

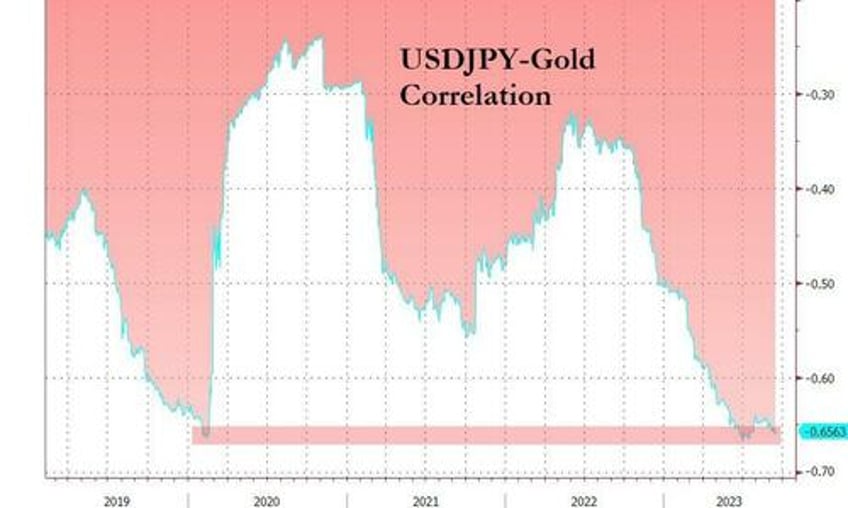

The retail gold price in Japan — the main reference price for the metal in the country — tracks global spot prices, which have been pushed up by the coronavirus pandemic, the war in Ukraine, the debt ceiling crisis in the US and global tensions between the east and west. But most of all, it reflects the dramatic collapse in the value of the yen, which recently passed ¥147 against the dollar, a level that last year triggered verbal market intervention by the Japanese authorities but this year has been widely ignored by a central bank which realizes that intervention at this point is futile and would only precipitate Japanese hyperinflation and systemic collapse.

And since Japan's inflation, which recently surpassed that of the US, will keep rising...

... as the weak yen will only get weaker - occasional desperation intervention aside - as long as there was no signal from the Bank of Japan that it is ready to tighten its ultra-loose policy which won't happen for a long time (and when it does, it will spark a collapse in the JGB bond market forcing the trapped BOJ to immediately reverse once again) demand for gold in Japan will only keep rising.

Economists cited by the FT, said the move in retail gold prices, which extends an 18-month rally at gold stores around Japan, was part of a rapid shift in household attitudes to risk as years of deflation have given way to rising consumer prices.

Imagine a world where the biggest source of demand for gold in Asia is not India but Japan, and where demand will only rise as the yen (inevitably) falls as it gets closer to its inevitable and catastrophic end. Well, we are pretty much there now.

Jesper Koll, an economist and adviser to the Japan Catalyst Fund, an investment fund, said the primary driver for the buying by Japanese households was an urgent search for inflation protection after years without strong incentive to move assets out of cash.

“The fact that gold is a non-yen asset helps, but the trigger is inflation,” said Koll, and since inflation in Japan is only going to rise, so will demand for gold.

Japanese households emerged from the pandemic with a record of more than ¥2 quadrillion in accumulated assets or around four times the country’s annual gross domestic product. About half of that was held in cash and deposits — a balance closely eyed by Japan’s securities houses, which are trying to convince customers that inflation is here to stay and they now need to switch their savings into other financial products. The problem is that core CPI in Japan reached 3.1% last month.

“Inflation in Japan is at a crossroads,” said Tomohiro Ota, senior Japan economist at Goldman Sachs, noting that although consumer prices keep going up, some of the increase is down to temporary government subsidies while consumption growth has stalled since March. Goldman Sachs predicts that Japan’s currency will hit ¥155 against the dollar in the next six months.

Eiichiro Kato, a general manager for Tanaka Kikinzoku’s Precious Metals Retail Department, said that gold had become particularly attractive to customers concerned about the yen’s fall to multi-decade lows and their assets being denominated in yen.

Of course, it's not just Japanese savers who are rushing to the safety of gold: a year of record gold purchases by central banks in a world where the dollar is now weaponized against enemies of Ukraine the Biden administration, has made it clear that demand for gold will only rise.

"We do not see many factors that would cause the dollar-denominated price to fall significantly, and we think that the yen-denominated price could rise further if the yen continues to weaken,” said Kato.

However, Hideo Kumano, chief economist at Dai-Ichi Research Institute, warned against reading too much into the rise in Japan’s gold price due to the small size of the market.

“It could prove to be an outlier and the country’s elderly population might not change their behaviour and start to consume, even if inflation does remain high,” he said. On the other hand, with deflation now dead and buried (at least until the next global depression) the odds that Japan's notoriously thrifty population will continue to save at a time when its currency is collapsing are nil, especially since the BOJ itself has given up trying to contain the surge in yen-denominated gold...

... something it did for much of the previous decade.