What could possibly go wrong? Doesn't anyone remember TVIX? Or XIV?

Today saw an ETF based on zero-day-to-expiry (0-DTE) options start trading for the first time in history.

Defiance ETFs, a small Miami-based thematic house with $860mn in five ETFs, has listed the Defiance Nasdaq Enhanced Option Income ETF (QQQY) on the Nasdaq stock exchange, opening the door for less sophisticated traders to participate in this hot new gambling market with the strategy designed to use these daily options to produce income.

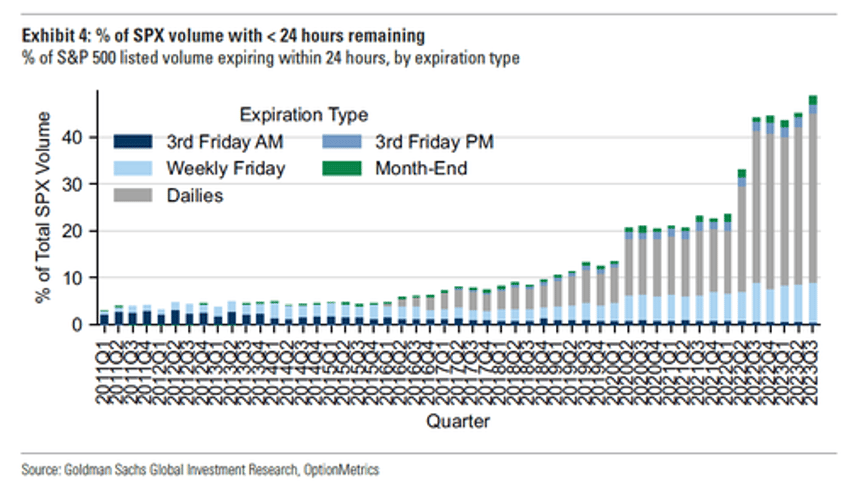

As we have detailed numerous times, popularity of 0-DTE options has soared in recent months:

“The daily notional trading value of 0DTE options has skyrocketed to about $1tn,” said Sylvia Jablonski, chief executive of Defiance ETFs.

“These ETFs exemplify our commitment to innovation and to meeting the evolving needs of investors. With daily options at the core of these products, we’re unlocking a new dimension of income generation within the ETF space.”

0-DTE options now account for a record 49% of S&P volume...

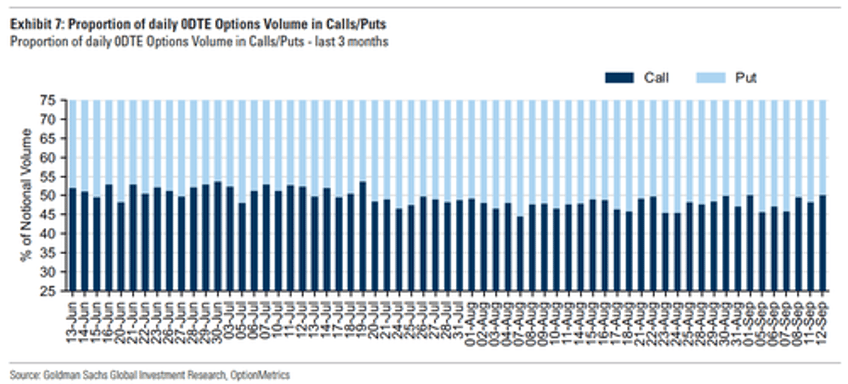

For now, the 0-DTE options market remains directionally-balanced with puts and calls each making up 50% of volume - however, with the introduction of QQQY, that may shift the balance towards puts.

Each day, QQQY plans to sell at- or slightly in-the-money puts tied to the Nasdaq 100 with an expiration of 24 hours.

QQQY will hold cash and short-term Treasuries as collateral for its derivative investments.

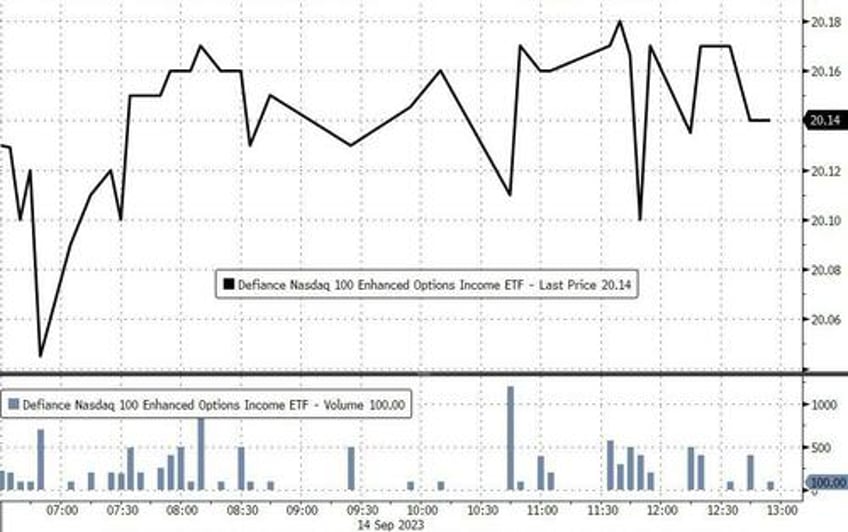

QQQY traded just over 14,000 shares on its opening day today...

Today had some interesting characteristics from a 0-DTE perspective.

While QQQY is a 0-DTE Nasdaq 'put-selling' strategy, we saw massive 0-DTE CALL-SELLING in the afternoon...

Source: SpotGamma

And in the S&P (which will soon see the launch of JEPY - Defiance S&P 500 Enhanced Option Income ETF), we saw multiple bouts of heavy 0-DTE put-BUYING...

Source: SpotGamma

As Bloomberg reports, Defiance isn’t the only firm aiming to ride the 0DTE craze. ProShares filed in May to start an ETF employing the contracts, though it has yet to launch.

“0DTEs have become the hot new thing and it was only a matter of time before ETF issuers incorporated them into a fund,” said James Seyffart, ETF analyst at Bloomberg Intelligence.

SpotGamma had some initial thoughts:

Defiance 0DTE put selling Ticker QQQY:

— SpotGamma (@spotgamma) September 14, 2023

>"Current income with indirect exposure to Index"

>Each day sell 0 - 5 DTE options from ATM to 5% ITM puts

>Targeting 25 bps of daily income, and adjust positions around that

>"Invest up to 80% of assets"

>Naked short puts - no indication… pic.twitter.com/1fotNfzNDB

As they explain in the clip, Defiance is 'naked short puts' - so if the market drops sharply, you have that full exposure

And so, as @Talley_trey noted on X:

"...as ivol slides lower in up markets, their 25bps income target will naturally move them closer to the money, just as the propensity of a market fall becomes more probable.

Without making mountains out of molehills, this seems flawed?"

Flawed indeed...

yup :) which is why launching now is so interesting...

— SpotGamma (@spotgamma) September 14, 2023

Unlike covered call funds, they do not hold the underlying equities, instead owning a portfolio of Treasury bonds that are used as collateral against the options they write. Both ETFs will charge annual management fees of 0.99 per cent, according to filings.

“Retail and institutional investors have shown great interest in alternative income products,” said Sylvia Jablonski, co-founder and chief investment officer at Defiance.

“These ETFs will seek to even further enhance the income outcomes the market has thus far experienced.”

The ETFs bear some resemblance to the $94mn WisdomTree PutWrite Strategy Fund (PUTW), which sells put options written on the S&P 500, although that fund uses one-month, rather than zero-day, options.

"QQQY is attempting to timely scratch two itches, potential income from an asset that doesn’t typically generate income and exposure to the sudden popularity of trading ODTE options," said Lois Gregson, senior ETF analyst at FactSet Research Systems.

But it's not all sunshine and rainbows.

"The fund is 'betting' the market will rise more often than fall," Gregson said, noting that the portfolio manager would have to buy back the short put options potentially at a loss.

"The strategy is similar to picking up dimes in front of a bulldozer. The income potential is there, but there are times you could also get run over," Gregson said.

As The FT reports, Nate Geraci, president of The ETF Store, a financial adviser, noted that with the recent surge in popularity of 0-DTE options, "it's absolutely no surprise to see ETF issuers looking for ways to capitalise."

However, Geraci said:

“My concern lies around the complexity of options-based strategies in general. Zero-day options are essentially daily bar bets. While longer-term strategies can certainly be constructed around these options, my fear is that investors might not fully appreciate the complexities and risks involved.”

Finally, we couldn't help but notice that with VIX hitting a 12 handle today, the timing of the launch of an ultra-short-dated vol-selling (income-generating) ETF seems... interesting...

“Everybody is looking for that free money,” said Ayako Yoshioka, senior portfolio manager at Wealth Enhancement Group.

“It fuels speculation.”

Good luck everyone.