In our preview of last week's BOJ we refrained from giving details and merely shared a candid assessment of what we thought the result would be:

BOJ preview: whatever is the dumbest possible thing that can happen, is what will happen. 100% guaranteed

— zerohedge (@zerohedge) July 30, 2024

And we were right, because by deciding to hike rates into an economic showdown, the BOJ - which as we noted last week "changed the rules" again - has unleashed a financial apocalypse by creating a positive feedback loop that culminates with a deflationary collapse of all assets (as the bank now goalseeks a surge in the yen and thus deflation and economic devastation) which has led to not only to the Nikkei promptly entering a bear market from its all time high hit just 3 weeks ago and wiping out all of its year to day gains, not to mention collapsing 15% since last week's BOJ meeting which we knew would be a disaster...

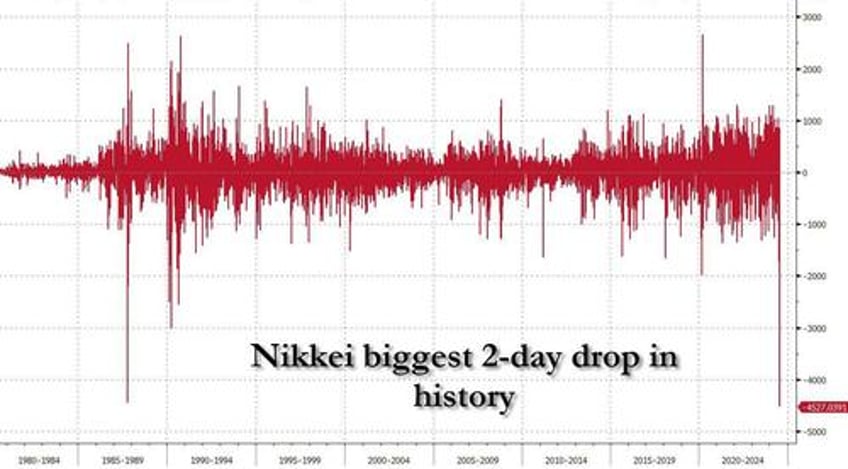

... which has also just suffered its biggest two-day drop in history, surpassing Black Monday...

... but also the halt of trading of both its peer, the Topix...

- *CIRCUIT BREAKER TRIGGERED FOR TOPIX INDEX

... as it too enters a bear market...

- *JAPAN'S TOPIX INDEX FALLS 20% FROM JULY PEAK

... and the entire Japanese bond market:

- *CIRCUIT BREAKER TRIGGERED FOR JAPAN GOVT BOND FUTURES

Meanwhile, among today's freefalling stocks are such names as the iconic Nintendo...

- *NASDAQ 100 FUTURES DROP AS MUCH AS 2%

...and perhaps something more troubling, is that Japan's megabanks are in freefall, starting with Mizuho...

- *MIZUHO SHARES FALL AS MUCH AS 12%, MOST SINCE MARCH 2020

and ending with Japan's largest bank, its JPMorgan, if you will, which just plunged the most on record!

- *MUFG SHARES FALL AS MUCH AS 21%, RECORD INTRADAY DECLINE

It's not just Japan: Korea is getting swept in as well...

- *KOSPI INDEX SLUMPS, TAKING LOSSES FROM JULY PEAK TO 10%

... and of course, the US, where Nasdaq futures crashing as much as 2% and the S&P is down 1.1%

- *NASDAQ 100 FUTURES DROP AS MUCH AS 2%

And then there's bitcoin which, well, lets not even go there.

So strap in folks, the day is just getting started...