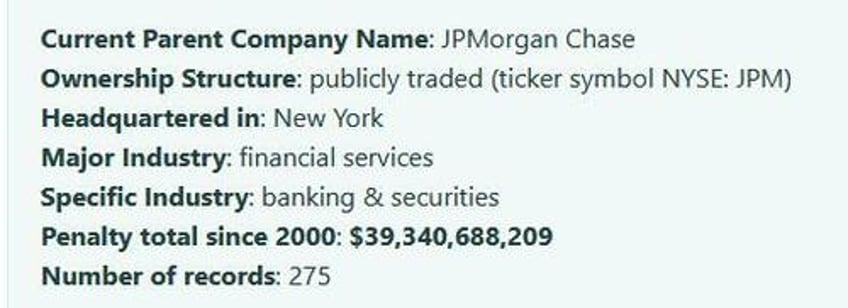

America's most officially corrupt and criminal bank - at least according to the Violation Tracker database which shows that its total penalties since 2020 amount to just shy of $40 billion...

... JPMorgan Chase, has just added another notch to its criminal track record when it was fined $348.2 million by a pair of US bank regulators over its inadequate program to monitor firm and client trading activities for market misconduct, the Federal Reserve announced on Thursday.

The Fed fined the bank alongside the Office of the Comptroller of the Currency (OCC), and said the misconduct occurred between 2014 and 2023. JPMorgan disclosed in February that it expected to pay roughly $350 million in civil penalties for reporting incomplete trading data to surveillance platforms. It said at the time it was also in "advanced negotiations" with a third regulator that may not result in resolution. The penalty consisted of $250 million from the Office of the Comptroller and $98 million from the Federal Reserve.

In a separate announcement, the OCC said JPMorgan failed to properly monitor "billions" of trades across at least 30 global trading venues. It ordered the bank to overhaul and improve its trade surveillance program and conduct a third-party review of its policies. The bank must clear any new trading venues with regulators under the new order.

“The consequences of these deficiencies include the bank’s failure to surveil billions of instances of trading activity on at least 30 global trading venues,” the OCC said in its consent order. The bank neither admitted nor denied the OCC’s findings.

According to the OCC, JPMorgan’s trade-surveillance program has operated with certain deficiencies since at least 2019. The firm failed to establish adequate governance over trading venues where it’s active, the regulator said, citing gaps in venue coverage and a lack of sufficient data controls. “These gaps and deficiencies in JPMC’s trade surveillance program

The regulator also issued a cease and desist order requiring the bank to take a number of remedial steps. The bank isn’t allowed to add new trading venues without receiving approval from the OCC and must get an independent third party to conduct a trade-surveillance program assessment, the regulator said.

A representative for the bank said it doesn’t expect any disruption to client services as a result of the actions.

“As we disclosed last month, we self-identified the issue, significant remedial actions have been taken and others are underway,” the spokesperson said. “We have not found any employee misconduct or harm to clients or the market in our review of the previously uncaptured data.” Yep, that misconduct happened entirely on its own.

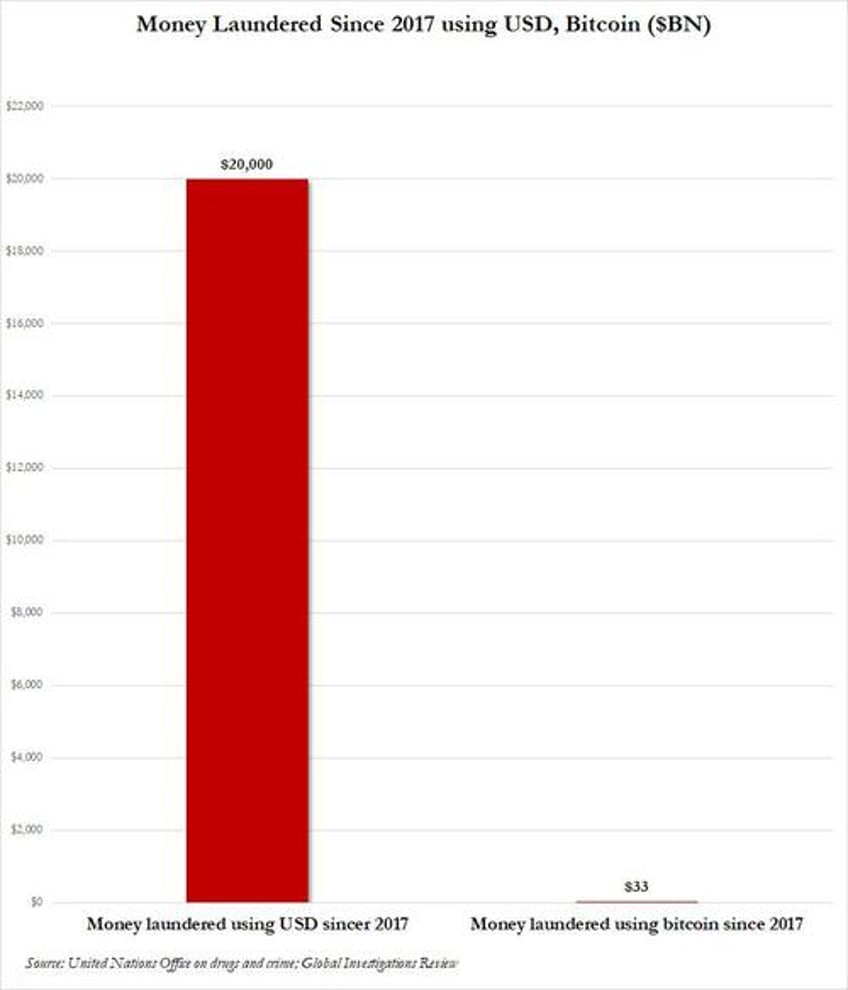

In other words, the criminal money transfers will go on, and while Jamie Dimon - and his puppet in Congress, Liz Warren - have been railing and against bitcoin and crypto for being the root of all evil for allow a few thousand transactions to go unsupervised...

... JPMorgan was intentionally closing it eyes to "billions" of potentially criminal transactions in good old fiat, dollars. One almost wonder if the full court press by Jamie and Pocahontas to malign bitcoin was intended to deflect attention from JPMorgan's far more conventional criminal conduct which enabled countless criminals to transact using good, old fiat currencies for decades.