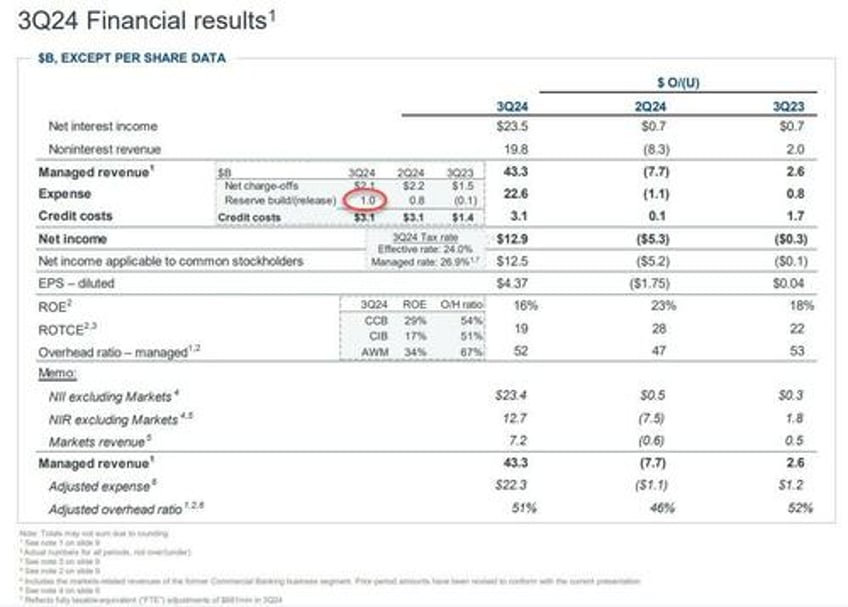

Third quarter earnings season officially started this morning when JPMorgan reported earnings just before 7am ET, and unlike last quarter, this time the company not only beat on the top and bottom line (even as loan loss reserves rose again hitting $1 billion), but reported blowout earnings in its investment banking division and also raised its full-year net interest income outlook. That however was eclipsed by an overall drop in profits (Net Income down $0.3BN to $12.9BN), a surprising jump in loan loss reserves to $1.0 billion, and compensation expenses of $12.8BN which rose and camd in above estimates. In any case, the kneejerk reaction on the stock was positive, helping it rise 2% (just shy of its all time high hit in late August) but the early spike appears to be fading a bit.

Here is a summary of what JPM reported for Q3:

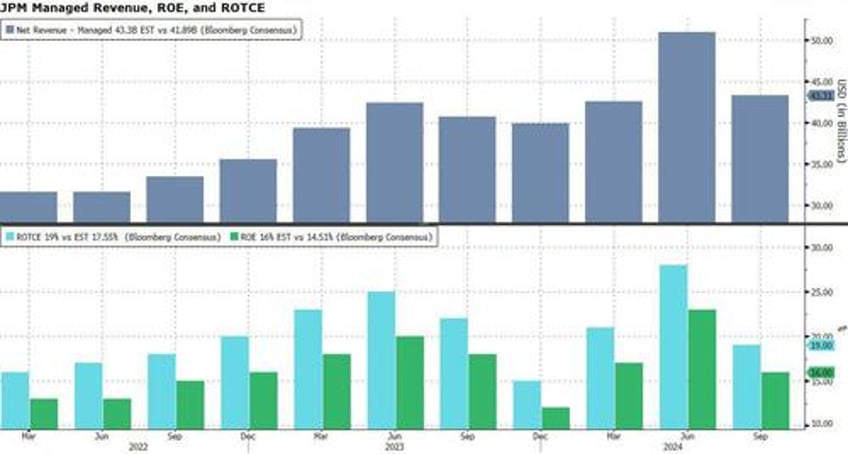

- Adjusted Revenue $43.32BN, up 3.4% from a year ago, and beating estimates of $41.9BN, consisting of Net Interest Income of $23.5BN, up 3.2% y/y (vs most other banks which are expected to see their NII down this quarter) and beating estimates of $22.8BN and non-interest income of $19.8BN, up 3.2% y/y and beating estimates of $19.2BN. This was good enough to generate a 16% return on equity (or 19% in ROTCE terms).

- Total trading revenue $7.152 billion, +6.9% y/y, beating estimates of $6.69 billion

- FICC sales & trading revenue $4.53 billion, +4.6% y/y, beating estimates of $4.36 billion

- Equities sales & trading revenue $2.62 billion, +21% y/y, beating estimates of $2.37 billion

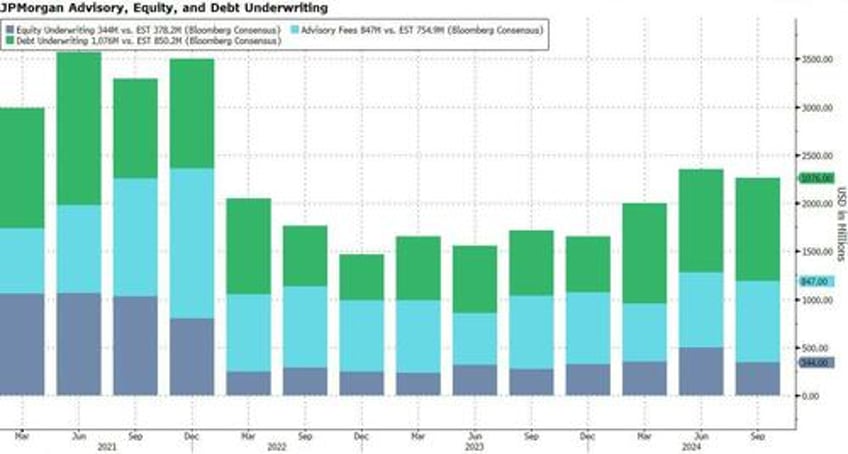

- Investment banking revenue $2.27 billion, +13.4% y/y, beating estimates of $1.99 billion

- Advisory revenue $847 million, +12.2% y/y, beating estimates of $754.9 million

- Equity underwriting revenue $344 million, down 9.0% y/y, missing estimates of $378.2 million

- Debt underwriting rev. $1.08 billion, +26.6% y/y, beating estimates of $850.2 million

- Total trading revenue $7.152 billion, +6.9% y/y, beating estimates of $6.69 billion

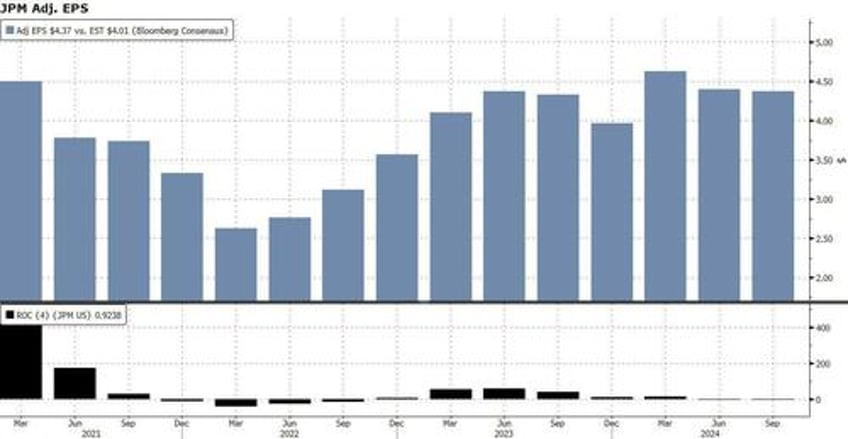

- EPS $4.37, up 8.99% from a year ago, and beating estimates of $4.01

- The bank reported $22.6 billion of total noninterest expenses, down 1.2% YoY and below estimates of $22.9 billion.

- However, compensation expenses $12.817 billion, up 2% y/y higher than estimates of $12.56 billion

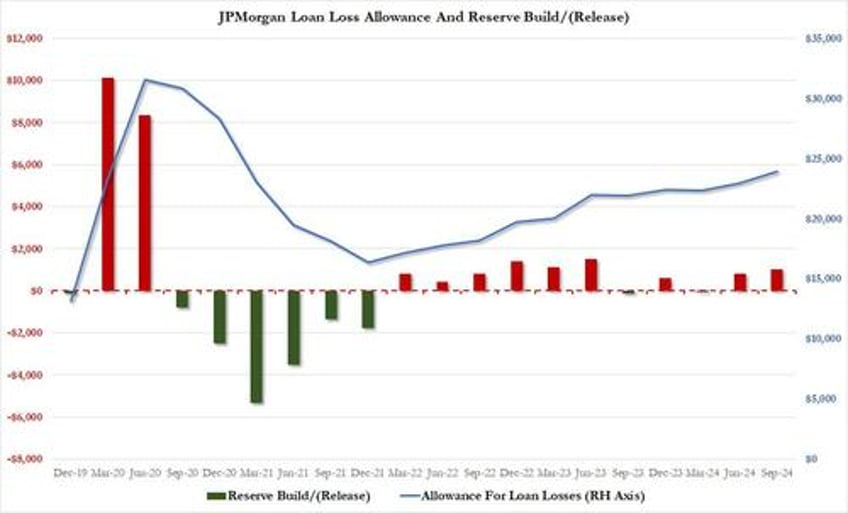

- While JPM's net charge-offs in Q3 dropped modestly to $2.09 billion, below the estimate of $2.37 billion, from $2.2 billion in Q2 (but above the $1.5 billion a year ago), the reserve build grew again, rising to $1.0 billion from $0.8 billion in Q2 and up from a $0.1 billion reserve release a year ago. This means that the total provision for credit losses was $3.11 billion, higher than the estimate of $2.94 billion, and in line with the $3.1 billion in Q2.

Here are the visual snapshots:

Some more details:

- Managed net interest income $23.53 billion, beating estimates of $22.8 billion

- Loans $1.34 trillion, beating estimate of $1.33 trillion

- Total deposits $2.43 trillion, beating estimates of $2.4 trillion

- Non-interest expenses $22.57 billion, below estimates of $22.85 billion even though compensation expense of $12.8 billion came in higher than the $12.56 billion expected.

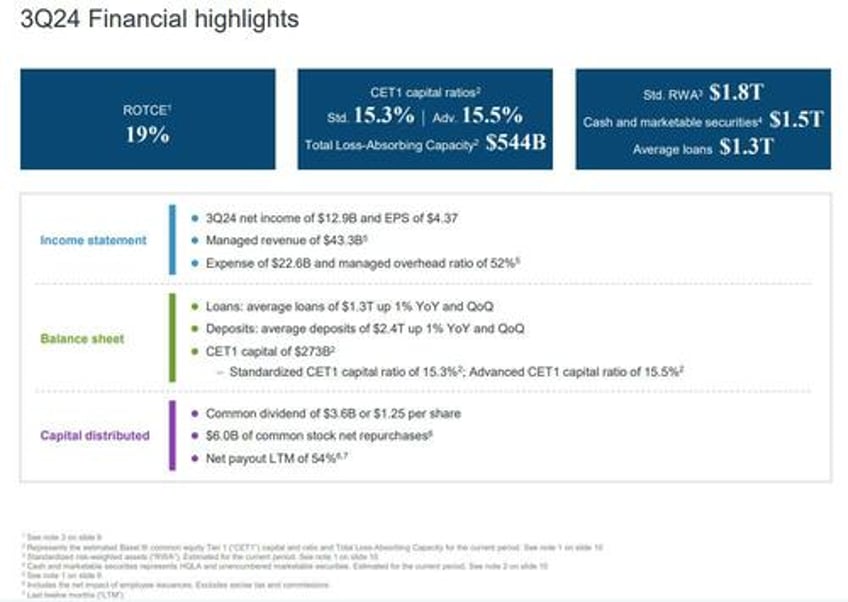

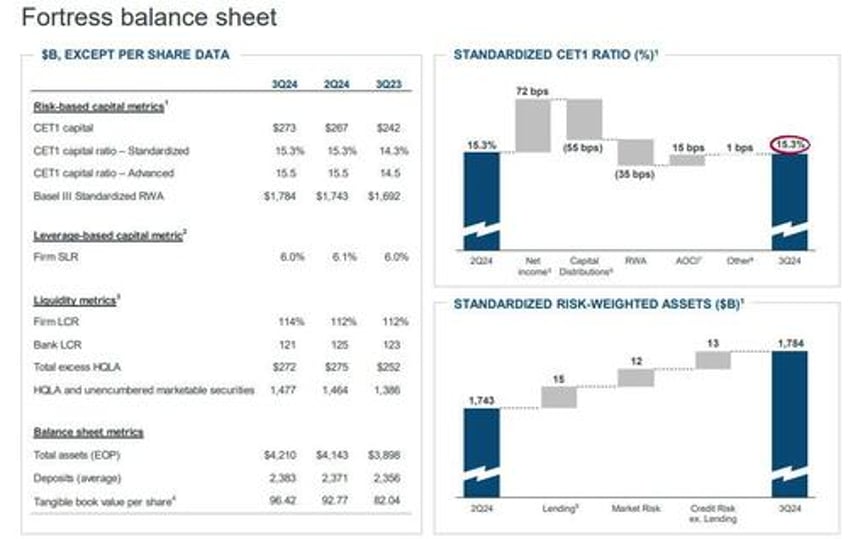

Looking at the bank's balance sheet we find the following details:

- Net yield on interest-earning assets 2.58%, higher than the estimate 2.57%

- Standardized CET1 ratio 15.3%, higher than the estimate 15.1%

- Standard risk-weighted assets are $1.8 trillion, cash and marketable securities hit $1.6 trillion, and average loans were at $1.3 trillion.

- Managed overhead ratio 52%, below the estimate 54.7%

- Return on equity 16%, higher than the estimate 14.5%

- Return on tangible common equity 19%, higher than the estimate 17.5%

- Assets under management $3.90 trillion, higher than the estimate $3.8 trillion

- Book value per share $115.15, above estimates $113.80

Something else worth noting: JPM revealed that its Q2 stock buybacks surged to $6.0 billion from $4.9 billion last quarter, and up from $2.8 billion in Q1. This took place after the Fed greenlighted more shareholder returns on at the end of Q2.

What we also find notable is that in a reversal from last quarter, the bank actually built reserves by just over $1 billion ( up from $821 million in Q2 and a $72 million release in Q1): this was the biggest reserve build since the bank crash quarter in Q2 2023 when the bank added $1.5 billion in reserves. This meant that provision for credit losses was roughly unchanged from last quarter at $3.1 billion, above the $2.94 billion expected even as total charge-offs came in at $2.09 billion, below the $2.37 billion expected.

Commenting on the quarter, Jamie Dimon once again pushed a familiar narrative for the largest US bank, pushing back against aggressive regulation and saying that he awaits "our regulators’ new rules on the Basel III endgame and the G-SIB surcharge as well as any adjustments to the SCB or CCAR. We believe rules can be written that promote a strong financial system without causing undue consequences for the economy, and now is an excellent time to step back and review the extensive set of existing rules – which were put in place for a good reason – to understand their impact on economic growth, the viability of both public and private markets, and secondary market liquidity. Regardless of the outcome of these rules, we have an extraordinarily strong balance sheet, evidenced by total loss-absorbing capacity of $544 billion plus cash and marketable securities of $1.5 trillion, while our riskiest assets, loans, total $1.3 trillion. On share repurchases, given that market levels are at least slightly inflated, we maintain our modest pace of buybacks, although we reserve the right to adjust this at any time.”

Taking a look at the geopolitical picture, Dimon said that he has been "closely monitoring the geopolitical situation for some time, and recent events show that conditions are treacherous and getting worse. There is significant human suffering, and the outcome of these situations could have far-reaching effects on both short-term economic outcomes and more importantly on the course of history. Additionally, while inflation is slowing and the U.S. economy remains resilient, several critical issues remain, including large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment.”

Dimon also took the opportunity to thank the bank's employees, saying that as he gets to travel around the country and the globe "it gives me immense pride to see our employees tirelessly serve their clients and communities, which include over 82 million U.S. consumers and 6 million small businesses, 40 thousand large and medium-sized businesses – who we bank wherever they do business – and thousands of institutional clients, as well as veterans, schools, cities, states and countries around the world. I know you join me in extending gratitude to our employees.”

And speaking of employees, it is notable that at a time when other banks are cutting staff to keep expenses in check, JPMorgan added to its headcount which rose 2% year-over-year to 316,043 employees. That appears to also be driving JPMorgan’s costs higher.

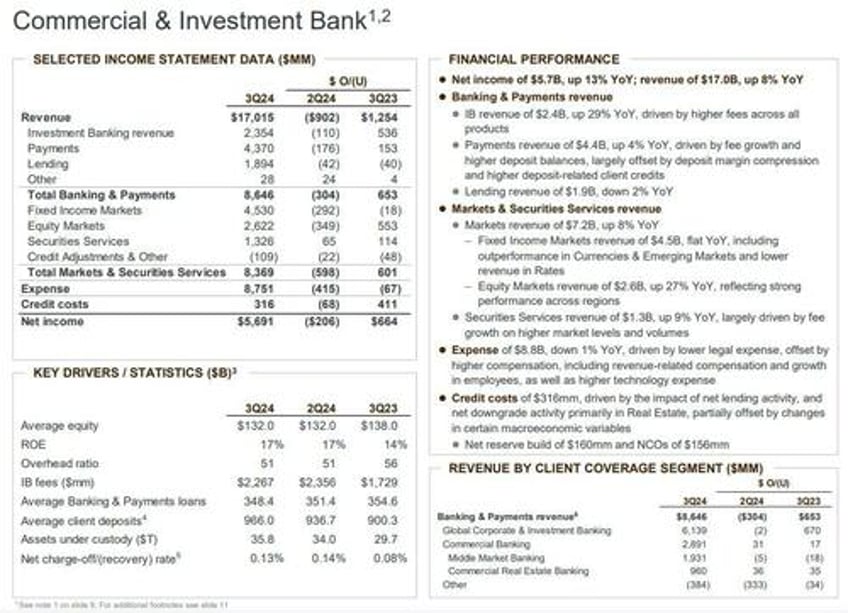

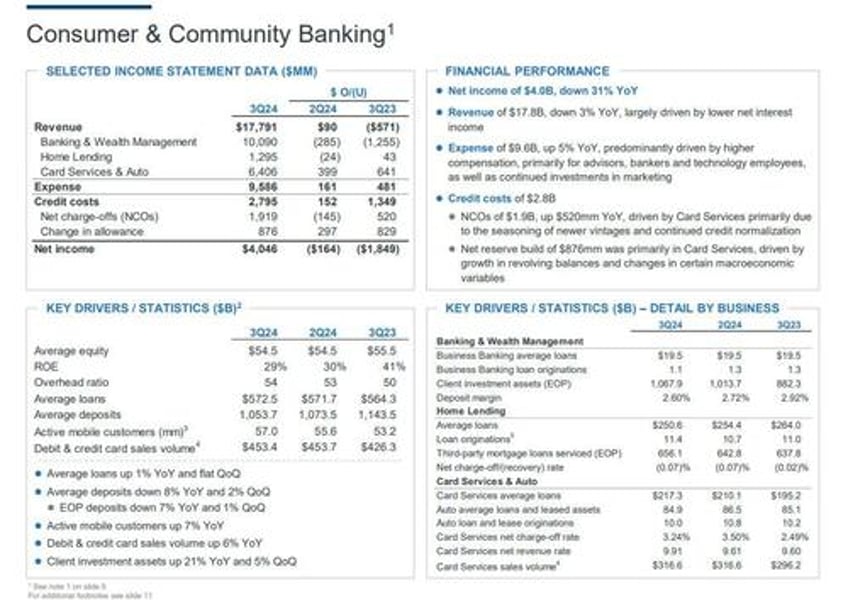

And some more detailed from Bloomberg: CCB’s $9.6 billion noninterest expense was up 5% (“predominantly driven by higher compensation, primarily for advisers, bankers and technology employees, as well as continued investments in marketing”), CIB’s $8.8 billion noninterest expense was down 1% (“driven by lower legal expense, offset by higher compensation, including revenue-related compensation and growth in employees, as well as higher technology expense”) and AWM’s was up 16% (!) to $3.6 billion, (“driven by higher compensation, including revenue-related compensation and continued growth in private banking advisor teams, as well as higher legal expense and distribution fees”).

Turning to the all-important commercial and investment bank, here the results were impressive and beat almost across the board, with the exception of equity underwriting which continued to be quite soft. Here are the details:

- Total trading revenue $7.152 billion, beating estimates of $6.69 billion

- FICC sales & trading revenue $4.53 billion, fractionally lower y/y, but beating estimates of $4.36 billion

- Equities sales & trading revenue $2.62 billion, up $553 million y/y, beating estimates of $2.37 billion

- Investment banking revenue $2.27 billion, +31% y/y, beating estimates of $1.99 billion

- Advisory revenue $847 million, up 10% y/y, beating estimates of $755 million

- Equity underwriting revenue $344 million, up 26% y/y, missing estimates of $378 million

- Debt underwriting rev. $1.08 billion, +56% y/y, beating estimates of $850 million

Turning to JPM's consumer and community bank, the first thing that sticks out is the $2.8 billion provision for credit losses, reflecting a $876 million net reserve build and $1.9 billion of net charge-offs. The latter was up $520 million, “driven by Card Services, primarily due to the seasoning of newer vintages and continued credit normalization.” As BBG notes, why does that $2.8 billion provision matter? Because a year ago it was only $1.4 billion.

Also of note in CCB is that net income of $4 billion was down 31%, nearly a third. Why? One contributor: “Banking & Wealth Management net revenue was $10.1 billion, down 11%, driven by lower net interest income on deposit margin compression and lower deposit balances, partially offset by higher asset management fees in J.P. Morgan Wealth Management.” Another reason: That rise in noninterest expense to $9.6 billion noted above.

Meanwhile, Home Lending net revenue was $1.3 billion, which was “up 3%, driven by higher net interest income, partially offset by lower servicing and production revenue.” And Card Services & Auto net revenue was $6.4 billion, “up 11%, driven by Card Services, reflecting higher net interest income on higher revolving balances.”

Finally, looking at the company's guidance, JPM sees the following:

- 2024 FY net interest income (Ex-CIB Markets) of ~$91.5B, previously saw about ~$91B. Including markets, the bank now sees NII of $92.5BN, above the $91.0BN previously.

- 2024 FY Adj. Expense ~$91.5B, saw about ~$92B

- 2024 FY Card Services NCO Rate of About 3.4%

Said otherwise, JPM now expects full-year NII to come in around $92.5 billion, well above the original forecast of $91 billion. It’s “market dependent,” the bank says, but still noteworthy given that JPM was telling analysts to temper their expectations a month ago. Excluding markets, the NII increase is more modest, from $91.0 billion to $91.5 billion. Expenses are now expected around $91.5 billion for full-year 2024, lower than the original forecast of $92 billion last quarter. This implies about $23 billion for the fourth quarter.

After all that, the market reaction was favorable: unlike last quarter when JPM stock got hammered on mixed earnings, this time the stock pumped 3% before modestly easing gains as the algos were satisfied. It remains to be seen if gains will persist once human are also done parsing the results.

Elsewhere, other banks also reported results. Wells Fargo climbed about 3% during the session after third-quarter profit beat estimates. Investment-banking fees helped counter a dip in lending revenue as interest rates fall. Shares of Bank of America, Citigroup and other lenders are higher ahead of the US open. They report their earnings next week.

The full Q3 investor presentation is below (link here).