The market is not ready for a re-rise in inflation, with positioning long in stocks, bonds and rates futures.

Inflation has been relegated to secondary importance for now, but unwatched pots often boil over.

Structural price-growth remains elevated, while core consumer prices are still above 3% - harbingers that it’s not time to mute the inflation alarm.

It would be around now – before inflation has returned to a low-and-stable regime – that a shock arrives and prices re-accelerate.

Price pressures had already begun to boil in the late 1960s, and it was the “bad luck” of Nixon closing the gold window in 1971, the Arab oil embargo in 1973 and the Iranian Revolution in 1979 that turned the decade into the Great Inflation.

For September’s PPI data today (and following yesterday's CPI), it’s clear positioning is not expecting any big upside shocks, or more concernedly, not prepared for inflation that starts to trend higher again.

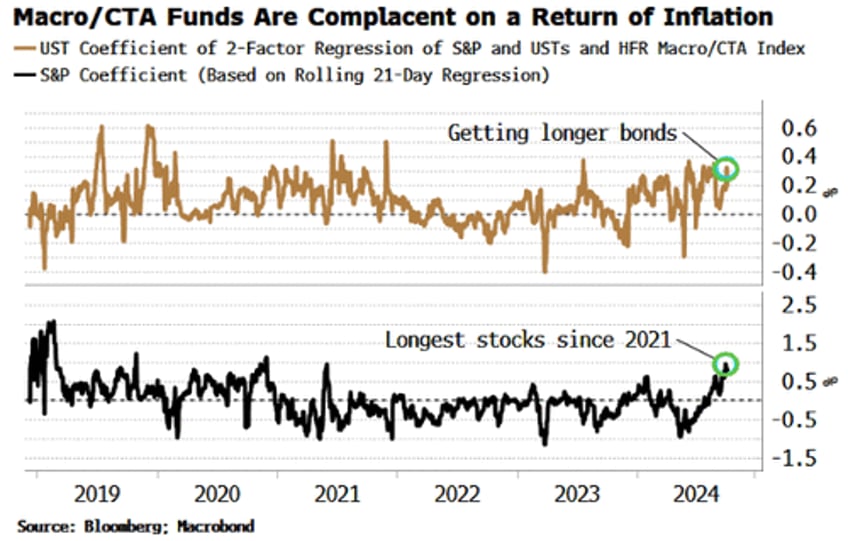

The chart below shows inferred positioning for CTAs based on HFR’s indices. A multiple regression on CTA returns versus the S&P 500 and Treasuries shows that they are likely long and getting longer stocks and bonds.

The CTA fund data is not perfect, but we see corroboration elsewhere.

The DBi Managed Futures ETF shows it has been getting longer 2-year and 10-year note futures as well as long-bond futures.

It is long the S&P, MSCI Emerging Markets index and MSCI EAFE as well.

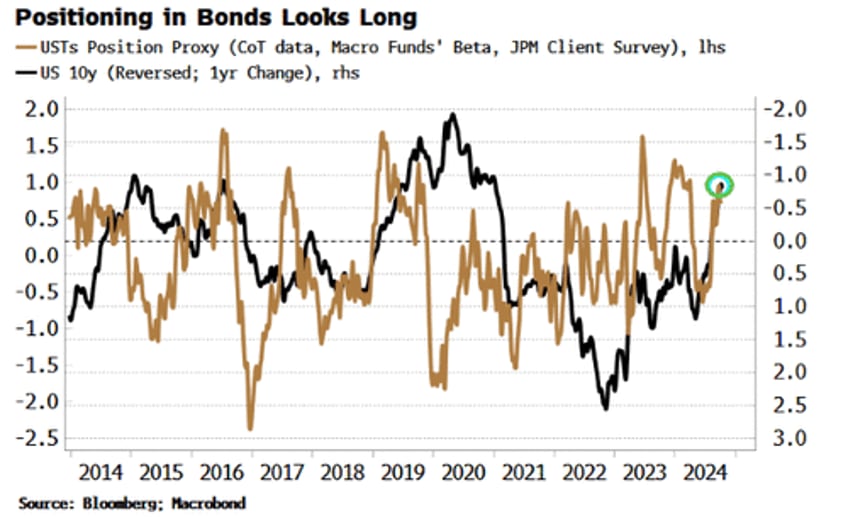

Commitment of Trader positioning shows the net long of speculators in US stocks is rising. And the US Bonds Position Proxy, where I have amalgamated hedge funds’ beta to Treasuries, COT data and the JPMorgan Treasury Client Survey, also shows a long in bonds that’s burgeoning outside of CTAs.

Furthermore, COT data shows significant longs in fed funds and SOFR futures. There is a net short bond position between leveraged funds and asset managers, but some of this could be related to the basis trade, i.e. it is not clear how much of this is outright short risk.

A revival in inflation very likely means higher rates, lower bonds, and quite possibly lower stocks, as valuations are throttled by higher discount rates.

With SOFR options implying a near-zero probability of an inflation tail, and positioning as it is, it’s clear the market is not prepared for such an outcome.