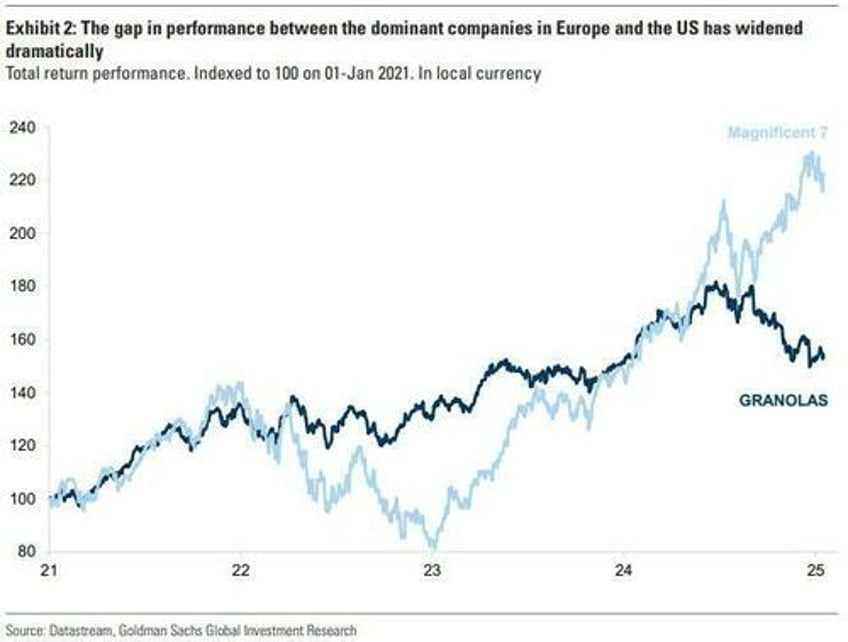

Just over two months ago, when the US was the global capital markets darling (remember "US exceptionalism"?) and world's best performing stock market, and Europe was barely green for the year, we presented a note from Goldman Mark Wilson which, accurately, asked if it was time to go long Europe as most European largecaps had dramatically lagged their US peers (by the way, the note's conclusion was a resounding yes).

In retrospect, going long Europe in January turned out to be the best trade of 2025 so far, entirely on the back of German taxpayers who were dragged by their politicians (ironically, the "conservative" variety who promised no more debt and spending... only to renege on all their promises the moment they got into the Bundestag) into hundreds of billions of euros of added debt servitude (you know, to stop Putin... when he attacks in 5 to 10 years.... because Europe will certainly not have an effective military before then and Putin is obviously nice enough and can be relied to wait until there is a defensive force strong enough to repel him, and certainly not attack earlier).