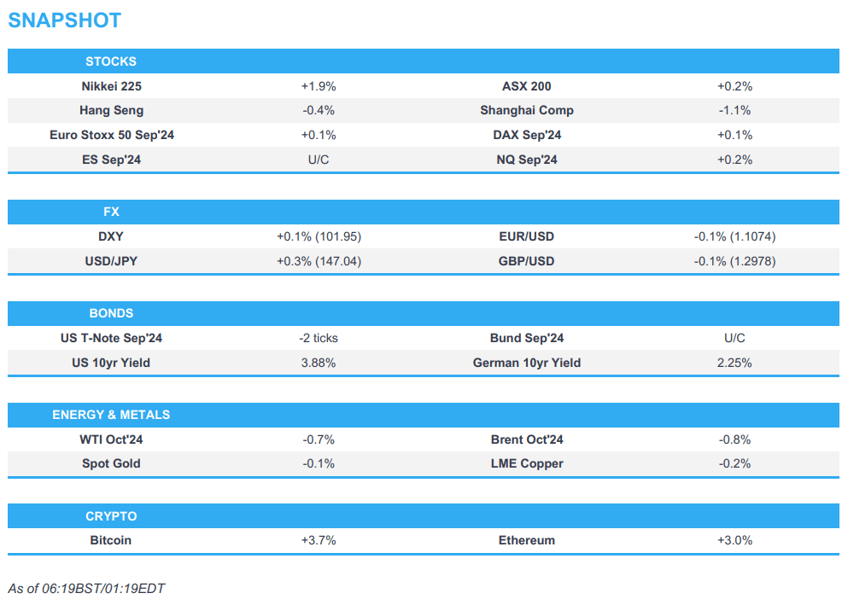

- APAC stocks traded mixed and only partially took impetus from the tech-led gains stateside amid a lack of major macro drivers.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 future up 0.1% after the cash market finished with gains of 0.6% on Monday.

- DXY remains sub-102, JPY has given back some gains vs. the USD, Cable is unable to breach 1.30.

- ECB's Rehn said the recent increase in negative growth risks in the euro area has reinforced the case for a September rate cut.

- Looking ahead, highlights include German Producer Prices, EZ HICP (F), Canadian CPI, Riksbank & CBRT Policy Announcement, Comments from Riksbank's Thedeen, Fed's Bostic & Barr, Supply from Germany, Earnings from Antofagasta, Lowe’s & Medtronic.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks began the week on the front foot with outperformance in the Nasdaq 100 which was buoyed by gains in Nvidia (+4.4%) in a day of very sparse newsflow and a very quiet calendar. Nonetheless, all sectors were exclusively in the green with large-cap Technology, Communication Services, and Consumer Discretionary at the top of the pile, while Consumer Staples and Energy were the respective laggards but still finished higher with gains in the latter capped amid pressure in the crude complex owing to continued Gaza ceasefire talks and Chinese economic concerns.

- SPX +0.97% at 5,608, NDX +1.32% at 19,766, DJIA +0.58% at 40,897, RUT +1.20% at 1.19% at 2,168.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Former US President Trump said he would consider ending the USD 7,500 electric vehicle tax credit and if elected, he would tap Elon Musk for a cabinet or advisory role if Musk would do it, according to an interview. Trump later stated that VP Harris informed that she will not do the Fox News debate on September 4th and he will conduct a tele-town hall, according to a post on Truth Social.

APAC TRADE

EQUITIES

- APAC stocks traded mixed and only partially took impetus from the tech-led gains stateside amid a lack of major macro drivers.

- ASX 200 edged mild gains with stock news in Australia dominated by earnings releases, while the RBA Minutes noted it is possible the cash rate would have to stay steady for an extended period and members agreed a rate cut in the short term was unlikely.

- Nikkei 225 outperformed and reclaimed the 38,000 level despite the absence of notable catalysts.

- Hang Seng and Shanghai Comp. declined amid lingering economic concerns, while China also maintained its Loan Prime Rates which was widely expected after last month's bout of cuts to key funding rates.

- US equity futures held on to recent gains but with further upside capped ahead of key events.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 future up 0.1% after the cash market finished with gains of 0.6% on Monday.

FX

- DXY sat beneath the 102.00 level after weakening yesterday amid strength in its major counterparts, while newsflow was light and the calendar stateside is quiet early in the week ahead of upcoming key events including the Jackson Hole Symposium.

- EUR/USD plateaued overnight after having gained a firm footing at the 1.1000 handle.

- GBP/USD took a breather following recent advances with momentum capped by resistance near the 1.3000 level.

- USD/JPY initially dipped below the 146.00 level but then staged a recovery and briefly returned to 147.00 territory.

- Antipodeans held on to most of the spoils from Monday's outperformance with an ultimately muted reaction seen after the RBA Minutes from the August meeting which noted holding the cash rate target steady for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe, but the Board will need to reassess this possibility at future meetings.

- PBoC set USD/CNY mid-point at 7.1325 vs exp. 7.1317 (prev. 7.1415).

FIXED INCOME

- 10-year UST futures lacked demand amid light macro catalysts and as participants await upcoming key events.

- Bund futures were rangebound after the prior day's whipsawing, while German PPI data and Bund supply are due later.

- 10-year JGB futures traded indecisively amid outperformance in Japanese stocks and mixed 20-year JGB auction results.

COMMODITIES

- Crude futures were subdued after yesterday's declines amid Gaza ceasefire efforts and China economic concerns.

- Spot gold traded sideways amid a lack of catalysts and remained around the USD 2,500/oz level.

- Copper futures marginally pulled back after recent advances and amid the mixed risk appetite in Asia.

CRYPTO

- Bitcoin rallied overnight after breaking back above the USD 60,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Aug) 3.35% vs. Exp. 3.35% (Prev. 3.35%)

- Chinese Loan Prime Rate 5Y (Aug) 3.85% vs. Exp. 3.85% (Prev. 3.85%)

- China is unleashing billions of dollars of lending to technology start-ups and other small companies using their intellectual property as collateral as Beijing seeks to revive demand for loans and stimulate a lagging economy, according to FT.

- RBA Minutes from the August 5th-6th meeting stated the board considered the case to raise rates but decided a steady outcome better balanced the risks and it is possible the cash rate would have to stay steady for an extended period. Members agreed it is unlikely rates would be cut in the short term and they need to be vigilant to upside risks to inflation, while policy would need to remain restrictive and it was noted that an immediate hike in rates could be justified if risks to inflation had increased materially. Furthermore, members also observed that holding the cash rate target steady at its current level for a longer period than currently implied by market pricing may be sufficient to return inflation to target in a reasonable timeframe, but the Board will need to reassess this possibility at future meetings.

GEOPOLITICAL

MIDDLE EAST

- Israel conducted a strike which targeted a Hezbollah arms depot in Lebanon's Bekaa valley, according to Reuters citing two security sources.

- Israeli PM Netanyahu confirmed they are working to release the largest number of hostages in the first phase of the deal, according to Al Arabiya.

- Israeli PM Netanyahu accepted the updated proposal that includes some of his new demands because he knew that Hamas would reject it, according to Al Jazeera citing Axios quoting Israeli officials.

- US Secretary of State Blinken made it clear to Israeli PM Netanyahu that the US expects negotiations to continue until an agreement is reached, according to Al Jazeera citing Axios sources. It was separately reported that Blinken said everyone should avoid taking steps or measures that escalate tensions and expand violence, while Blinken said the meeting with Netanyahu was constructive and Netanyahu assured him Israel accepted the proposal which Hamas must now accept.

- Hamas senior official Hamdan said they confirmed to mediators that they don't need new Gaza negotiations and what they need is to agree on an implementation mechanism. Hamdan added that US Secretary of State Blinken's statement that Netanyahu accepted an updated proposal 'raises many ambiguities' since it is not what was presented to them and not what was agreed on, according to Reuters.

- Senior Hamas official said they agreed to the proposal made by US President Biden and the US administration failed to convince Netanyahu of it, while the official said the Israelis retracted issues included in Biden's paper and Netanyahu's talk about approving an updated proposal means the US failed to convince him of the agreement. Furthermore, the Hamas official said they only want to implement President Biden's proposal which they agreed to and they do not know the exact updated proposal, but the Israeli delegation that came to Doha presented conditions that contradict it, according to Al Jazeera.

- Sources close to Hezbollah told Lebanon's Al-Jadid TV that Hezbollah tied its response to the killing of Fouad Shukr in Beirut to the outcome of the negotiations which is similar to assessments made by Israeli and American officials, according to Kann News. However, the sources said that with Hamas' rejection of the latest proposal, Hezbollah felt that it was freed from the limitations of waiting for the outcome of the negotiations.

- Iran's Foreign Ministry said they affirm the right to respond to the attack on their sovereignty and will do so at the appropriate time, while it was also reported that an IRGC Deputy Commander said Haniyeh's revenge is inevitable and will be carried out in due course, according to Al Jazeera.

- Iran's mission to the UN said they have no intention to interfere in US elections and demanded evidence from Washington after Tehran was accused of targeting the Trump campaign electronically.

OTHER

- Ukrainian military said its forces experienced repeated attacks in the Toretsk zone, Donetsk region and that its forces were under heavy Russian attack around Pokrovsk, eastern Ukraine. Ukrainian military later announced that air defence units were engaged in repelling a Russian air attack on Kyiv.

- Russia on Monday ruled out any peace talks with Ukraine despite Kyiv raising pressure on the Kremlin by claiming fresh advances in its offensive into Russian territory, according to AFP.

- US and South Korea are holding joint air drills to counter North Korean threat, according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB's Rehn said there are no clear signs of a pick-up in the manufacturing sector, while he added the recent increase in negative growth risks in the euro area has reinforced the case for a rate cut at the next ECB monetary policy meeting in September.