Having already lost more than 10% of its value versus the US dollar this year, the yen plunged further overnight after Bank of Japan Governor Kazuo Ueda indicated monetary policy will stay easy as he kept rates unchanged and showed little to no support for the embattled currency during the press conference.

While investors had not expected the BoJ to change its policy this week, there was an expectations that Ueda would strike a hawkish tone regarding future rate rises to slow the yen’s decline.

Instead, Ueda said at a news conference on Friday that the central bank’s board members judged there was “no major impact” from the weaker yen on underlying inflation for now.

“Currency rates is not a target of monetary policy to directly control,” he said.

“But currency volatility could be an important factor in impacting the economy and prices. If the impact on underlying inflation becomes too big to ignore, it may be a reason to adjust monetary policy.”

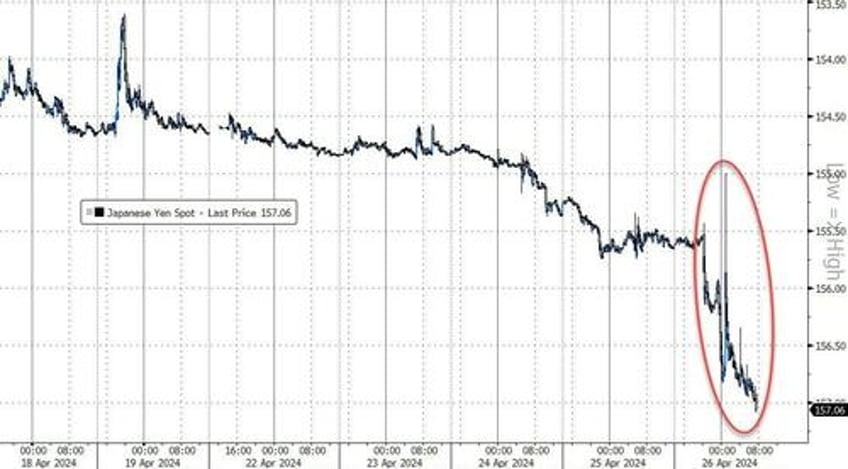

And that sent the currency reeling (amid chaotic swings) back above 157/USD...

Source: Bloomberg

“There is no intention by the BoJ to stop the yen’s decline, at least looking at its statement and its outlook report,” said UBS economist Masamichi Adachi.

“The finance ministry will have to act [to stem the yen weakness]... It would have been more effective if both the government and the BoJ faced the same direction,” he added.

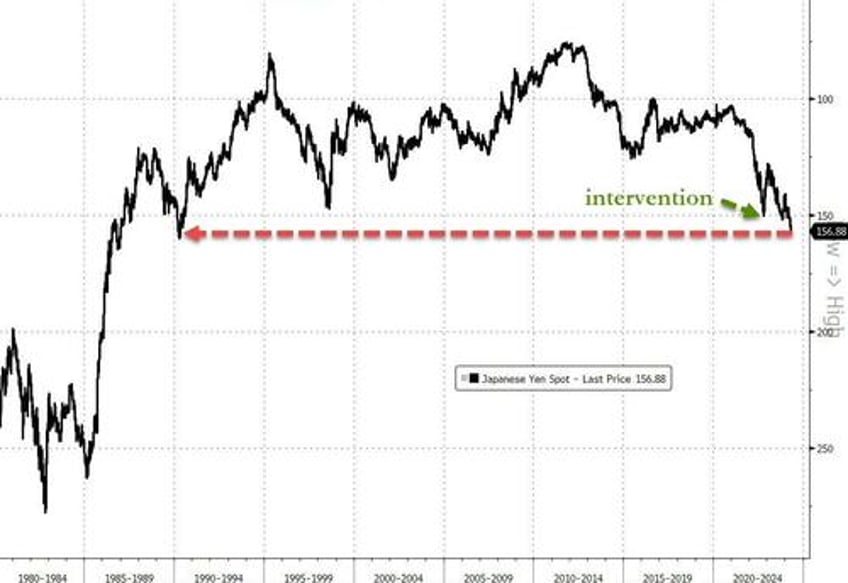

Blowing further below the 'interventionist' levels seen previously to a fresh 34-year low...

Source: Bloomberg

“Markets remain on high alert for any indication of whether the yen’s current weakness will be interpreted as a lasting inflationary signal,” said Naomi Fink, global strategist at Nikko Asset Management.

“The BoJ however is likelier to find any knock-on impact from yen weakness upon inflation as more concerning than short-term currency moves.”

Driving the depreciation is the yawning gap between the interest rates in the US - which are at highest in decades after the Fed’s aggressive tightening cycle last year - and those in Japan, where borrowing costs remain stubbornly low near zero.

“Intervention is possible at anytime, but it could have been just someone selling a large lot, which stoked intervention speculation and spurred follow-through moves,” said Koji Fukaya, a fellow at Market Risk Advisory Co. in Tokyo.

“It does not look like intervention, but the only way to confirm is to check data that will be released later by the Ministry of Finance.”

Policymakers have repeatedly warned that depreciation won’t be tolerated if it goes too far too fast.

Finance Minister Shunichi Suzuki reiterated after the BoJ meeting that the government will respond appropriately to foreign exchange moves.

Potential triggers for interventions are public holidays in Japan on Monday and Friday next week, which bring the risk of volatility amid thin trading.

“Should the yen fall further from here, like after the BOJ decision in September 2022, the possibility of intervention will increase,” said Hirofumi Suzuki, chief currency strategist at Sumitomo Mitsui Banking Corp.

“It is not the level but it’s the speed that will trigger the action.”

But so far, nothing! And so the market continues to call Ueda and Suzuki's bluff, knowing full well that a sudden intervention will perhaps briefly support the currency but will pancake the current gains in Japanese stocks.

However, not everyone is convinced intervention is imminent.

In a note this morning, Deutsche Bank says the currency's decline is warranted and finally marks the day where the market realizes that Japan is following a policy of benign neglect for the yen.

We have long argued that FX intervention is not credible and the toning down of verbal jawboning from the finance minister overnight is on balance a positive from a credibility perspective. The possibility of intervention can't be ruled out if the market turns disorderly, but it is also notable that Governor Ueda played down the importance of the yen in his press conference today as well as signalling no urgency to hike rates. We would frame the ongoing yen collapse around the following points.

Yen weakness is simply not that bad for Japan. The tourism sector is booming, profit margins on the Nikkei are soaring and exporter competitiveness is increasing. True, the cost of imported items is going up. But growth is fine, the government is helping offset some of the cost via subsidies and core inflation is not accelerating. Most importantly, the Japanese are huge foreign asset owners via Japan’s positive net international investment position. Yen weakness therefore leads to huge capital gains on foreign bonds and equities, most easily summarized in the observation that the government pension fund (GPIF) has roughly made more profits over the last two years than the last twenty years combined.

There simply isn't an inflation problem. Japan's core CPI is around 2% and has been decelerating in recent months. The Tokyo CPI overnight was 1.7% excluding one-off effects. To be sure, inflation may well accelerate again helped by FX weakness and high wage growth. But the starting point of inflation is entirely different to the post-COVID hiking cycles of the Fed and ECB. By extension, the inflation pain is far less and the urgency to hike far less too. No where is this more obvious than the fact that Japanese consumer confidence are close to their cycle highs.

Negative real rates are great. There is a huge attraction to running negative real rates for the consolidated government balance sheet. As we demonstrated last year, it creates fiscal space via a $20 trillion carry trade while also generating asset gains for Japan's wealthy voting base. This encourages the persistent domestic capital outflows we have been highlighting as a key driver of yen weakness over the last year and that have pushed Japan's broad basic balance to being one of the weakest in the world. It is not speculators that are weakening the yen but the Japanese themselves.

The bottom line, Deutscxhe concludes, is that for the JPY to turn stronger the Japanese need to unwind their carry trade. But for this to make sense the Bank of Japan needs to engineer an expedited hiking cycle similar to the post-COVID experiences of other central banks. Time will tell if the BoJ is moving too slow and generating a policy mistake. A shift in BoJ inflation forecasts to well above 2% over their forecast horizon would be the clearest signal of a shift in reaction function. But this isn’t happening now.

The Japanese are enjoying the ride.

But there is potential for yen upside as Bloomberg's Simon White notes that profit taking on foreign asset positions might soon prompt some yen repatriation and pressure USD/JPY lower.

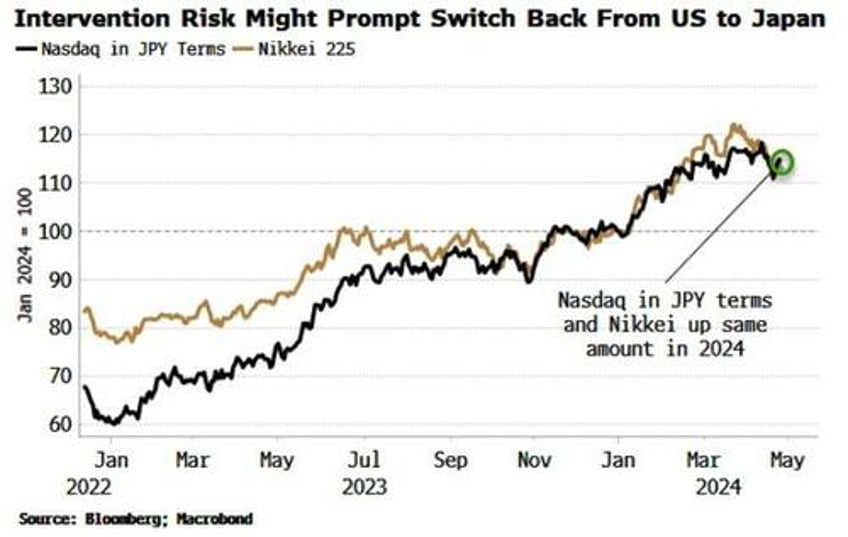

If it is perceived that the yen won’t get much cheaper due to intervention risk, domestic investors might choose to start switching some of their US equity positions back to the domestic market, repatriating yen and pressuring USD/JPY lower in the process.

The chart below shows that on the year, the Nasdaq in yen terms and the Nikkei are both up by the same 13%-14% on the year. A stronger yen would present an ongoing headwind to the US position.

Equity positions are typically less FX hedged than bond positions, meaning that the repatriation of the currency is not neutered by the unwind of the hedge.

The dynamics of spot trading, options barriers and potential intervention as well as US PCE data released later today will dominate the currency’s short-term gyrations, but the slightly longer-term considerations of profit taking on foreign positions will start to drive the medium-term outlook.

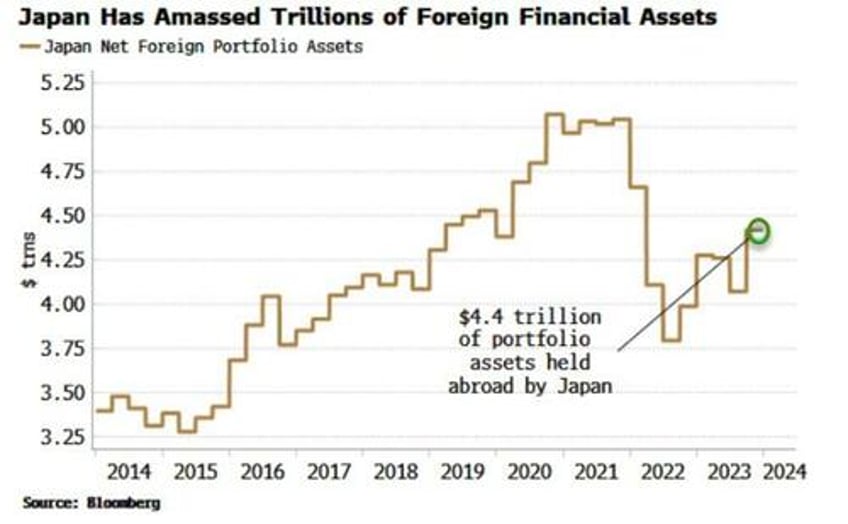

Once that trend establishes itself, longer-term drivers of the yen will come into focus. Japan is the world’s largest net creditor, and there is a significant structural short in the yen.

The country’s net international investment position is $3.3 trillion, but its net position in portfolio assets, i.e. so-called hot flows that could be liquidated quickly, is $4.4 trillion.

Only a fraction of that being repatriated has significant potential to drive the yen considerably higher.

The question is, how much pain is China willing to take from its regional neighbor's 'devaluation'?