Gold trading in China has exploded and stocks of copper have risen sharply prompting speculation that policymakers are on the brink of a yuan devaluation. Even though it’s still a tail-risk, it’s one requiring greater vigilance as the economy becomes increasingly deflationary, redoubling capital outflow pressures.

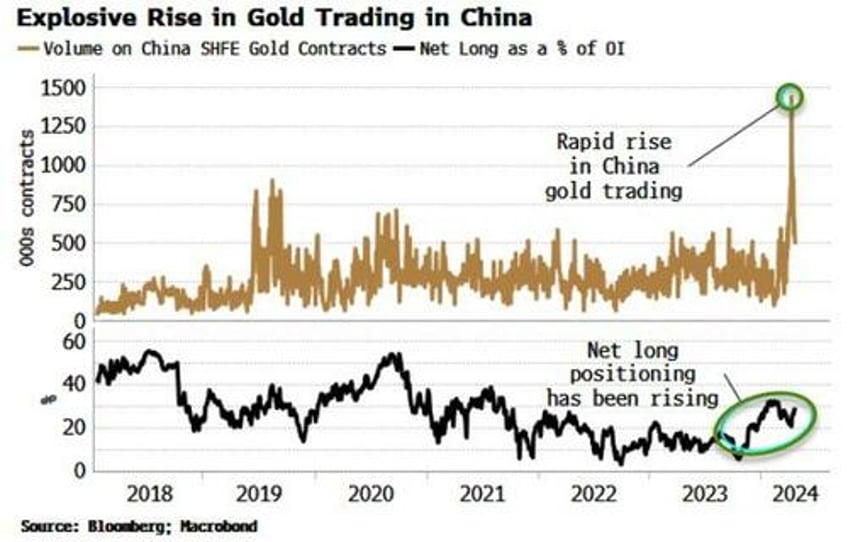

The yuan has been steadily falling versus the dollar this year. So far the decline has been measured, but activity in commodities has prompted conjecture that China is about to orchestrate a significant one-off yuan devaluation. Futures gold trading in China has moved sharply higher, and the net long position has been rising.

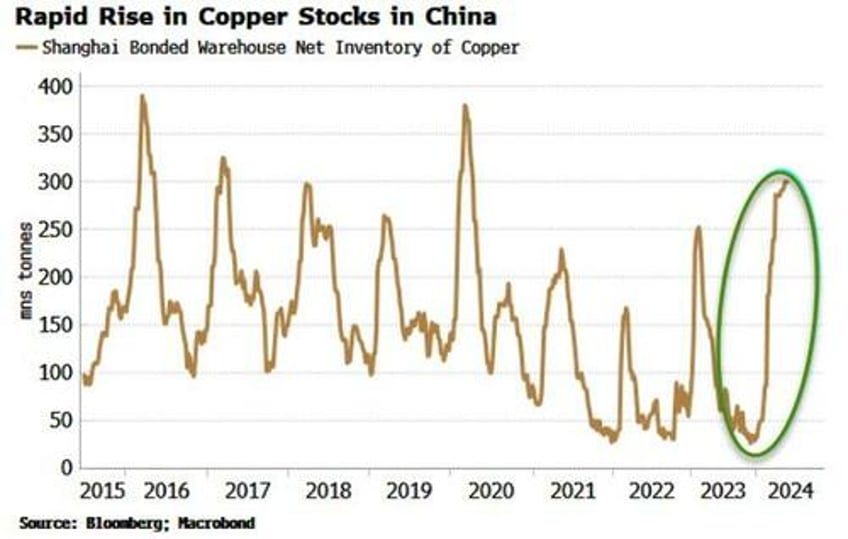

Also, there has been a sharp rise in China’s copper stocks. Copper as well as other commodities is used as a source of collateral in China.

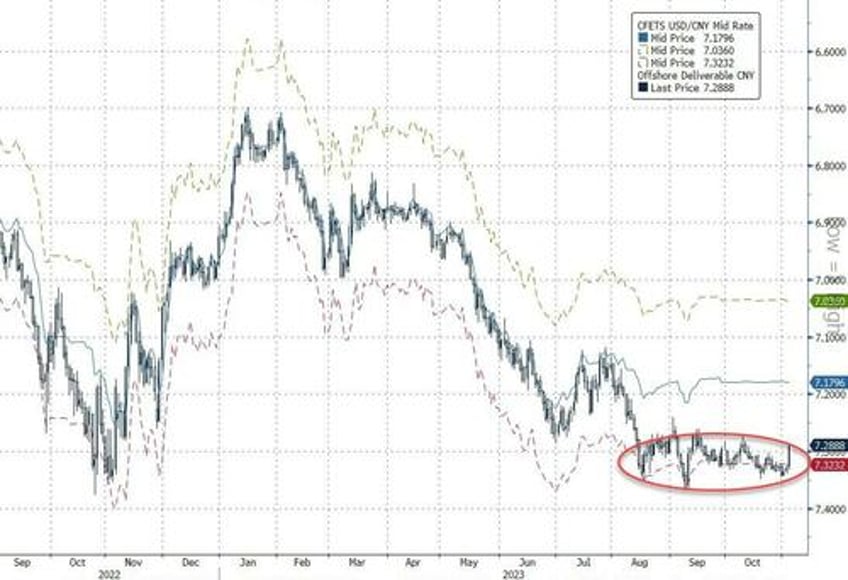

USD/CNY has been bumping up against the upper band of the PBOC’s fix for the currency pair.

China has a nominally closed capital account, but it is de facto leaky. Capital outflow is rising, and this puts further pressure on the economy as it has a geared negative effect on domestic liquidity.

Allowing the yuan to depreciate against the dollar (it is appreciating against most other currencies) takes some of the pressure off.

China, though, has been unofficially intervening, via the state banks, to stabilize the yuan’s fall.

Nonetheless, it is still less likely than not they will countenance a significant devaluation of the yuan versus the dollar.

First, it would compromise the financial stability that China has sought to obtain.

Second, it risks a tariff backlash from the US.

Third it may be counter-productive if it looks panicky and prompts even more capital outflow.

The stockpiling could well be for other reasons.

Rising global inflation risks (there is more to come, and even China will likely soon face consumer inflation);

reserve diversification in a more multi-polar world;

and raw materials for solar (AI needs a lot of energy) and EVs, and so on.

China planning for an invasion of Taiwan is another tail-risk that can’t be completely discounted.

Falling bond yields, though, show China is nearing a crunch point (read why here) and will need to do something soon to avert a debt deflation.

Even though a full-scale devaluation is less likely, it’s a non-negligible risk that can’t be ignored.