Another quiet macro day (although an ugly picture was painted late on by the unexpectedly weak revolving credit increase - potentially signaling a US consumer who really has hit their limit).

Some FedSpeak wiped a little lipstick off the early pig's squeeze higher as Kashkari seemed to offer both sides some hope (but it spoiled the fun with the 'we could hike' line):

“It’s a little too soon to declare that we’re definitely stalled out [on disininflation],” Kashkari says on Bloomberg Television.

“The most likely scenario is we sit here for an extended period of time,” he added later at the Milken Institute Global Conference.

“If inflation starts to tick back down or we saw some marked weakening in the labor market then that might cause us to cut back on interest rates.”

“Or if we get convinced eventually that inflation is embedded or entrenched now at 3% and that we need to go higher [in rates], we would do that if we needed to,” he added.

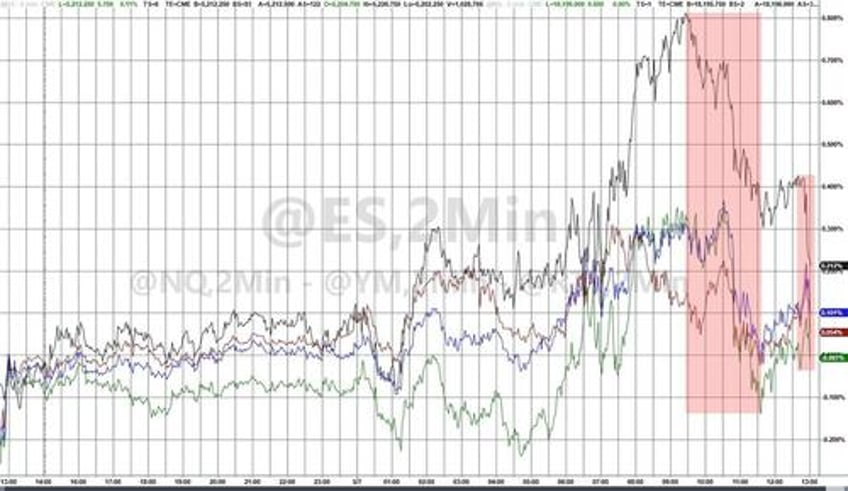

Stocks reversed their gains (leaving only squeezable Small Caps higher). Selling pressure in the last few minutes really took the shine off...

Goldman's trading desk highlighted the fact that their buyback desk was running at 1.4x ytd daily avg notional executed (Equating to $5.5b of US equities purchased street wide on daily basis). They also added that ETF and Swaps desks are much more active than cash and dominated by HF activity (short hedges getting scaled back).

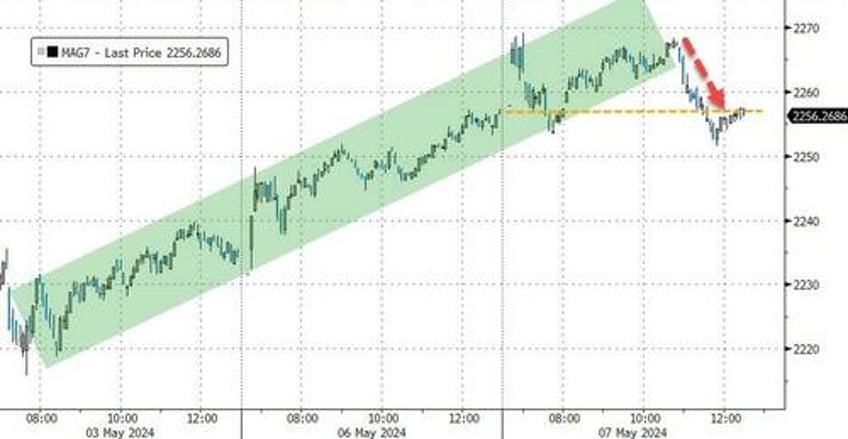

The post-Powell resurgence of Mag7 stocks stalled today...

Source: Bloomberg

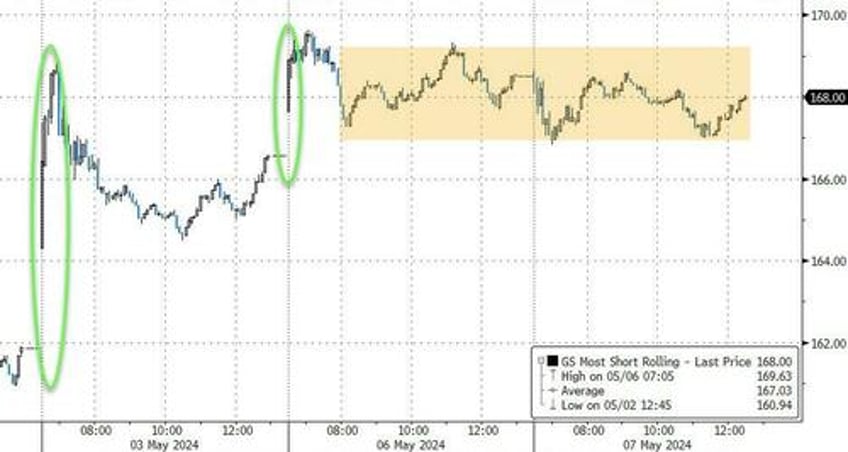

...and 'most shorted' stocks flatlined as algos could not ignite any momentum...

Source: Bloomberg

Treasury bonds also reversed on Kashkari's comments (yields reversing higher to almost erase earlier declines)...

Source: Bloomberg

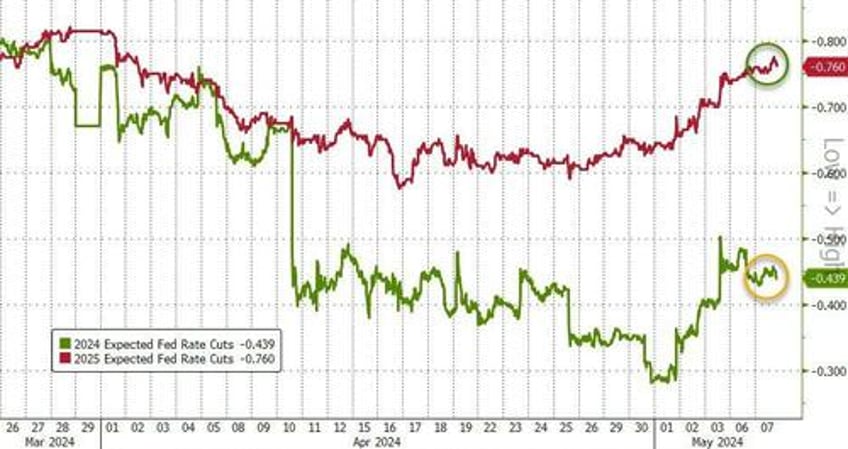

While stocks and bonds reversed on that, rate-cut expectations were stoic...

Source: Bloomberg

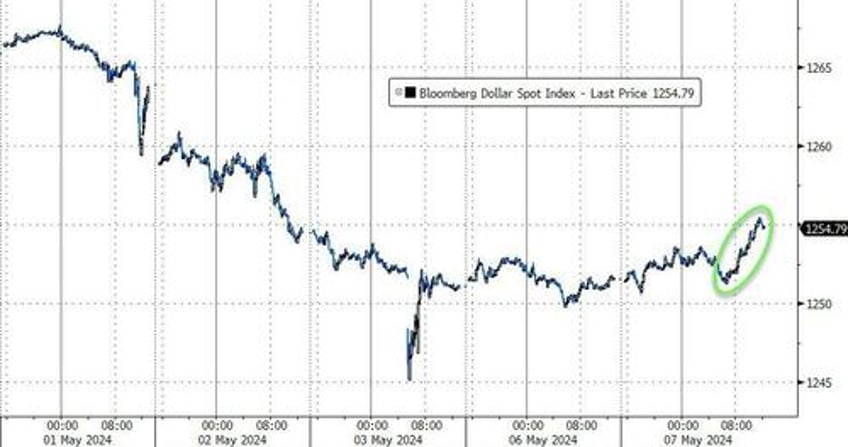

The dollar rallied for the first time in 5 days (but only modestly)...

Source: Bloomberg

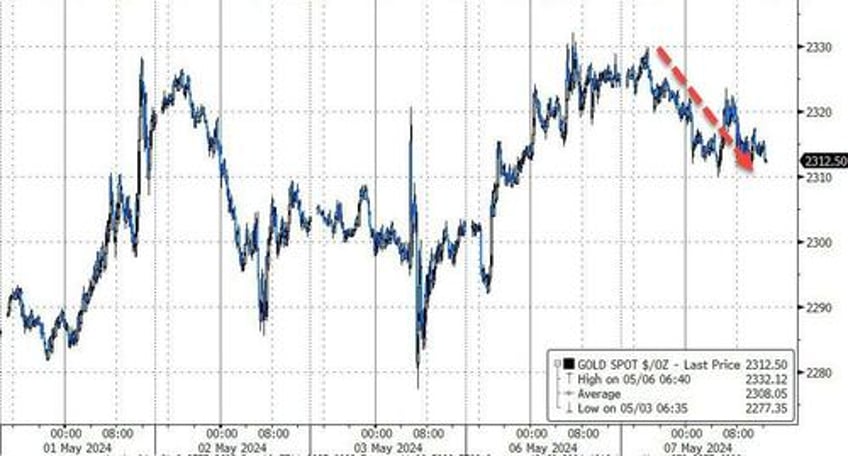

...and the dollar's gains were gold's losses...

Source: Bloomberg

Bitcoin was quiet... too quiet.. today, hovering just above $63,000...

Source: Bloomberg

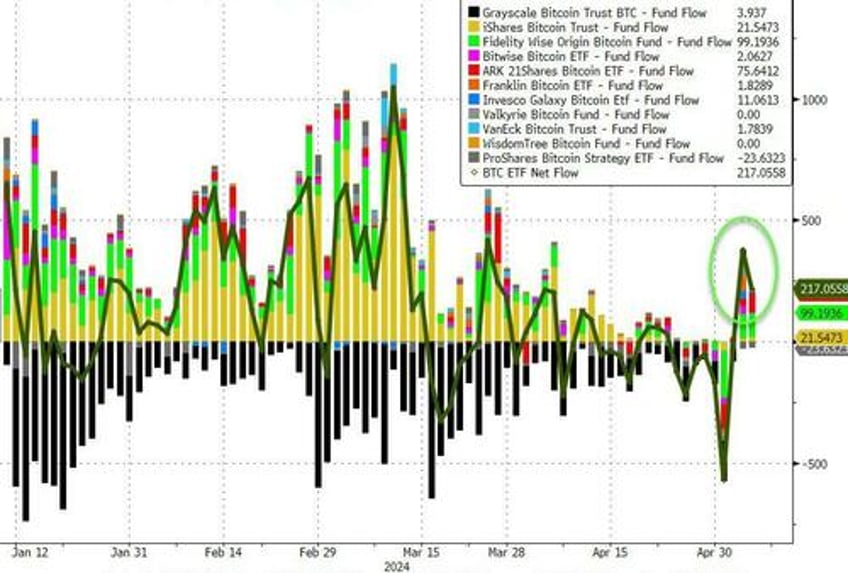

...after a second day in a row of net inflows...

Source: Bloomberg

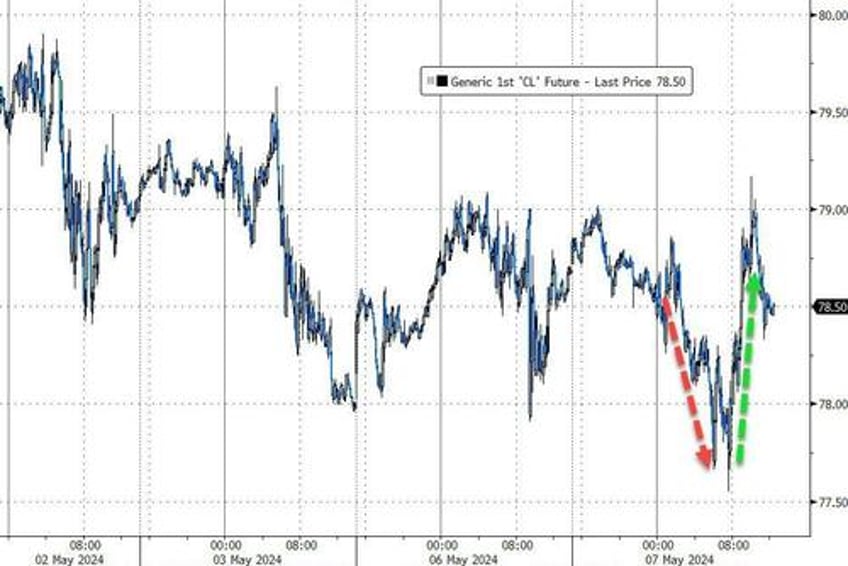

Oil prices were flat on the day, recovering from losses during the EU session...

Source: Bloomberg

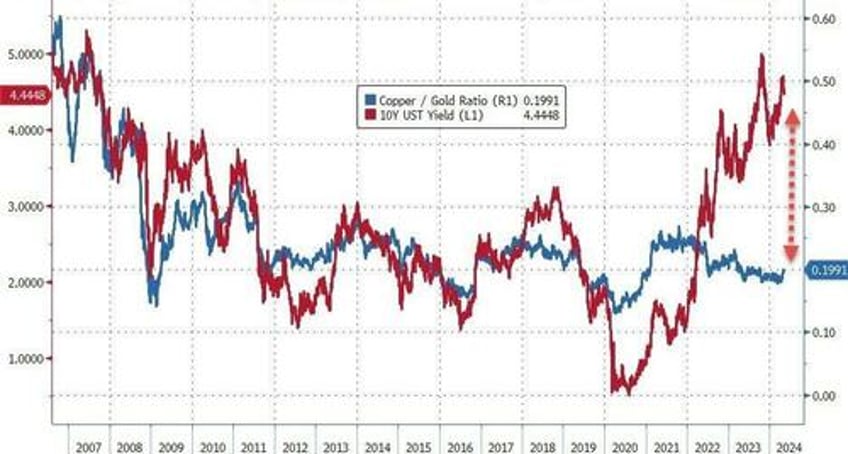

Finally, with copper top of mind for many, we brushed off a oldie-but-a-goodie chart - comparing copper/gold to 10Y yields...

Source: Bloomberg

Either copper is very cheap (relative to gold) or 10Y yields are too high (i.e. growth/flation under-priced in copper and/or over-priced in bonds).