Billionaire investor and Duquesne Family Office Chairman & CEO Stan Druckenmiller slammed Bidenomics and warned the Federal Reserve and federal government "misdiagnosed Covid and thought it was -- we were going into a depression."

Druckenmiller has been irritated by the massive fiscal spending by the federal government, which we outlined last year as a "stealth stimulus" propelling Bidenomics. Meanwhile, Fed chair Jerome Powell has enabled the Bidenomics disaster as the government spends $1 trillion every 100 days. Now, with stagflationary threats emerging, the US economic situation is quickly deteriorating.

CNBC Joe Kernen asked Druckenmiller:

Let me ask you how this plays into to -- it's another I think issue of being, you know, things are going, well, and then we totally overspent in terms of fiscally as well in Bidenomics.

Druckenmiller responded:

If I was a professor, I'd give them an F. Basically, they misdiagnosed COVID and thought it was -- we were going into a depression. The Fed did, too. I worried about it, too, in early days. The Fed eventually pivoted, better late than never. Treasury -- Treasury is still acting like we're in a depression. It's interesting because I've studied the Great Depression and you had a private sector crippled with debt, with basically no new ideas. So interventionist policies were called for and were effective.

The private sector could not be more different today than it was in the Great Depression. Their balance sheets are fine. They're healthy. And have you ever seen more innovative ideas that the private sector could take advantage of? Now, you got Blockchain, you got AI, you've got the whole thing.

All government needed to do was get out of their way and let them innovate. Instead, they've spent and spent and spent, and my new fear now is that spending and the -- and the resulting interest rates on the -- on the debt that's been created are going to crowd out some of the innovation that otherwise would have -- would have taken place.

We've got a 7 percent budget deficit at full employment. It's just -- it's unheard of...

Here's the clip of Druckenmiller speaking with Kernen about Bidenomics failures:

Investor Stanley Druckenmiller on Bidenomics: "If I were a professor, I'd give them an 'F'." pic.twitter.com/WfsU4ecO6y

— Squawk Box (@SquawkCNBC) May 7, 2024

In macro, the consumer data just continues to worsen.

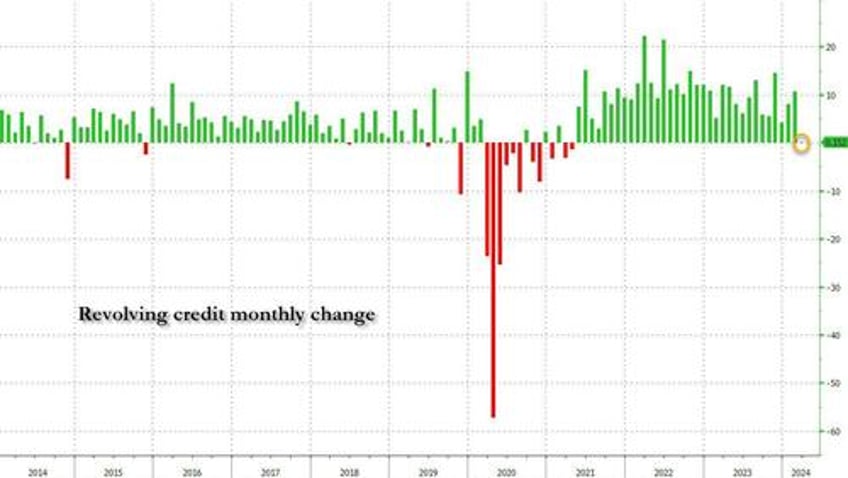

The latest consumer credit data published by the Federal Reserve shows credit growth just imploded as credit card APRs hit an all-time high.

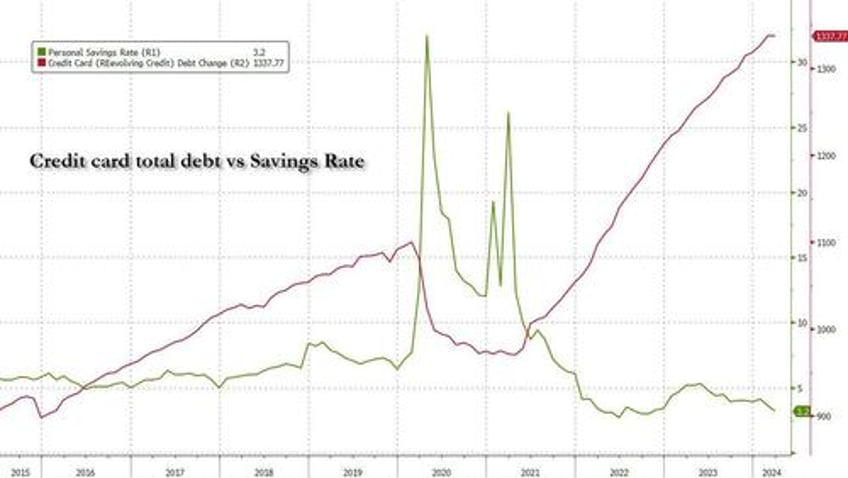

Meanwhile, total credit card debt jumped to a record high while the personal savings rate slid to a record low.

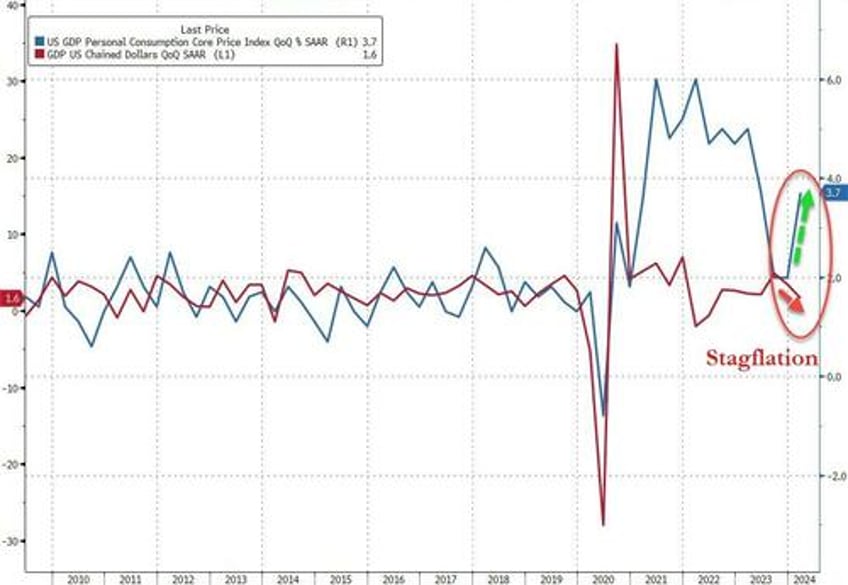

Last week, one of the loudest stagflationary warnings printed when US GDP unexpectedly collapsed to just 1.6% in 1Q, down more than 50% from the Q4 print of 3.4%, the lowest print since Q2 2022. However, all-important core PCE for Q1 soared from 2.0% to 3.7%, suggesting the US was nearing a stagflationary recession.

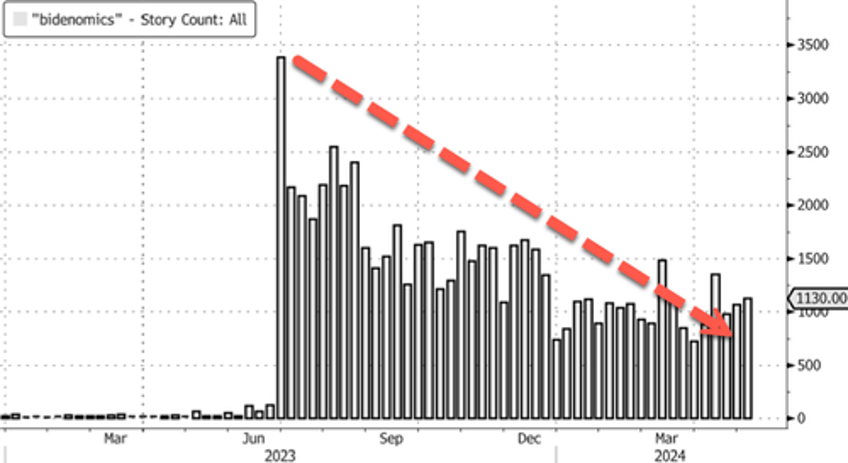

The Biden team has understood this failure and dialed back "Bidenomics" propaganda in corporate media headlines.

We suspect the Gen-Zers who voted for Biden in the first go around won't make that mistake again: "Bidenomics Failure Shows Up At Polls As Gen-Z Revolts Against Democrats."