This Wednesday's FOMC meeting and decision (to keep rates unchanged) will highlight a busy week for markets with central banks at the fore. And, as DB's Jim Reid previews, outside of the Fed, the BoE (Thursday), and the BoJ (Friday) are the other main events on this front. Central banks in Norway, Sweden, Switzerland and Turkey (all Thursday) all have policy meetings too.

Away from central banks, the CPI inflation data for both the UK (Wednesday) and Japan (Friday) will also be out this week. The global flash PMIs due Friday will be another big focus. The latest manufacturing PMI for Germany printed at 39.1 (43.5 in the Eurozone), much lower than the still soft 47.9 in the US and 49.6 in Japan. Momentum in the services gauge, especially in the US (50.5) where it’s only just above 50, will also be in focus after stronger comparable prints in other US surveys.

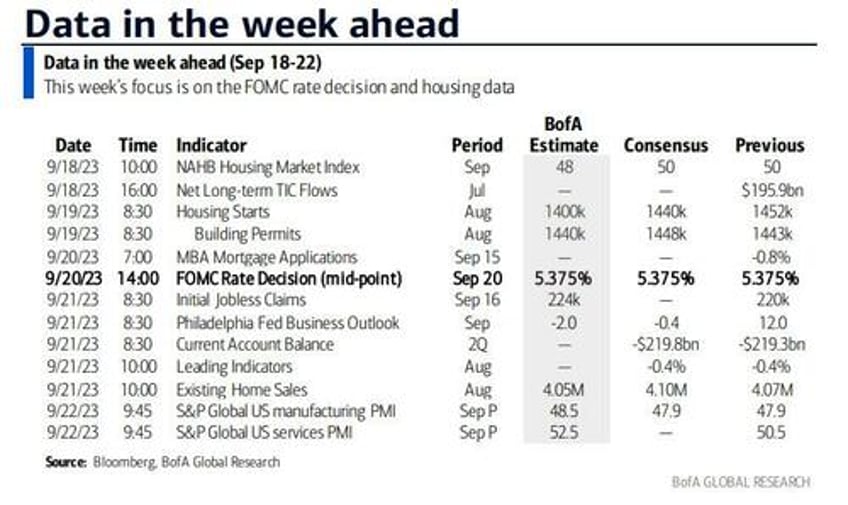

In the US we will get the monthly housing week data dump even if it will be tough to learn something new. US housing affordability is around the worst on record for buyers, and activity is at around 30 year low, but for the vast majority of existing homeowners there is no stress. We have today's NAHB homebuilder index (forecast 45 vs. 50 previously), Tuesday's housing starts (1.478mn vs 1.452mn) and building permits (1.460mn vs. 1.443mn) and Thursday's existing home sales (4.25mn vs. 4.07mn). Elsewhere in the US, Thursday's Philadelphia Fed survey (-5.0 vs. +12.0) will be of some interest.

Elsewhere the UAW autoworkers strike that started on Friday will gain more macro attention the longer it lasts. Some may say this is an idiosyncratic risk to the economy but with inflation having been high and corporate profits coming back, this sort of thing is a genuine consequence of the macro environment.

Next, Reid dives into a brief FOMC preview, and writes that one would be hard pressed to find someone who thinks they'll hike this week but the prevailing expectation is that they keep the door open for another hike later this year which the dot plot will continue to reflect. DB's economists believe other parts of the SEP are likely to undergo meaningful revisions, particularly for 2023. Stronger growth (2023 could double to 2%, 2024 could increase around 25bps to 1.3%) and lower unemployment should counterbalance softer inflation (2023 revised down but core forecasts for 2024 likely to be unchanged). So the meeting is likely to see a confident pause but one where further tightening is seen as the risk.

After the Fed, the focus will shift to the BoE on Thursday. Most economists expect another +25bps hike that would take the Bank Rate to 5.5% and then see another, potentially final, hike in November. The market is pricing in around a 70% chance of a hike at the close on Friday. Perhaps a swing factor on the outlook could be the UK CPI the day before where headline is expected to rise from 6.8% to 7.2% due to energy costs but core is expected to dip 0.1pp to 6.8%. A big fall in October's headline release should occur alongside a big fall in energy bills as bad YoY comps drop out. Retail sales on Friday completes a busy week for the UK. Retail sales will also be due on Thursday in France. Highlights in Germany include the PPI out on Wednesday.

The BoJ will wrap up the busy week on Friday. DB's economists expect the central bank to stick to its current policy stance but revise the MPM statement to point to policy normalisation. Further out, they see the YCC and negative interest rate policy ending at the October and January meetings, respectively. Japan's latest nationwide CPI will also be out that day. Our Chief Japan economist sees the headline gauge at 2.9% YoY (+3.3% in July), core inflation excluding fresh food at 2.9% (+3.1%), and core-core inflation excluding fresh food and energy (+4.3%).

Courtesy of DB, here is a day-by-day calendar of events

Monday September 18

- Data: US September NAHB housing market index, New York Fed services business activity, July total net tic flows, Canada August raw materials and industrial product price index, housing starts

Tuesday September 19

- Data: US August housing starts, building permits, Italy July current account balance, ECB July current account, Canada August CPI

- Central banks: ECB's Elderson speaks

- Other: OECD Interim Economic Outlook

Wednesday September 20

- Data: UK August CPI, PPI, RPI, July house price index, Japan August trade balance, Germany August PPI, EU27 August new car registrations, Eurozone July construction output

- Central banks: Fed's decision, BoC summary of deliberations, ECB's Elderson speaks

- Earnings: General Mills, FedEx

Thursday September 21

- Data: US September Philadelphia Fed business outlook, Q2 current account balance, August leading index, existing home sales, initial jobless claims, UK August public finances, France September business and manufacturing confidence, August retail sales, Eurozone September consumer confidence

- Central banks: BoE decision, ECB's Schnabel and Lane speak

Friday September 22

- Data: US, UK, Japan, Germany, France and the Eurozone September PMIs, UK September GfK consumer confidence, August retail sales, Japan August national CPI, Canada July retail sales

- Central banks: BoJ decision, Fed's Cook and Daly speak, ECB's Guindos speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are jobless claims and the Philadelphia Fed manufacturing index on Thursday. The September FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, September 18

- 10:00 AM NAHB housing market index, September (consensus 49, last 50)

Tuesday, September 19

- 08:30 AM Housing starts, August (GS -2.5%, consensus -1.0%, last +3.9%); Building permits, August (consensus -0.2%, last +0.1%)

Wednesday, September 20

- 02:00 PM FOMC statement, September 19-20 meeting: As discussed in the FOMC preview, we expect the dot plot to show a narrow 10-9 majority still penciling in one more hike, if only to preserve flexibility for now. Over 2023-2026, we expect the median dot to show a path of 5.625% / 4.625% / 3.375% / 2.875%. We also expect the median neutral rate dot to rise to 2.75%. In the economic projections for 2023, we expect a substantial upward revision to GDP growth (+1.1pp to +2.1%) and moderate downward revisions to the unemployment rate (-0.2pp to 3.9%) and core inflation (-0.4pp to 3.5%). Revisions to later years should be small and point in the same direction.

Thursday, September 21

- 08:30 AM Current account balance, Q2 (consensus -$221.0bn, last -$219.3bn); Initial jobless claims, week ended September 16 (GS 220k, consensus 225k, last 220k); Continuing jobless claims, week ended September 9 (consensus 1,695k, last 1,688k)

- 08:30 AM Philadelphia Fed manufacturing index, September (GS +6.0, consensus -1.0, last +12.0): We estimate that the Philadelphia Fed manufacturing index pulled back to a still-positive +6 in September, reflecting the pickup in East Asian industrial activity.

- 10:00 AM Existing home sales, August (GS flat, consensus +0.7%, last -2.2%)

Friday, September 22

- 08:50 AM Fed Governor Cook speaks: Fed Governor Lisa Cook will give the keynote address at the National Bureau of Economic Research’s Economics of Artificial Intelligence Conference. Speech text will be made available.

- 09:45 AM S&P Global US manufacturing PMI, September preliminary (consensus 48.0, last 47.9)

- 09:45 AM S&P Global US services PMI, September preliminary (consensus 50.4, last 50.5)

- 01:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will join Greater Phoenix Leadership for a fireside chat to discuss inflation, monetary policy, and the economy. The conversation will be livestreamed and made available as a recording after the event.

Source: DB. Goldman, BofA